|

Source: VietstockFinance

|

Closing alongside the VN-Index in negative territory was the HNX-Index, which dropped 1.08 points to 266.96. Meanwhile, the UPCoM index managed to maintain its morning gains, ending the day up 0.78 points at 113.42.

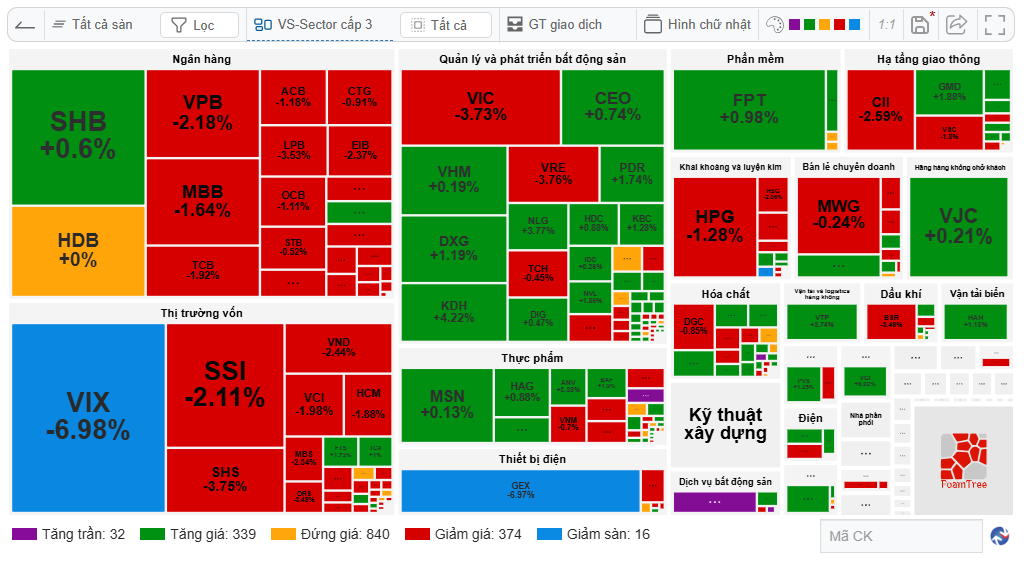

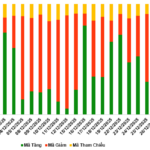

The market recorded 390 declining stocks (including 16 that hit the lower limit), outpacing the 371 advancing stocks (32 of which hit the upper limit). This disparity was even more pronounced across sectors, with 14 out of 23 sectors ending in the red. The hardest-hit sectors were consumer services, down 1.97%; real estate, down 1.67%; and financial services (primarily securities), down 1.57%.

Within consumer services, significant pressure came from VPL (Vinpearl Joint Stock Company), which fell 2.15%. In the real estate sector, two other Vingroup ecosystem members, VIC and VRE, also faced negative outcomes, declining 3.73% and 3.76%, respectively. The remaining notable member, VHM, reversed course and closed with a slight 0.19% gain.

In the securities sector, a sea of red engulfed both large and small players. Notable decliners included VIX, which hit the lower limit, and SSI, down 2.11%; VND, down 2.44%; SHS, down 3.75%; MBS, down 2.34%; and VCI, down 1.98%. A few gainers emerged, such as TCX, up 1%; FTS, up 1.73%; and BVS, up 1.8%.

Additionally, although the banking sector declined by less than 1%, its 0.99% drop still resulted in significant point losses. Other notable stocks impacting today’s decline included HPG, MWG, and even GEX, which hit the lower limit.

|

Market Map for October 30th Session

Source: VietstockFinance

|

It’s evident that the higher number of declining stocks compared to advancing ones contributed to today’s market retreat. However, the negative performance of large-cap groups amplified the impact. According to VietstockFinance data, the Large Cap index fell by 1.04%.

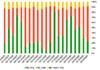

Market liquidity plummeted during today’s session, with total trading value reaching only approximately VND 23.4 trillion.

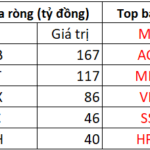

While it seemed foreign investors might also reduce their trading activity compared to the previous session, the reality was only partially true. Their buying value narrowed to nearly VND 2.5 trillion, while their selling value increased to nearly VND 3.6 trillion. As a result, foreign investors were net sellers, offloading nearly VND 1.2 trillion today.

The market witnessed five instances of net selling exceeding hundreds of billions. Leading the way was VIX, with nearly VND 390 billion; followed by GEX, with over VND 196 billion; MBB, with over VND 169 billion; SSI, with nearly VND 148 billion; and CII, with over VND 130 billion. In contrast, FPT was the only stock to see net buying in the hundreds of billions, specifically nearly VND 195 billion, far surpassing other stocks.

Morning Session: Red Dominates as VN-Index Closes Morning Down 12 Points

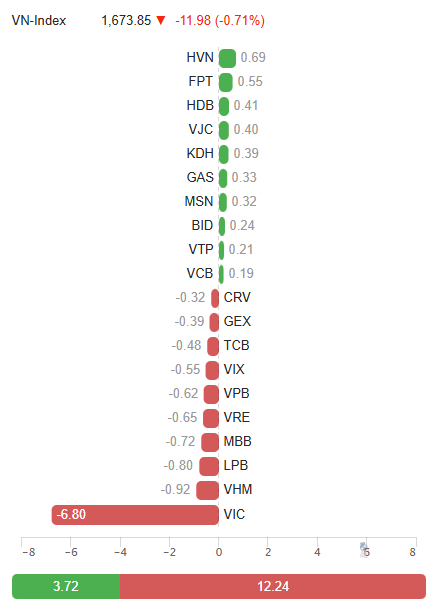

By the end of the morning session, the VN-Index had fallen 11.98 points to 1,673.85, while the HNX-Index rose 0.56 points to 268.6, and the UPCoM-Index gained 0.99 points to 113.63. The number of declining stocks had surpassed advancing stocks, and selling pressure was evident across many blue-chip stocks.

Amid significant pressure, the VN-Index dipped to nearly 1,667 at one point during the morning session, representing a decline of almost 19 points. However, late-session efforts helped narrow the index’s losses.

|

VN-Index Dips Nearly 19 Points Before Late-Session Recovery Efforts

Source: VietstockFinance

|

As observed from the start of the morning session, red dominated key sectors such as banking, securities, and Vingroup, alongside persistent weakness in many blue-chip stocks.

The market recorded four sectors declining by over 1%, including real estate, down 1.99%; financial services (primarily securities), down 1.21%; entertainment and communication, down 1.11%; and pharmaceuticals, down 1.09%. Additionally, credit institutions (banking) declined by 0.42%, adding further pressure.

Among the top 10 stocks negatively impacting the VN-Index, the duo of VIC and VHM led with losses of 6.8 points and 0.92 points, respectively. VRE also contributed, taking away 0.65 points. The list featured several banking stocks, including LPB, MBB, VPB, and TCB. Collectively, these top 10 stocks directly caused the VN-Index to lose 12.24 points. In contrast, the top 10 positive contributors managed to add only 3.72 points.

|

Top Stocks Impacting VN-Index in the Morning Session

Source: VietstockFinance

|

On the final day for Q3 financial report submissions, the atmosphere was highly animated as major companies unveiled results with a collectively positive tone. However, amidst the morning’s developments, a familiar concern resurfaced: “sell on news.”

Morning liquidity was unremarkable, totaling only VND 12.2 trillion across the market, with HOSE accounting for just over VND 11 trillion. This was generally lower than recent averages. Against this backdrop, foreign investors also scaled back their trading, buying just over VND 1.1 trillion and selling nearly VND 2.1 trillion, resulting in a net sell-off of nearly VND 924 billion.

10:30 AM: Mounting Pressure as Large Caps Decline Sharply

In the continuing morning session, polarization intensified, with declining stocks reaching 284, nearing the 296 advancing stocks. Notably, the prevalence of red across securities, banking, and Vingroup sectors directly eroded index points.

As of 10:30 AM, the VN-Index had fallen 11.49 points to 1,674.34, a significant expansion of losses from the session’s start.

In the securities sector, VIX widened its decline to 4.92%, followed by SSI, down 1.12%; SHS, down 2.08%; and ORS, down 2.53%. Notably, VIX continued to face heavy net selling by foreign investors, surpassing VND 200 billion. Similarly, in the banking sector, numerous stocks retreated, including MBB, down 1.23%; EIB, down 1.51%; STB, down 1%; and LPB, down 1.48%.

Additionally, declines in other large-cap stocks such as HPG, MWG, GEX, DGC, GVR, and BSR further pressured the market.

Meanwhile, the real estate sector remained polarized, with KDH up 3.92%, CEO up 3.32%, HDC up 2.06%, and NLG up 2.08%. However, declines in key players like VIC, down 3.3%; VRE, down 3.48%; and VHM, down 1.45%, created immense pressure, making real estate the hardest-hit sector in the morning, down 1.93%.

Across market capitalizations, all groups declined. Most notably, Large Caps retreated 0.7%, leading market losses. Mid Caps fell 0.05%, Small Caps dropped 0.02%, and Micro Caps decreased 0.41%. Clearly, significant pressure is currently at play.

Market Open: Mixed Signals as Q3 Financial Report Deadline Looms

On the final day for Q3 financial report submissions, Vietnam’s stock market opened with a mix of green and red.

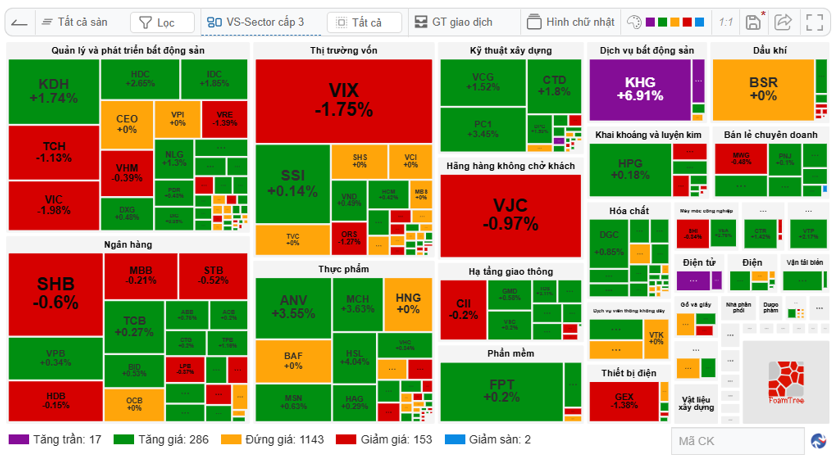

As of 9:30 AM, the VN-Index had dipped slightly by 0.78 points to 1,685.05, while the HNX-Index rose 1.04 points to 269.08, and the UPCoM-Index gained 1.45 points to 114.09. Although the market recorded 286 advancing stocks and 17 upper-limit stocks, outpacing the 153 declining stocks and 2 lower-limit stocks, the presence of many blue-chip stocks in the red significantly eroded index points.

On the advancing side, notable sectors included seafood, with ANV and VHC; real estate services, with KHG and LDG hitting upper limits early; retail, with PNJ, HAX, and FRT gaining; and chemicals, with early gains in stocks like DGC, DCM, DPM, and NTP…

Additionally, the food sector featured Masan Group stocks such as MSN, up 0.63%, and MCH, up 3.63%. Notably, at Masan Group’s investor conference on the afternoon of October 29th, CEO Danny Lê expressed confidence that MCH would recover from Q4 and affirmed that listing MCH on HOSE remains a top priority.

Meanwhile, the banking sector exhibited mixed performance. While VPB, TCB, BID, and ABB advanced, SHB, STB, MBB, and HDB retreated. Similarly, in the real estate sector, TCH and the trio of VIC, VHM, and VRE declined, while KDH, HDC, NLG, and PDR gained.

The securities sector, which had already completed Q3 financial report submissions, performed poorly. Many stocks quickly declined at the open, including VIX, down 1.9%; SSI, down 0.42%; SHS, down 0.42%; and ORS, down 1.9%… Notably, VIX faced early net selling by foreign investors, reaching nearly VND 50 billion in just half an hour of trading, the highest in the market.

|

Market Map as of 9:30 AM

Source: VietstockFinance

|

In the U.S. market overnight, the Dow Jones reversed course and fell sharply after reaching an early session high. A key highlight was Federal Reserve Chair Jerome Powell’s statement that the central bank might not cut rates further in 2025.

At the close, the Dow Jones fell 74.37 points (0.2%) to 47,632.00, while the S&P 500 ended nearly flat at 6,890.59. Meanwhile, the Nasdaq Composite advanced 0.55% to a new record closing high of 23,958.47, supported by Nvidia’s gains.

– 15:45 30/10/2025

Vietstock Daily 31/10/2025: Market Volatility Persists?

The VN-Index has retraced and continues to oscillate around the 50-day SMA. Trading volume declined for the fourth consecutive session, remaining below the 20-day average. Additionally, the Stochastic Oscillator has reversed, signaling a sell indication, suggesting that short-term volatility is likely to persist.

Bank Stocks Surge on October 29th: Top 3 UPCoM Bank Codes Skyrocket, HDB Leads Foreign Buying Spree

At the close of trading on October 29th, the banking sector saw a remarkable performance with 24 out of 27 stocks ending the day in positive territory. Notably, several stocks, including KLB, ABB, BVB, OCB, and HDB, surged by more than 3%, highlighting a strong investor sentiment in the industry.