According to the Q3/2025 financial report, Saigon Thuong Tin Real Estate Joint Stock Company (TTC Land, HOSE: SCR) successfully acquired partial land use rights and an office building at 266-268 Nam Ky Khoi Nghia, Xuan Hoa Ward, Ho Chi Minh City, valued at VND 885.4 billion.

Simultaneously, SCR secured a 5-year lease agreement with a bank for the office building, generating nearly VND 661.5 billion in rental income.

As a result, SCR’s investment property value surged from VND 710 billion at the beginning of the year to over VND 1,576 billion by the end of September. Long-term unearned revenue from advance rentals skyrocketed to VND 808 billion, a 13-fold increase from the start of the year.

In addition to the acquisition, SCR divested from Phuoc Tan Construction and Trading Joint Stock Company, reducing its ownership stake from 11.33% to 1.41%, equivalent to a decrease in book value from VND 177.3 billion to approximately VND 22.1 billion.

In 2021, TTC Land acquired 14 million shares (20% of charter capital) in Phuoc Tan at a maximum price of VND 330 billion, aiming to expand its land bank.

Phuoc Tan is the developer of the Nuí Dòng Dài Garden Villa and Resettlement Area project in Phuoc Tan Ward, Bien Hoa City, Dong Nai Province. The project spans over 156.3 hectares, accommodating 16,000-16,500 residents, 531 villas, and 3,184 apartments.

Project rendering. Source: TID

|

Established in 2009 with a charter capital of VND 100 billion, Phuoc Tan’s founding shareholders include Tin Nghia Corporation (30%) and Long Thanh Golf Investment and Trading Joint Stock Company (49%), along with employees of Tin Nghia (20%) and Long Thanh Golf (1%). The company increased its capital to VND 400 billion in 2018 and VND 700 billion in 2021. Currently, Mr. Tran Ba Tai serves as the Director and legal representative.

As of September 2025, Tin Nghia Industrial Park Development Joint Stock Company (HOSE: TIP) holds a 40% stake in Phuoc Tan, equivalent to VND 280 billion.

By Thu Minh

– 11:42 30/10/2025

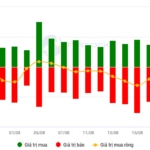

Stock Market Wrap-up: A Peak Pause

The VN-Index struggled during the week’s final session as intense profit-taking pressure drowned the market. This development mirrors late July 2025, when the rally stalled after an extended uptrend. The upcoming trading sessions will be pivotal in determining whether the market is taking a breather before resuming its ascent or transitioning into a more distinct corrective phase.