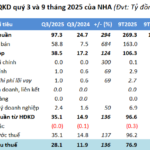

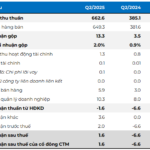

The Q3 financial report reveals that HUT’s revenue surpassed 9.1 trillion VND, marking a 14% increase. Gross profit from core operations soared by 40%, reaching nearly 958 billion VND, just shy of the record 992 billion VND achieved in Q4/2024, a period boosted by the 50% reduction in registration fees for automobiles.

The primary growth driver was the automotive business segment, which generated a gross profit of 750 billion VND, a 38% increase. The profit margin improved from 7% to 8.7%. Meanwhile, contributions from toll collection activities decreased, but income from other business segments rose.

| Gross profit just below Q4 last year |

However, the key factor propelling HUT’s profit surge was the divestment from a real estate project, which contributed 552 billion VND in financial revenue, a 5.5-fold increase year-over-year. After deducting related expenses, HUT recorded a net profit of 514 billion VND from financial activities, likely stemming from the sale of the Long Hòa project (Cần Giờ) by its subsidiary Savico.

Additionally, the company earned 46 billion VND in other income, resulting in a consolidated after-tax profit of 487 billion VND, with the parent company’s shareholders’ profit reaching 303 billion VND.

In the first nine months, HUT’s after-tax profit totaled 601 billion VND, a 4.7-fold increase compared to the same period last year, exceeding the annual plan by 5% despite having one quarter remaining. CEO Hoàng Minh Hùng stated that, excluding the allocation of trade advantages—primarily from the Tasco Auto acquisition—and the revaluation of assets post-merger, the actual profit would be around 877 billion VND.

As of the end of Q3, HUT’s total assets surged to over 35.2 trillion VND, an increase of approximately 6.2 trillion VND from the beginning of the year. Other receivables nearly doubled to 6.7 trillion VND, while bank deposits rose to over 4 trillion VND. Conversely, debt increased by 3.4 trillion VND, driving up interest expenses. Borrowings in the first nine months exceeded 20 trillion VND, a significant rise from the 14 trillion VND in the same period in 2024.

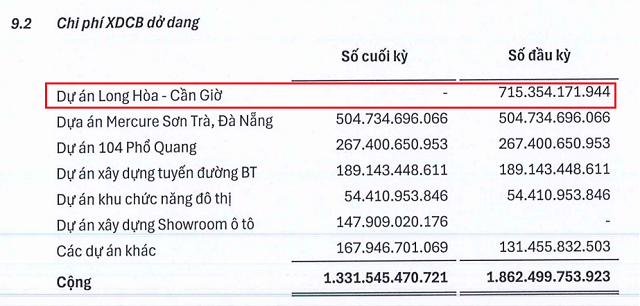

In terms of investment, construction in progress decreased to 1.3 trillion VND, primarily due to HUT writing off the Long Hòa project following its divestment.

The Long Hòa – Cần Giờ project has been removed from the books. Source: HUT’s Q3/2025 financial report

|

Regarding ownership, HUT’s shareholders approved allowing the foreign fund VIAC (No.1) Limited Partnership to receive share transfers from the post-merger swap group, while being exempt from the obligation to make a public tender offer if its holdings exceed 25% of the charter capital. VIAC has committed to maintaining its ownership until August 31, 2028, except for internal transfers approved by the General Meeting of Shareholders.

Furthermore, VII Holding—a company established with contributions from HUT’s Chairman Vũ Đình Độ—was also approved by shareholders to continue receiving share transfers from the same group, following its previous acquisition of 30% of HUT’s capital.

Chairman Vũ Đình Độ’s affiliated company completes 30% stake acquisition in Tasco

Tasco plans to allow foreign fund VIAC to hold company shares

– 10:26 30/10/2025

NHA Surpasses Annual Plan in Just 9 Months

Revenue and profit of the Hanoi Southern Housing and Urban Development Investment Corporation (HOSE: NHA) surged significantly in Q3, driven by land use rights transfers and the recognition of substantial construction volumes, surpassing the annual plan after nine months.