LPBank Securities Joint Stock Company (LPBS) has announced that November 17, 2025, will be the record date for shareholders to attend the 4th Extraordinary General Meeting of Shareholders in 2025.

The meeting is expected to amend the company’s charter and replace one Board of Directors member for the remaining term of 2023-2028.

On October 28, LPBS received a resignation letter from Ms. Nguyễn Thị Kiều Anh, who stepped down from her position as a Board member. In her letter, Ms. Kiều Anh mentioned she was elected to the Board in December 2024 but has since decided to focus on other commitments.

Aside from Ms. Kiều Anh, the LPBS Board consists of five other members: Chairman Nguyễn Duy Khoa (appointed in February 2025); Vice Chairman Vũ Thanh Huệ (appointed in December 2023); Ms. Dư Thị Hải Yến and Ms. Phạm Thu Hằng (both appointed in April 2024); and Mr. Hoàng Duy Hiền (appointed in December 2024).

On the same day, LPBS announced the dismissal of Ms. Trần Lan Hương from her role as Acting Chief Accountant. Ms. Nguyễn Thị Ngàn has been appointed as the new Chief Accountant, effective October 28, 2025.

In other developments, LPBS completed the distribution of 878 million shares to shareholders on October 15, increasing the total outstanding shares to 1.26 billion, equivalent to a charter capital of VND 12,668 billion.

With a selling price of VND 10,000 per share, LPBS raised VND 8,780 billion. The company plans to allocate 60% to invest in securities and deposit certificates, 30% to margin lending activities, and 10% to underwriting and other operations.

The capital utilization is scheduled from 2025 to 2026. Until margin lending funds are deployed, the capital will be invested in bonds and deposit certificates to ensure efficient use.

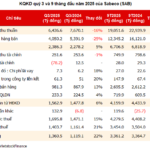

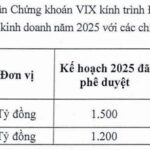

In Q3 2025, LPBS reported VND 430 billion in operating revenue and VND 123 billion in pre-tax profit, up 68% and 33% year-on-year, respectively.

All business segments saw growth, with the most significant contribution coming from FVTPL financial assets, surging from VND 3 billion to VND 187 billion.

For the first nine months of 2025, LPBS recorded VND 976 billion in operating revenue, an 887% increase, and VND 432 billion in pre-tax profit, 8.7 times higher than the same period last year.

LPBS targets VND 1,015 billion in revenue and VND 503 billion in pre-tax profit for 2025, both over five times the 2024 results. The company has achieved 86% of its annual profit goal.

Sabeco Q3 Profit Surges 22%, Gross Margin Hits Decade-High

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”c1e6c0ea-afbb-4ef7-a109-fa67b2fcaf61″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Despite”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” revenue”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” decline”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Q”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”/”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”5″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Saigon”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Beer”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Alcohol”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Bever”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”age”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Sab”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”eco”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” SAB”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reported”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” its”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” highest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” net”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” profit”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” quarters”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reaching”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” nearly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” trillion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” This”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” achievement”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” was”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” driven”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” by”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” significantly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reduced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” production”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” costs”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” gross”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” margin”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” exceeding”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” and”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” consistent”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” interest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” income”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” from”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” deposits”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” averaging”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” over”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” billion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” daily”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

Viglacera Sets Date to Distribute Nearly VND 1 Trillion in 2024 Dividends

On December 5, 2025, Viglacera will distribute a substantial dividend of 986.37 billion VND to its shareholders, reflecting the company’s strong performance in 2024.

Novaland (NVL) Reports 9-Month Revenue of Nearly VND 5.4 Trillion, Accumulated Losses Halved Year-on-Year

Novaland (NVL) has unveiled its Q3 business results, reporting consolidated net revenue of nearly VND 5.4 trillion for the first nine months. The accumulated loss has been significantly reduced by more than half compared to the same period last year, now standing at VND 1.820 trillion. The company’s operations highlight several key achievements: accelerated construction across all flagship projects, successful handover of 720 units, and the issuance of 1,935 land-use right certificates in the first three quarters.

Unlocking Broader Capital Access for F88 Through Enhanced Credit Rating Upgrade

F88 unveiled its Q3/2025 results, showcasing remarkable performance metrics and earning a credit rating upgrade to “BBB, Stable” by FiinRatings. This dual affirmation—one from operational achievements and the other from independent assessment—underscores that F88’s secured lending model is entering a new era of enhanced efficiency and reliability.