According to the draft, when calculating land use fees, infrastructure construction costs are only applied to the land area handed over to the state by the investor. The Vietnam Real Estate Association (VNREA) argues that this regulation is unreasonable. VNREA suggests that infrastructure costs for the entire project should be considered, not just the handed-over land.

Additionally, VNREA proposes adding provisions for handling land reclamation costs when determining land prices. Currently, these costs are only included in project development expenses using the surplus method.

VNREA emphasizes that the current land price list is primarily based on existing land plots. Consequently, many infrastructure projects without land handed over to the state (e.g., industrial zones) cannot deduct infrastructure costs.

In reality, infrastructure investment costs vary significantly across projects, especially in new areas or land reclamation projects requiring substantial landfilling and infrastructure development. Allowing infrastructure cost deductions only for land handed over to the state would be unfair to investors.

Another issue concerns Clause 7 of Article 3 on land recovery, compensation, support, and resettlement. The draft stipulates that advance payments made by investors for compensation, support, and resettlement will be deducted from land use fees or land rent for the entire project, as per Clause 2 of Article 94 of the Land Law.

However, VNREA notes that the current Land Law allows investors to deduct advance payments from land use fees or rent, with any surplus added to the project’s total investment capital.

VNREA believes the draft’s provisions do not adequately protect investor interests and discourage advance payments for compensation, support, and resettlement, especially in projects exempt from or eligible for reduced land use fees or rent.

Therefore, the association recommends allowing investors to deduct advance payments from other financial obligations to the state.

VNREA highlights that Article 5 of the draft Resolution mandates the use of land price lists to calculate land use fees and rent for all projects upon land allocation, lease, or change of land use purpose.

However, the association suggests adding specific land pricing for large-scale projects (100+ hectares) or those in newly developed areas without established land price lists, instead of using the general price list.

VNREA also comments on the regulation for additional fees during periods without land price determination. Currently, individuals with land allocation or lease decisions before August 1, 2024, but without determined land prices, must pay a 5.4%/year supplement (expected to decrease to 3.6%/year).

The association argues that determining land prices is the state’s responsibility, not the land user’s. Requiring land users to pay additional fees during this period lacks justification, as they cannot exercise rights like buying, selling, transferring, or mortgaging until land use fees or rent are paid.

Thus, VNREA proposes that land users pay supplements only if the land has been utilized for exploitation, business, or other purposes. If the land remains unused, no supplement should be required.

If land users have already paid supplements, they should be refunded or allowed to deduct the amount from other financial obligations to the state.

Hanoi Proposes Up to 26% Land Price Hike: New Land Valuation Must Remain Neutral

Determining land valuation to establish a “neutral” pricing framework that balances the interests of all stakeholders remains a complex challenge. Adjusting legal documents related to taxes, fees, and charges associated with land use could help mitigate the drawbacks of rising land prices and better protect citizens.

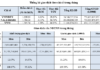

Proposed Implementation of Land Price Tables by Land Type

The government proposes implementing a standardized land price table, categorized by land type, area, and location, to calculate financial obligations and compensation when the state reclaim land, replacing the current method of determining specific land prices.