Recently, REE Real Estate LLC has issued a notice regarding the transaction of SGR shares held by Saigonres, a leading real estate corporation in Saigon.

According to the announcement, REE Real Estate plans to sell over 3.05 million SGR shares as part of its portfolio restructuring strategy. The transaction is scheduled to take place between October 31, 2025, and November 28, 2025, through order matching and/or negotiated deals.

If successful, REE Real Estate’s ownership in SGR will decrease from over 15.26 million shares to more than 15.21 million shares, reducing its stake from 21.84% to 17.48% of Saigonres’ capital.

Previously, during the transaction period from September 23, 2025, to October 21, 2025, REE Real Estate successfully sold only 55,000 SGR shares out of the registered 3 million shares, accounting for nearly 2%. The incomplete transaction was attributed to unmet price expectations.

Following this transaction, REE Real Estate’s holdings in SGR decreased from nearly 15.32 million shares to 15.26 million shares, reducing its ownership from 21.92% to the current 21.84%.

REE Real Estate is a wholly-owned subsidiary of REE Corporation (stock code: REE, listed on HoSE). Currently, Mr. Nguyen Van Khoa, Director of REE Real Estate, also serves as Vice Chairman of Saigonres’ Board of Directors.

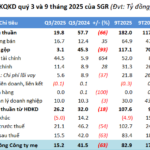

In terms of business performance, Saigonres’ consolidated financial report for Q3/2025 revealed a net revenue of over VND 19.8 billion, a 65.7% decline compared to the same period last year. After deducting the cost of goods sold, gross profit reached more than VND 3.1 billion, down 93.1%.

During the period, the company generated over VND 44.5 billion in financial revenue, a 7.5-fold increase year-over-year.

After tax and fee deductions, Saigonres reported a net profit of over VND 15.5 billion, a 63.1% decrease compared to the same period last year.

For the first nine months of 2025, Saigonres achieved a net revenue of over VND 182 billion, up 54.4% compared to the same period in 2024; post-tax profit reached nearly VND 83.4 billion, 4.5 times higher year-over-year.

For 2025, Saigonres has set a business target of VND 1,025 billion in revenue and VND 320 billion in post-tax profit.

By the end of Q3/2025, the company had achieved 17.8% of its revenue target and 26.1% of its post-tax profit goal.

As of September 30, 2025, Saigonres’ total assets increased by 14.6% compared to the beginning of the year, reaching over VND 2,581.7 billion; total liabilities stood at over VND 1,131.5 billion, down 11.4%.

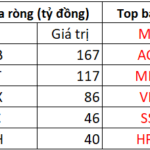

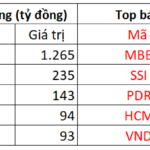

Foreign Investors Net Sell Nearly VND 1.6 Trillion in Session 29/10, Unloading a Bank Stock in a Sudden Surge

In contrast, foreign investors heavily accumulated HDB and FPT shares, making them the most sought-after stocks in the market with values of 167 billion VND and 117 billion VND, respectively.

Saigonres Achieves 26% of Profit Plan After 9 Months

Plummeting revenue and soaring costs left Saigonres with a meager Q3 net profit of just over VND 15 billion, a staggering 63% decline. After nine months, the company has achieved a mere 26% of its annual profit target.