On the morning of October 30th, the Banking Times hosted a seminar titled “Savings – The Inherent Strength in the Digital Era.”

|

Attending and speaking at the seminar, Deputy Governor of the State Bank of Vietnam (SBV), Pham Thanh Ha, stated that the seminar, held on the occasion of World Savings Day (October 31st), is a meaningful activity. It aims to promote a culture of savings, encouraging citizens to adopt healthy financial habits, safe accumulation, and effective investment.

Simultaneously, it raises awareness of the responsibility in utilizing savings efficiently, ensuring optimal use of resources from the state budget to the private sector and the entire society.

According to SBV data, as of now, resident deposits at credit institutions have reached approximately 8 quadrillion VND, a nearly 13% increase compared to the same period last year.

“This abundant financial resource has significantly contributed to maintaining Vietnam’s GDP growth at a high level, a highlight in the region,” said Deputy Governor Pham Thanh Ha. He added that this is a clear demonstration of the effectiveness of leveraging savings within the population as an inherent strength of the economy.

The Deputy Governor also noted that in the current volatile global economic landscape, with intensifying competition for resources, shrinking international capital, and rising capital costs, harnessing internal strength, savings, and efficient resource utilization is more strategically crucial than ever.

Therefore, savings are not merely a traditional value but have become a developmental requirement, a foundation for strengthening national financial resilience, ensuring macroeconomic stability, and enhancing the economy’s resilience.

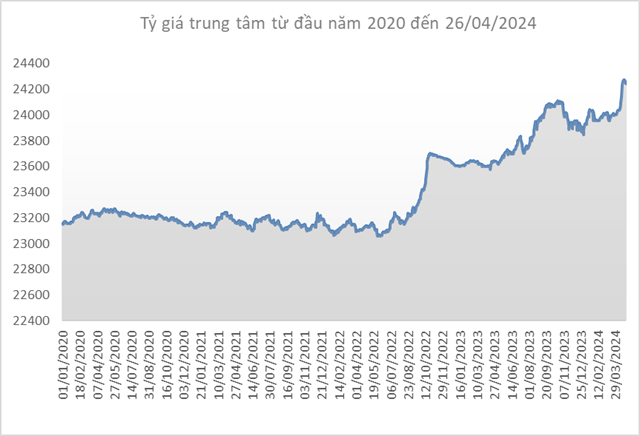

Over the years, the SBV has proactively and flexibly managed monetary policy, supporting credit institutions in maintaining reasonable interest rates. This has facilitated access to capital for individuals and businesses, fostering the flow of savings and investment.

|

In the context of robust digital transformation, Deputy Governor Pham Thanh Ha believes that savings are not just about financial accumulation but also about efficiently utilizing resources for innovation and future investment.

Digital transformation has opened new development avenues for the banking sector: innovating business models, automating processes, optimizing operational costs, enhancing productivity, and reducing societal waste.

Currently, over 95% of citizen transactions are conducted through digital channels, with non-cash payments increasing by an average of 45% annually, saving society a substantial amount each year.

Banks continue to develop modern, convenient savings products such as online savings and flexible savings, enabling citizens to easily deposit savings anytime, anywhere, ensuring safety and transparency.

From a banking perspective, diversifying savings products on digital platforms not only increases the ratio of non-term deposits (CASA) – a crucial factor in reducing capital costs and improving operational efficiency – but also creates conditions for banks to further lower interest rates, supporting businesses and the economy.

“Only when savings become a habit, a cultural norm, and a governance principle, can we build a self-reliant economy, a sustainably developing society, and a prosperous, happy nation,” Deputy Governor Pham Thanh Ha emphasized.

NGOC DIEP

– 13:58 30/10/2025

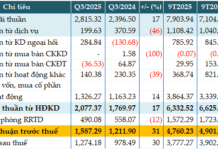

Eximbank Credit Grows by 8.51%, Pre-Tax Profit for 9 Months Reaches VND 2,049 Billion

Eximbank is embarking on a transformative journey, poised to establish a robust foundation for sustainable growth and solidify its position within Vietnam’s financial and banking ecosystem.

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability, Dividends, and Bonus Shares Up to 30%

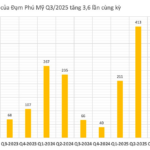

HDBank (HOSE: HDB) has reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% year-on-year growth. The bank continues to lead the industry in profitability metrics, boasting an impressive ROE of 25.2% and ROA of 2.1%, underscoring its operational efficiency and robust financial foundation.

Pi Group Forges Strategic Partnerships with Global Leaders to Build the Digital City of Picity

On October 28, 2025, Pi Group Corporation hosted the “Strategic Cooperation Signing Ceremony – Building the Digital City Picity” at the Hilton Hotel in Ho Chi Minh City.

Hallmark Achieves Vietnam’s First WiredScore Platinum Certification

On October 29th, The Hallmark, a premier Grade A+ office building in the heart of Ho Chi Minh City, proudly achieved Platinum certification—the highest level in the WiredScore system. This prestigious recognition marks The Hallmark as the first building in Vietnam to attain this global benchmark for digital infrastructure excellence.