VHM reported a consolidated net revenue of VND 70.4 trillion (including revenue from business cooperation contracts and large-lot sales recorded in financial revenue).

The total sales for the first 9 months reached VND 162.6 trillion, a 96% increase compared to the same period last year, demonstrating strong market demand and the effectiveness of the sales strategy. Unrecorded sales by the end of September hit a record high of VND 223.9 trillion, up 93% from the end of Q3 2024.

|

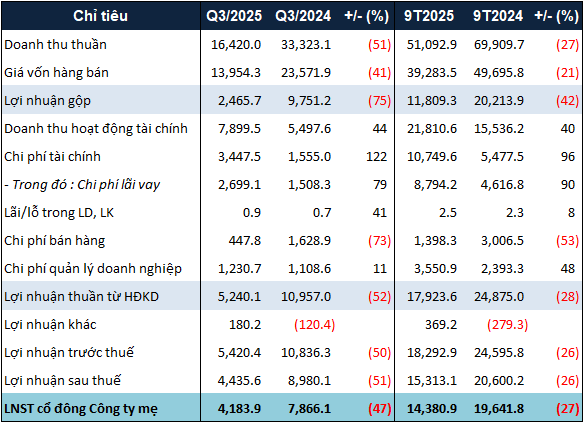

VHM’s 9-month business results in 2025. Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, VHM’s total assets reached VND 768.3 trillion, a 36% increase from the beginning of the year. Short-term cash holdings rose by 67% to nearly VND 50.9 trillion, reflecting healthy operating cash flow. Inventory stood at VND 125.6 trillion, 2.3 times higher than at the end of Q4 2024, primarily due to the accelerated development of large-scale projects, indicating active investment progress for the new sales cycle.

To celebrate the 80th anniversary of Vietnam’s National Day, Vinhomes and its parent company Vingroup inaugurated and commenced six key projects nationwide. The highlight was the Vietnam Exhibition Center in Dong Anh (Hanoi), completed in just under 10 months. Simultaneously, the Royal Bridge in Hai Phong opened to traffic, reducing travel time from Vinhomes Royal Island to the city center to approximately 5 minutes. Additionally, an 18-hole international standard golf course in Quang Hanh (Quang Ninh), an industrial park in Vung Ang (Ha Tinh), and the new urban area of Phuoc Vinh Tay (Tay Ninh) were also launched, marking strategic steps in expanding Vinhomes’ footprint across the country.

These nationally significant projects not only boost local economies, infrastructure, industry, and tourism but also reinforce Vinhomes’ pioneering role in fostering national strength and supporting Vietnam’s development and integration journey.

– 22:03 30/10/2025

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability, Dividends, and Bonus Shares Up to 30%

HDBank (HOSE: HDB) has reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% year-on-year growth. The bank continues to lead the industry in profitability metrics, boasting an impressive ROE of 25.2% and ROA of 2.1%, underscoring its operational efficiency and robust financial foundation.