Illustrative Image

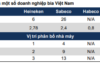

According to the Hanoi Stock Exchange (HNX), Vietnam National Petroleum Group (Petrolimex) has submitted a notification to the State Securities Commission (SSC), the Stock Exchange, and Petrolimex Hanoi Trading and Transportation Joint Stock Company (Stock Code: PJC) regarding a related party transaction involving shares of an insider.

Petrolimex plans to acquire over 3.7 million PJC shares (equivalent to a 51.06% stake) from Petrolimex Petroleum Service Joint Stock Corporation. Prior to this transaction, Petrolimex held no PJC shares. Post-transaction, Petrolimex is expected to own more than 3.7 million PJC shares, representing a 51.06% stake.

The purpose of this transaction is to transfer ownership rights as per the enterprise merger agreement. The transaction is scheduled to take place from October 27, 2025, to November 26, 2025, through an off-exchange share transfer method at the Vietnam Securities Depository (VSDC).

Regarding the relationship between these entities, Petrolimex Hanoi Trading and Transportation Joint Stock Company is a second-tier subsidiary of Petrolimex, with its direct parent company being Petrolimex Petroleum Service Joint Stock Corporation.

Currently, Mr. Bùi Văn Thành, Chairman of PJC’s Board of Directors, represents nearly 1.5 million PJC shares (20.43%) held by Petrolimex Petroleum Service Joint Stock Corporation in PJC.

Mr. Phạm Quốc Hùng, a Board Member and Director of PJC, represents 17.87% of Petrolimex Petroleum Service Joint Stock Corporation’s equity in PJC.

Mr. Phan Văn Tân, Deputy Director of PJC, is authorized by Petrolimex Petroleum Service Joint Stock Corporation to represent 12.27% of its equity in PJC.

Additionally, Petrolimex plans to acquire nearly 3.8 million PSC shares of Petrolimex Saigon Transportation and Service Joint Stock Company from PTC.

PSC is a second-tier subsidiary of Petrolimex, with its direct parent company being PTC. If the transaction proceeds as planned, Petrolimex will hold nearly 3.8 million PSC shares, equivalent to a 52.73% stake.

Earlier in October 2025, Petrolimex announced the signing of a merger agreement. Based on Resolution No. 036/PLX-NQ-HĐQT on the PTC Restructuring Plan and Resolution No. 01/2025/PLX-NQ-ĐHĐCĐ dated March 28, 2025, from the Extraordinary General Meeting of Shareholders in 2025, Petrolimex and PTC signed Merger Agreement No. 125/2025/PLX-PTC on October 1, 2025.

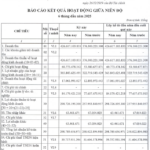

PJC Reports 51% Profit Surge, Ownership Transferred to Petrolimex

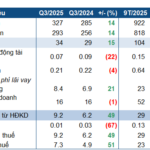

Petrolimex Hanoi Joint Stock Company (HNX: PJC) experienced robust growth in Q3 2025, driven by improved output compared to the same period last year. Additionally, over 51% of the company’s shares are set to be transferred to Petrolimex (HOSE: PLX) in the near future.

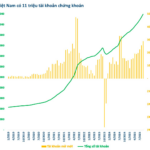

The VN-Index Hits Record Highs, While Stock Exchange and Securities Depository See Mixed Fortunes

The VN-Index surged by 110 points, an impressive 8.6%, in the first half of the year, despite a period of intense adjustment due to tariff fluctuations. This contrasting performance was observed when comparing the business situation of the Vietnam Securities Depository and Settlement Corporation and the Vietnam Stock Exchange.