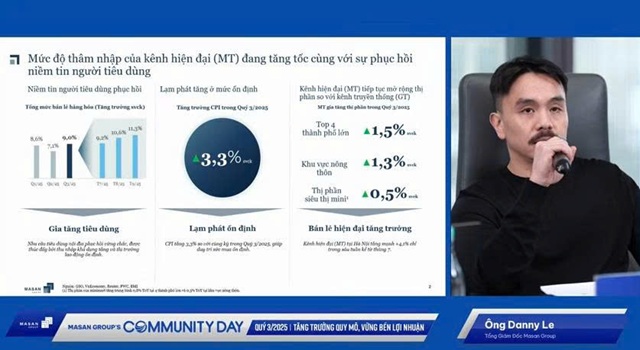

At the investor conference of Masan Group Corporation (HOSE: MSN) on the afternoon of October 29, 2025, Mr. Danny Lê, CEO of Masan, shared insights on the overall market conditions. He noted that consumer purchasing power has been rebounding since Q1 and is expected to sustain through Q4 and into Q1 of 2026.

More significantly, he highlighted the rapid shift from traditional markets (GT) to modern trade channels (MT). This is evidenced by a 0.5% increase in market share for mini-supermarkets and a 1.3% rise in rural areas. According to Mr. Danny Lê, this validates Masan’s 5-year strategy, which aims to increase MT penetration from 12% to 30% of market share. He predicts that by 2029-2030, MT will account for 25-30% of the market.

Regarding Masan Group’s performance, most of its platforms—WinCommerce, Masan MEATLife, Phúc Long, and Masan High-Tech Materials—have grown by over 20%. Masan Consumer (MCH), however, recorded a decline in Q3 2025 due to ongoing distribution restructuring. Mr. Danny Lê mentioned that growth resumed in October, with a 2026 target of over 10% growth.

In terms of profitability, Q3 2025 marked Masan’s highest profit since Q1 2022, primarily driven by WinCommerce, Masan MEATLife (MML), and Masan High-Tech Materials (MHT), thanks to record-high metal prices.

Financially, the net debt-to-EBITDA ratio improved to 2.8 times (compared to the mid-term target of 2.5 times). Cash reserves increased by nearly 30% from Q2, fueled by strong operating cash flows.

WinCommerce is confident in achieving its 2025 target of 700+ new stores

WinCommerce (WCM) saw a 22% revenue increase and a nearly 60% EBITDA rise, with an EBITDA margin of nearly 3%. Its network now includes nearly 4,300 stores, with a 10.6% like-for-like (LFL) growth rate.

Mr. Phan Nguyễn Trọng Huy, CFO of WinCommerce, stated that WCM has been improving quarter by quarter. The 22% growth is attributed to a 10% contribution from LFL and 10% from new store openings. Notably, all regions (North, Central, South) recorded double-digit growth.

Newly opened stores this year have outperformed previous years. These stores achieve positive EBIT at the store level in their first year (with a 1-2% profit margin) and a payback period of under 3 years. This performance is particularly strong in rural areas.

As of October, WCM has opened 550 new stores and is confident in reaching its 2025 target of 700+ stores. With this momentum, the company plans to open 1,000 to 1,500 stores in 2026, focusing on the North and Central regions.

A key milestone in Q3 was both Minimart (WinMart+) and large supermarket (WinMart) models achieving positive pre-tax profits for the first time. Over the past 4-5 years, WCM has focused on stabilizing its Minimart foundation and is now shifting focus to large supermarket chains. This year, WCM aims to renovate 50 supermarkets, enhancing the shopping environment and promoting fresh, processed, and non-food items. This strategy has yielded results, with LFL growth in supermarkets increasing from 0-2% to nearly 10% in Q3.

Meanwhile, the rural model remains a key growth driver for the next 3-5 years, with a 44% growth rate in Q3 (and nearly 20% LFL growth) and a store-level EBITDA margin of nearly 10%.

Masan Consumer to return to positive growth in Q4

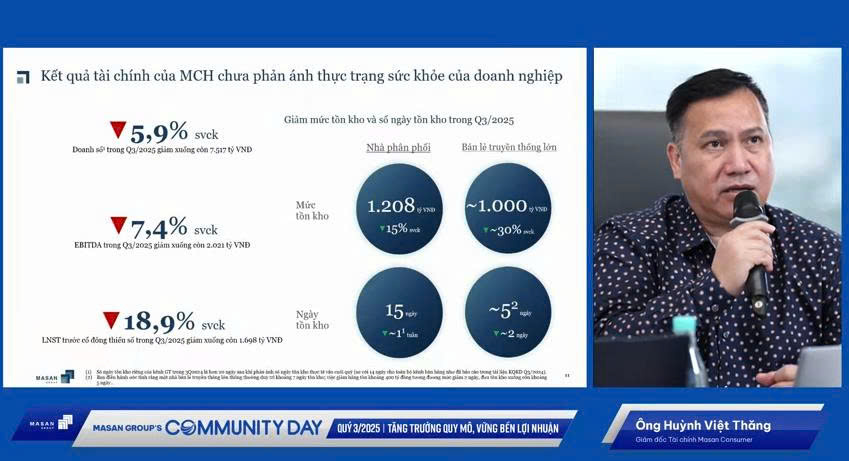

Masan Consumer (MCH) reported a 5.9% revenue decline, a 7.4% EBITDA drop, and a nearly 19% decrease in net profit in Q3, partly due to cash dividend payments.

Mr. Huỳnh Việt Thăng, CFO of Masan Consumer, explained that this short-term decline is due to the implementation of the “Retail Supreme” system, which optimizes distributor and wholesaler inventory. The project aims to bring MCH products closer to end consumers, reducing intermediary inventory and impacting MCH’s Q3 revenue. The project was completed in 34 provinces by early September, and MCH is seeing positive signs since October.

Additionally, the market has been affected by tax policy changes. Since June 2025, businesses with revenue over VND 1 billion must issue electronic invoices. From January 1, 2026, all businesses will transition from lump-sum tax to tax declaration. Mr. Thăng noted that MCH has proactively adapted through digital transformation and retailer identification.

Regarding “Retail Supreme,” Mr. Danny Lê explained that the project transforms three areas: people, technology, and connectivity. It restructures the sales team into “business representatives” managed by region, introduces new software with order suggestion features, and enables direct connectivity between representatives and retailers.

Initial results are promising: MCH’s direct coverage increased by 40%, reaching 345,000 retail points; wholesaler dependence dropped from 60% to 30%. Efficiency-wise, sales staff can serve 50% more retail points, and each order includes 50% more SKUs, while costs remain stable.

Notably, areas in Phases 1-3 (since September 2024) took 6-9 months to recover average revenue, while Phase 4-6 areas (recently implemented) took only 3 months. This halved recovery time is why MCH is confident about returning to growth in Q4.

Wherever WCM expands, MML follows

Masan MEATLife (MML) achieved a 23% revenue increase. Crucially, this is the first year MML has sustained profitability after divesting its animal feed segment. All products, including poultry, pork, and processed meat, grew by double digits. Processed meat is identified as a future profit driver, with innovative products contributing 33% to this segment’s revenue.

The synergy between MML and WCM continues to grow. MML now accounts for 65% of animal protein sales in WCM. MML’s revenue per WCM store increased by 20% to VND 2.3 million/day, contributing 3% to WCM’s 11% LFL growth. Efficiency-wise, gross profit margin slightly increased to 27.6% (from 26.4%), and MML expects this to exceed 30% as processed meat gains higher share.

MML aims to increase the use of pork in processed meat production (optimizing value), which has risen by 8% year-on-year through marination and processing optimizations.

Regarding cold chain and sales channel expansion, Mr. Danny Lê stated, “Wherever WCM expands, MML follows.” Next year’s plan includes 1,000-1,500 new WCM stores, with MML (fresh meat, marinated meat, processed meat) accompanying them. The company is also exploring models to sell MML products in traditional channels (GT) alongside MCH. MML aims to shift its product mix from 50% fresh meat and 50% processed meat to 60-65% processed meat revenue.

Focus on MCH IPO and strategic investors for MHT

For 2025, Masan Group’s CEO emphasized that the company is on track, even exceeding its 2025 profit plan. He stressed that MCH’s distribution restructuring is crucial for mid-to-long-term growth, noting that “a quarter’s results are less important than long-term value creation.” Masan remains committed to modernizing Vietnam’s retail and consumer platforms, with digital transformation and restructuring results becoming evident from 2026.

Mr. Michael Hung Nguyen, Deputy CEO of Masan Group, addressed the listing progress of Masan Consumer (MCH) and plans for Masan High-Tech Materials (MHT).

For MCH, he noted that the plan has been approved by shareholders since early 2025. Documentation is nearly complete, and investment banks are advising. Strong Q4 2025 and Q1 2026 results, coupled with positive market conditions, will support the listing. Mr. Michael is confident MCH will list on HOSE and join the VN30 index, with an official timeline to be announced later.

Regarding MHT, profits are strong due to record tungsten prices (over USD 600) following China’s export ban. This has attracted interest from strategic investors and foreign governments. Mr. Michael expects positive developments on this front by year-end or early next year.

When asked about listing or divesting WCM and Phúc Long, Mr. Michael confirmed that Masan is currently focused on MCH’s IPO and finding strategic investors for MHT. Future opportunities for listing subsidiaries or raising capital will be considered as they arise.

– 21:07 29/10/2025

WinMart Expands Reach, Bringing Modern Retail to Over 100 Million Vietnamese Consumers

Vietnam’s retail market, valued at over $309 billion, is entering its fastest growth phase in the region, with modern retail channels projected to reach 35% by 2030. Amidst fierce competition from global giants, WinMart stands out as a formidable domestic player, rapidly expanding to secure a strong foothold for Vietnamese businesses.

Billionaire Nguyen Dang Quang’s Pork Business: Q3 Profits Surge Fivefold

Masan’s meat business segment delivered another quarter of robust performance in Q3, showcasing significant growth across both livestock farming and processed meat divisions. Concurrently, the company demonstrated effective management of financial expenses, further solidifying its market position.