HSBC’s Global Investment Research team has released a report titled “Vietnam at a Glance – Striding Forward,” forecasting robust economic growth driven by domestic resilience. HSBC has revised Vietnam’s GDP growth projections upward to 7.9% for 2025 (from 6.6%) and 6.7% for 2026 (from 5.8%).

Trade Surpasses Expectations

According to HSBC, Vietnam’s economic growth exceeded 8% year-on-year in Q2 2025, marking the second consecutive quarter of outperformance. While other ASEAN nations saw slight export declines to the U.S. as frontloading effects waned, Vietnam’s trade remained robust with double-digit growth. The trade surplus in Q3 doubled compared to the first half of the year, fueled by increased surpluses with non-U.S. trading partners. This strength is partly attributed to surging demand for AI-related technology, benefiting tech-focused economies.

Retail sales showed significant improvement, and tourism continued to thrive, with Vietnam leading ASEAN in tourism recovery. Government-driven infrastructure megaprojects further boosted construction activity. However, public investment disbursement reached only 50% of the annual target by Q3, indicating room for growth acceleration.

Revised GDP Growth Forecasts

Following Q3’s stronger-than-expected performance, HSBC raised its GDP growth forecasts to 7.9% for 2025 (from 6.6%) and 6.7% for 2026 (from 5.8%). Trade volatility remains the primary risk to growth. Inflation projections were also adjusted slightly upward to 3.3% for 2025 (from 3.2%) and 3.5% for 2026 (from 3.2%).

HSBC notes that ASEAN economies maintained strong momentum in Q2, particularly trade-dependent nations like Singapore and Malaysia. Vietnam’s Q3 growth of 8.2% year-on-year stood out, surpassing market expectations of 7.2% and reaffirming its position as Southeast Asia’s fastest-growing economy.

Industrial Production Rebounds

Despite global trade uncertainties, Vietnam’s industrial production rose 10% year-on-year in Q3, with exports and imports growing nearly 20%. The trade surplus doubled to $3 billion in Q3 compared to the first half of 2025, reflecting increased surpluses with non-U.S. partners. While the U.S. remains Vietnam’s largest export market (one-third of total exports), electronics drove trade growth, with consumer electronics and components leading the charge. Exports to the U.S. in Q3 neared 30% year-on-year growth.

Vietnam’s export resilience contrasts with the broader ASEAN trend of slowing frontloading. This highlights a regional shift: tech-intensive economies are capitalizing on surging AI-related demand, providing robust trade support.

Retail sales, a key consumption indicator, improved significantly, with Q3 growth of 12% year-on-year, narrowing the gap to pre-pandemic levels to just 3%, down from 10% at the start of 2025.

Tourism Surges Ahead

Tourism-related sectors, including transportation and accommodation, are booming. Vietnam has emerged as a favored destination for Chinese tourists, despite lacking visa-free policies. With 15 million tourists by Q3 2025, Vietnam’s tourism recovery reached 120% of 2019 levels. While less tourism-dependent than Thailand, Vietnam’s growing competitiveness in this sector offers a buffer against trade challenges.

On the demand side, Q3 consumption grew over 8% year-on-year, and investment rose nearly 10%. Accelerated infrastructure projects remain a priority, with public investment disbursement at 50% of the annual target by Q3, leaving room for further growth.

FDI Inflows Remain Strong

Foreign direct investment (FDI) continues to drive Vietnam’s growth. Despite concerns since April, total FDI in Q3 rose 15% year-on-year, though new registrations fell 9%. Notably, FDI composition shifted in 2024: Singapore and mainland China now account for one-quarter each of new FDI, while South Korea’s share declined, with the U.S. filling the gap. Despite trade tensions, the world’s two largest economies remain committed to investing in Vietnam. As ASEAN’s emerging markets face similar tariffs (19-20%), countries like Malaysia and Vietnam, benefiting from trade shifts, will continue to thrive.

Inflation Under Control

Inflation remains manageable, with September’s headline inflation at 3.4% year-on-year, in line with expectations (HSBC: 3.4%; BBG: 3.4%). Food prices and fuel costs drove this increase, while core inflation held steady at 3.2%, well below the central bank’s 4.5-5% ceiling. With inflation concerns easing, the State Bank of Vietnam aims for higher credit growth to support economic expansion. Credit growth surged to 20% year-on-year by August, on track to meet the 19-20% annual target, up from the initial 16% goal.

Emerging Trends: Shifting Investment Focus Towards New Asset Classes

Hyundai Minh Tuan forecasts a diversification in asset allocation trends, with an increased focus on emerging asset classes. The anticipated shift in Vietnamese asset composition includes: a reduction in cash deposits, a rise in equities, bonds, and digital assets; real estate maintaining its dominance, and stable holdings in gold and precious metals.

Prime Minister: Every Completed Project Brings Joy and Happiness to the People

Every home that rises and every project that reaches completion brings joy, excitement, and happiness to the people, contributing to the nation’s development. This was the powerful message emphasized by the Prime Minister, highlighting the profound impact of progress on the well-being and prosperity of the community.

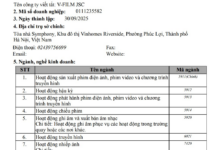

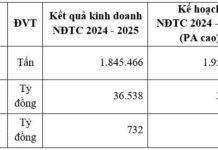

Vietnam Airlines Selected as Lead Investor for Three $240 Million Aviation Logistics Projects at Long Thanh International Airport

The largest of the three projects is the “Investment in Construction and Business Services for the Operation of Cargo Terminal No. 2,” with an initial investment of approximately VND 4,384 billion.