At the VIPF 2025 event held on the afternoon of October 29, during a panel discussion themed “Maintaining Position in Global Dynamics,” experts noted that Vietnam’s FDI competitiveness ranks third in ASEAN, following Singapore and Indonesia.

Ms. Tran Thi Hai Yen, Director of the Southern Investment Promotion Center, Foreign Investment Agency, Ministry of Finance, stated, “For ASEAN countries, Vietnam remains a star in attracting FDI, solidifying its position and set to enhance it further. Key reasons include Vietnam’s political stability and the government’s strategic policies aligned with global trends to attract high-quality FDI. These policies encompass economic zone planning, free trade development, and special incentives for high-tech sectors, boosting Vietnam’s regional and global competitiveness.”

Mr. Nguyen Cong Ai, Deputy General Director of KPMG Vietnam, noted that this competition extends beyond ASEAN. Vietnam must overcome internal challenges to stay competitive, especially as developed nations seek to repatriate investments.

Under the “China +1” strategy, Vietnam has demonstrated adaptability. Mr. Dinh Hoai Nam, Business Development Director at SLP Vietnam, a provider of high-quality industrial warehouses, shared initial uncertainties but highlighted Vietnam’s proactive tax negotiations, restoring investor confidence. SLP’s occupancy rate now exceeds 90%.

Mr. Truong Gia Bao, Vice Chairman and Secretary-General of the Vietnam Industrial Real Estate Association (VIREA), noted that current warehouse occupancy is a short-term response to long-term changes. He emphasized, “Vietnam’s political stability and infrastructure improvements signal both immediate and future opportunities.”

The Vietnam Industrial Real Estate Forum 2025 took place on October 29 in Ho Chi Minh City.

|

Vietnam’s Neutral Role in the New Supply Chain

Vietnam is pivotal in the “China +1” strategy, according to Mr. Hardy Diec, Executive Director of KCN Vietnam. Its rapid policy reforms, neutrality, and open economy position it to attract multinational corporations.

“Vietnam’s proactive handling of global minimum tax issues showcases its policy agility,” Mr. Hardy added.

Investment shifts are evident, with diverse investors from Europe and the U.S. Mr. Truong Gia Bao noted that Intel is discussing relocating a major chip development center from Costa Rica to Ho Chi Minh City.

Experts agree that development requires three factors: workforce, infrastructure, and finance. While Vietnam aims to develop international financial centers in Ho Chi Minh City and Da Nang, infrastructure and resource challenges persist.

Mr. Bao highlighted infrastructure and clean energy as critical. High-tech investors demand not just sufficient but also clean energy.

Mr. Tran Tan Sy, Deputy General Director of KN Holdings, emphasized the need for clean energy in high-tech sectors to achieve net-zero emissions.

With significant renewable energy projects, Mr. Sy is confident Vietnam can attract major tech investors, particularly in semiconductors.

Workforce stability remains a challenge. Despite aiming for 50,000 semiconductor engineers, experts trust Vietnamese potential. KPMG experts note that U.S. assessments rank Vietnamese engineers on par with Chinese R&D engineers and above Indian counterparts.

Mr. Nam (SLP) cited a case where a small firm interviewed 300 candidates to hire 100 engineers, as larger companies like GoTek offer higher salaries, complicating labor retention for smaller FDI firms.

Cost-wise, Vietnam is affordable, but reliance on Chinese raw materials poses risks. However, this presents an opportunity for Vietnam to develop upstream industries, enhancing sustainability.

Vietnam is shifting from a low-cost FDI destination to prioritizing sectors like semiconductors, digital economy, and financial centers.

The Role of the Private Sector and Escaping the Middle-Income Trap

The private sector is crucial in Vietnam’s new strategy. Mr. Bao emphasized its role in partnering with international firms, facilitating technology transfer. The planned doubling of industrial real estate output by 2030 underscores this sector’s importance.

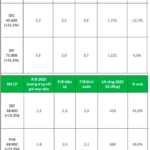

Green and smart industrial park development is essential but costly. Mr. Sy noted that green standards increase costs by 10% and reduce commercial land by 3-5%, but they are necessary for global market access.

“Higher costs lead to premium pricing and better market acceptance,” Mr. Sy concluded.

Logistics firms like SLP are also embracing ESG trends, supporting electric vehicle transitions. The Vietnamese government is promoting digital and green transformations with new reporting requirements.

Experts predict a shift from FDI volume to value by 2030. Mr. Hardy stressed the need to avoid the middle-income trap by aligning wage growth with productivity.

– 22:01 29/10/2025

Accelerating the Attraction of High-Quality FDI in Manufacturing and Processing

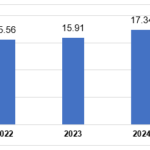

Vietnam has witnessed a significant surge in foreign direct investment (FDI), reaching an impressive $28.54 billion in the first nine months. The manufacturing sector remains at the forefront, attracting a substantial number of high-tech investors from Japan. This robust growth underscores Vietnam’s appeal as a prime destination for global investment.

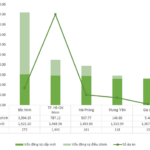

Unveiling the Top FDI Magnet in the First 9 Months of 2025: Outshining Ho Chi Minh City, Hanoi, and Hai Phong

As of September 30, 2025, Vietnam’s total registered foreign direct investment (FDI) reached an impressive $28.54 billion, according to the Foreign Investment Agency (Ministry of Finance). This figure includes newly registered capital, adjusted capital, and the value of foreign investors’ capital contributions and share purchases, marking a 15.2% increase compared to the same period last year.

Foreign Direct Investment in Vietnam’s Real Estate Sector Reaches Nearly $1.4 Billion in 9 Months

According to the socio-economic report by the Statistics Bureau, realized foreign direct investment (FDI) in Vietnam during the first nine months of 2025 reached an estimated $18.8 billion, marking an 8.5% increase compared to the same period last year—the highest level since 2021. Of this, the real estate business sector accounted for $1.37 billion, representing 7.3% of the total.