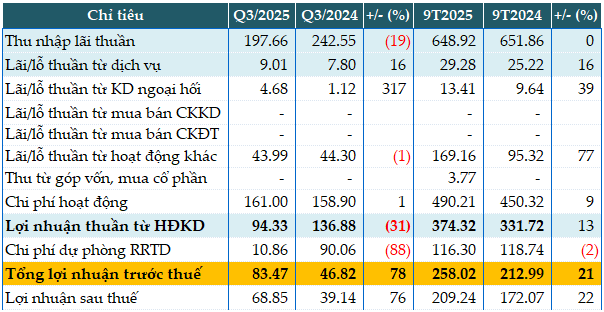

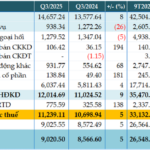

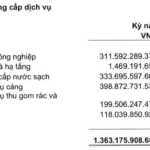

In Q3, SGB‘s business activities experienced a slight decline compared to the same period last year. Primary revenue sources dropped by 19%, with net interest income reaching nearly VND 198 billion.

Service-related profits rose by 16%, totaling over VND 9 billion. Despite a robust growth in foreign exchange operations, quadrupling the previous year’s performance, the profit margin remained modest at nearly VND 5 billion. Other operational profits saw a minor 1% decrease, settling at approximately VND 44 billion.

Operational expenses for the quarter increased marginally by 1%, reaching VND 161 billion. Consequently, net profit from business operations plummeted by 33%, amounting to just over VND 94 billion.

However, SGB significantly reduced its credit risk provisioning costs by 88%, allocating only VND 11 billion. This strategic move propelled pre-tax profits up by 78%, surpassing VND 83 billion.

For the first nine months of the year, the bank’s pre-tax profit stood at VND 258 billion, marking a 21% increase year-over-year. Against the annual target of VND 300 billion in pre-tax profit, Saigonbank has achieved 86% of this goal in the first three quarters.

|

Q3 and 9-month business results for 2025 of SGB. Unit: Billion VND

Source: VietstockFinance

|

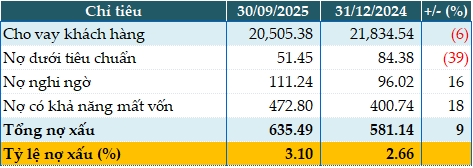

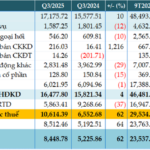

As of the end of Q3, the bank’s total assets grew by 5% from the beginning of the year, reaching VND 34,870 billion. Customer loans decreased by 6% to VND 20,505 billion, while customer deposits increased by 6% to VND 25,943 billion.

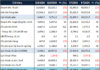

Total non-performing loans as of September 30, 2025, were recorded at VND 635 billion, a 9% increase. Substandard debts decreased by 39%. As a result, the non-performing loan ratio to outstanding loans rose from 2.66% at the beginning of the year to 3.1%.

The non-performing loan ratio according to Circular 31/2024/TT-NHNN as of September 30, 2025, was 2.23%.

|

Loan quality of SGB as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 16:28 30/10/2025

MSB’s Q3 Pre-Tax Profit Surges 31% on Strong Forex Gains

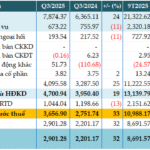

The Q3/2025 consolidated financial report reveals that Vietnam Maritime Commercial Joint Stock Bank (HOSE: MSB) achieved pre-tax profits exceeding VND 1.587 trillion, marking a 31% year-on-year increase. This impressive growth is attributed to the bank’s robust core income expansion and successful foreign exchange operations.

Vietcombank Reports 5% Surge in Pre-Tax Profit for Q3, Bolstered by Robust Reserves

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 11,239 billion in Q3/2025, marking a 5% year-on-year increase despite a significant rise in risk provisioning costs, as revealed in its recently released consolidated financial statement.

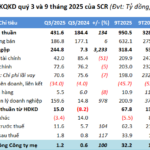

Sacombank Reports Pre-Tax Profit of Nearly VND 11 Trillion in 9 Months, Up 36%

Sacombank (HOSE: STB) reported a pre-tax profit of nearly VND 3.657 trillion in Q3/2025, marking a 33% year-on-year increase. This impressive growth is attributed to robust core revenue expansion and reduced risk provisioning costs. Consequently, the bank’s nine-month profit surged to VND 10.988 trillion, reflecting a 36% rise compared to the same period last year.