Taseco Land Joint Stock Company (Taseco Land – HoSE: TAL) recently released its Q3/2025 financial report, showcasing significant improvements in its core business operations.

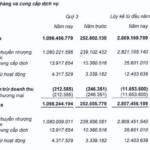

Specifically, Q3 net revenue reached VND 1,238 billion, nearly quadrupling compared to the same period last year. Correspondingly, the cost of goods sold and services provided also surged, recording VND 802 billion, triple the previous year’s figure. Despite this, gross profit still hit VND 437 billion, a sixfold increase. Consequently, the gross profit margin improved from 21.95% to 35.30%, indicating increasingly efficient core business operations.

In terms of financial activities, Taseco Land’s Q3/2025 financial revenue reached VND 17 billion, while financial expenses rose by 18.3% to VND 43 billion.

Additionally, expenses increased significantly in line with the company’s expansion. Specifically, selling expenses tripled year-on-year to nearly VND 55 billion, and administrative expenses rose by 45% to VND 73.6 billion. Nevertheless, Taseco Land’s Q3/2025 after-tax profit still reached VND 223 billion, a 20% increase compared to the same period last year.

For the first nine months, the company’s net revenue totaled VND 2,171 billion, a 74% increase. The financial statement reveals that revenue from real estate operations accounted for 51%, reaching VND 1,155 billion, a 1.5-fold increase. Notably, the company recorded an additional VND 636 billion from long-term leasing of land-use rights with technical infrastructure in industrial zones, diversifying revenue streams and ensuring stable cash flow in the medium to long term.

The cost of goods sold for these activities also increased accordingly, significantly raising the total cost of goods sold and services provided. However, this is deemed appropriate given Taseco Land’s ongoing expansion of its project portfolio in 2025, particularly in the northern region, where the company focuses on both urban and industrial real estate development. After deducting expenses, Taseco Land’s cumulative pre-tax profit reached VND 381.6 billion, a 47% increase year-on-year, with cumulative after-tax profit for the first nine months hitting VND 283 billion, a 40% increase.

According to its 2025 business plan, Taseco Land aims for consolidated revenue of VND 4,332 billion, 2.6 times higher than 2024 results, and consolidated after-tax profit of VND 536 billion, aligning with a cautious strategy in the early stages of its expansion cycle.

As of September 30, 2025, Taseco Land’s total assets reached VND 13,096 billion, a 40% increase since the beginning of the year, reflecting its expanding operational scale. Within its asset structure, inventory accounts for 55%, equivalent to VND 7,263 billion, a 78% increase compared to the same period in 2024. Most of this value stems from ongoing production costs at real estate projects, highlighting the company’s rapid deployment and substantial investment scale. This momentum is expected to drive a breakthrough in business results from Q4/2025 onwards, as projects become eligible for further revenue recognition.

Regarding financial structure, Taseco Land’s total liabilities stand at VND 6,951 billion, with loans accounting for VND 3,785 billion, mostly long-term debt. Notably, in September 2025, the company successfully issued private shares to professional securities investors, raising VND 1,492.65 billion. This new capital is being used to restructure bank loans, reducing financial leverage and increasing equity.

As a result, Taseco Land’s debt-to-equity ratio (D/E) sharply decreased from 112% to 61% compared to the semi-annual report. The capital structure has shifted towards greater stability and sustainability, focusing on medium to long-term capital, enabling the company to proactively finance large-scale projects and minimize liquidity risks.

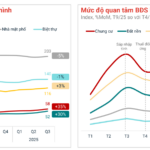

As the real estate market enters a recovery phase, Taseco Land’s efforts to strengthen its financial foundation and maintain a cautious yet flexible development strategy are considered prudent, laying the groundwork for sustainable profit growth in 2026.

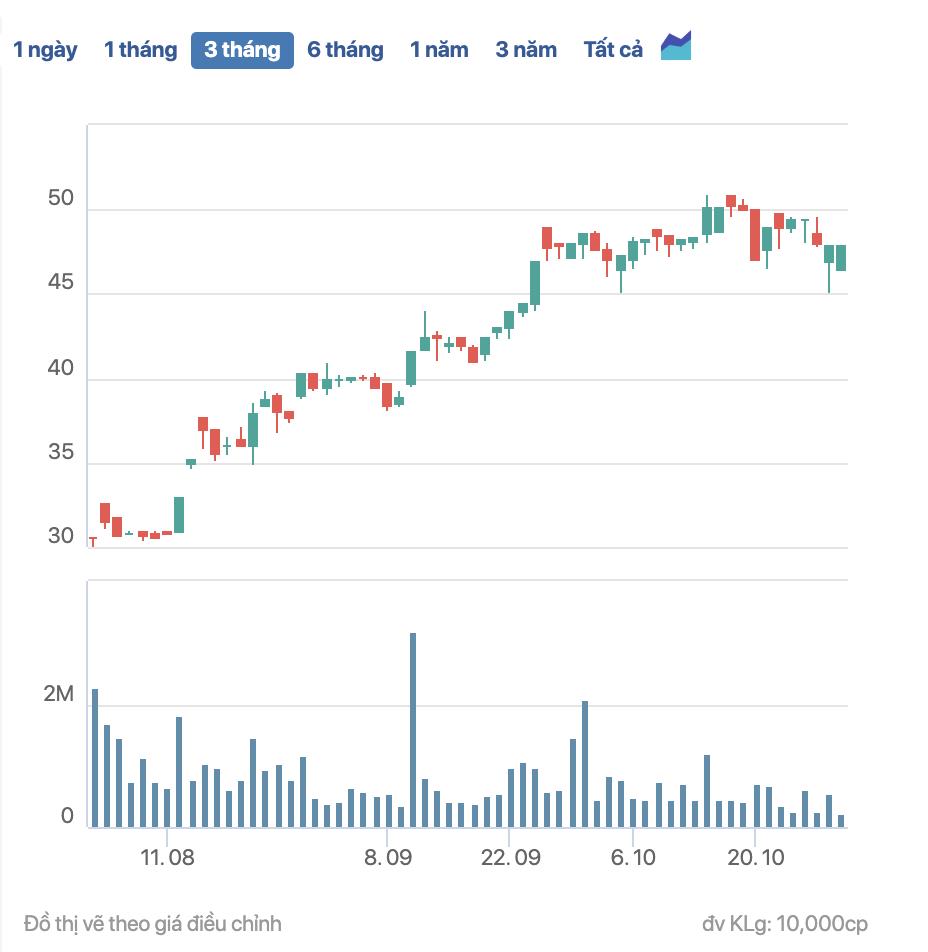

TAL Stock Price Chart

On the stock market, TAL shares are currently trading at around VND 48,000 per share, nearly doubling since their listing on HOSE on August 1, 2025—one of the strongest surges in the real estate sector. This upward trend reflects investor confidence in Taseco Land’s long-term strategy, project execution capabilities, and financial management efficiency during this transformative phase.

KDH’s Inventory Nears 23.1 Trillion VND, Q3 Profit Hits Nearly 236 Billion VND

As of Q3/2023, Khang Dien House Investment and Trading JSC (HOSE: KDH) boasts an inventory value nearing VND 23.1 trillion, marking a significant increase of nearly VND 830 billion since the beginning of the year. The company’s net profit for the period soared to approximately VND 236 billion, more than tripling the figure from the same period last year.

An Cuong Wood Continues Growth in Q3 Despite Declining Export Revenue

Amidst a declining export market in Q3, An Cuong Wood has achieved remarkable revenue growth, driven by robust domestic market performance. Over the first nine months, the company has successfully fulfilled 80% of its annual profit target, as mandated by shareholders.

Risk-Free Investment Solution with the 5-Right Townhouse Product: Homie City

Amidst declining lending rates and preferential credit for genuine homebuyers, Homie City emerges as a perfectly timed market opportunity. This offering stands as an ideal choice for prudent investors seeking both stable residence and efficient business exploitation, while also building long-term, sustainable value.