Implementing Resolution No. 198/QH15 on abolishing tax payment for business households from January 1, 2026, and Decision No. 3389/QĐ-BTC by the Ministry of Finance approving the project “Transitioning Tax Management Models and Methods for Business Households Upon Elimination of Presumptive Tax,” the Ho Chi Minh City Tax Department is rolling out various support measures for business households. Meanwhile, approximately 5 million business households nationwide are navigating the preparatory steps for this transition.

Supporting the Elderly and Traditional Traders

Speaking at the talk show “From January 1, 2026, How Can Business Households Pay Taxes Conveniently?” organized by the Labor Newspaper on October 28, Mr. Nguyen Tien Dung, Deputy Director of the Ho Chi Minh City Tax Department, stated that transitioning from presumptive tax to declaring actual revenue is an essential step toward building a transparent, equitable business environment and promoting national digital transformation.

However, many business households, particularly the elderly and traditional market traders, still rely on manual record-keeping, lack technological proficiency, and have insufficient skills in invoicing, documentation, and accounting. With the abolition of presumptive tax, they must shift their mindset and acquire the necessary tools to adapt.

“Business households need to understand regulations on invoices, documentation, accounting, and tax declaration on digital platforms such as eTax, eTax Mobile, or the National Public Service Portal. They must have devices like computers, printers, phones, and software, and choose a suitable electronic invoice service provider to record and pay taxes according to regulations,” Mr. Dung emphasized.

According to Mr. Dung, the Ho Chi Minh City Tax Department has issued a plan aimed at completely eliminating presumptive tax and transitioning 100% of business households to the tax declaration method by January 1, 2026. It has also directed 29 local tax offices to review and categorize business households into three groups based on annual revenue: under 200 million VND, 200 million to 3 billion VND, and over 3 billion VND. Detailed guidance will be provided throughout the transition process. The tax department is also collaborating with electronic invoice service providers, consulting firms, and tax agents to ensure a smooth transition for taxpayers.

Also present at the talk show, Ms. Phan Thi Hong Loan, owner of the 2G Coffee business, acknowledged that abolishing presumptive tax and transitioning to a business entity is an inevitable step for business households to become more mature and professional. “From being self-employed, business owners must adopt the mindset of a company owner, maintain discipline, closely monitor cash flow, and clearly distinguish between personal and company finances,” she said.

Delegates and guests at the Labor Newspaper’s talk show on the morning of October 28. Photo: Tan Thanh

According to this business owner, the initial investment in software, staff training, and familiarity with tax declaration technology may cause anxiety, especially for the elderly. However, she believes the biggest barrier is the fear of change. “Many people accustomed to simple record-keeping feel pressured when adapting to more structured processes, even though this change fosters more sustainable business development,” Ms. Loan shared.

According to Mr. Nguyen Chanh Trung, Deputy Director of the Individual Customer Division at Ban Viet Bank (BVBank), transitioning to a tax declaration mechanism is not just a technical change but also a pivotal step toward making business activities more transparent and closer to a corporate model. During this process, banks will act as partners, helping business households access capital, build financial histories, and establish standardized credit profiles for formal corporate conversion.

“We view business households as an integral part of the private sector, so BVBank has launched tailored financial and management solutions, from credit and payments to cash flow management, to help them maintain current efficiency and prepare for the future,” Mr. Trung emphasized.

Benefits After Tax Declaration

Discussing the benefits of transitioning from a business household to a company, Mr. Nguyen Tien Dung noted that companies have full legal entity status, can open bank accounts, sign contracts, participate in tenders with large partners, and gain higher trust. Companies can also expand their business scale and access various capital sources, such as joint ventures, partnerships, investors, and banks.

Companies declaring taxes under the deduction method may receive value-added tax refunds in certain cases and enjoy corporate income tax incentives with a 15% rate if annual revenue does not exceed 3 billion VND, along with a two-year tax exemption from the date of taxable income. Therefore, the Ho Chi Minh City Tax Department recommends that business households with 10 or more employees or annual revenue exceeding 3 billion VND (production) and 10 billion VND (trade, services) should convert to companies for further development.

Regarding corporate capital, Mr. Nguyen Chanh Trung observed that many business households face challenges when expanding, particularly due to a lack of collateral and non-standardized accounting records. As this is a systemic issue, BVBank has designed tailored credit solutions for this customer segment.

Specifically, alongside traditional production and business loans, BVBank is promoting cash flow-based lending models—relying on revenue through bank accounts, electronic invoices, POS data, or tax documents. This approach helps banks assess financial capacity more transparently while reducing reliance on collateral for customers.

“Banks are also developing seamless solutions for business households transitioning to small and medium-sized enterprises, supporting working capital, fixed asset investment, and post-transition cash flow management. The goal is to reduce capital access barriers while ensuring credit safety and fully supporting business households on their journey to becoming formal companies,” Mr. Trung said.

Ms. Phan Thi Hong Loan expressed hope for a fair and transparent competitive environment between business households and companies. In the initial transition phase, many business households still feel apprehensive when dealing with tax authorities. Therefore, they hope that during this period, tax authorities will act as partners, providing guidance and knowledge rather than just being supervisory bodies.

“With dedicated support from tax authorities and tailored solutions from banks, the transition from presumptive tax to tax declaration will certainly proceed smoothly. This will lead to more sustainable and synchronized development of Ho Chi Minh City’s economy,” Ms. Loan proposed.

Ms. Mai Thi Nghia Le, Head of the Individual Tax, Business Household, and Other Taxes Department at the Ho Chi Minh City Tax Department, stated that the department is directly managing approximately 363,000 business households across three provinces and cities after the merger, including Ho Chi Minh City, Binh Duong, and Ba Ria – Vung Tau (former). Of these, 345,000 households still pay taxes under the presumptive method, while 18,000 have switched to tax declaration. To ensure an effective transition, the tax authority has categorized the 345,000 presumptive tax households into three groups based on revenue scale, providing detailed support and guidance at each stage.

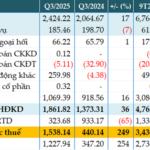

OCB Reports Q3/2025 Profit of VND 1.538 Trillion, a Threefold Increase Year-on-Year

Oriental Commercial Joint Stock Bank (Stock Code: OCB) has released its Q3/2025 financial report, revealing a pre-tax profit of VND 1,538 billion, a threefold increase compared to the same period last year. This remarkable growth is attributed to the continued expansion of its core business operations.

Hanoi Outlines Ambitious 11%+ Growth Plan for 2026-2030

In the economic and social development plan for 2026-2030, the Hanoi People’s Committee aims to achieve an average GRDP growth rate exceeding 11%, alongside significant increases in per capita income and overall labor productivity.