In a Tanishq jewelry brand advertisement, cricket legend Sachin Tendulkar explains why Indians should exchange old gold for new jewelry.

“India imports almost all its gold. But if you exchange old gold (for new jewelry), there’s no need to import gold. This will make our country stronger,” Tendulkar stated, targeting three distinct audiences: cricket enthusiasts, gold buyers, and those in the economic and financial community.

High gold imports exacerbate India’s merchandise trade deficit, meaning India pays more in foreign currency than it earns from exports. This growing deficit pressures the Indian rupee, making foreign goods and services more expensive for Indians.

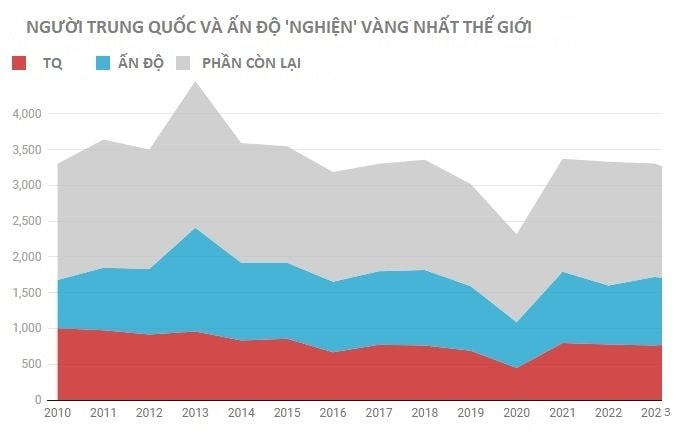

India ranks second only to China in gold demand. According to the World Gold Council (WGC), while Chinese consumers bought 857 tons of gold in 2024, Indians purchased 803 tons. Over the past 15 years, these two nations have consistently accounted for over half of global consumer gold demand.

However, this is just annual demand. Economists Upasna Chachra and Bani Gambhir of Morgan Stanley estimate Indian households held 34,600 tons of gold as of June 2025. At record-high prices, this gold is valued at approximately $3.8 trillion—equivalent to 89% of India’s GDP.

The last time a prominent figure warned Indians about the harms of continuous gold imports was over a decade ago, when Raghuram Rajan was Governor of the Reserve Bank of India (RBI).

At that time, households actively bought gold to hedge against inflation due to rising prices. In reality, WGC data shows Indian consumer gold demand has dropped nearly 20% compared to 15 years ago. This is partly due to the RBI’s flexible inflation targeting framework, which slashed average retail inflation from nearly 10% in 2012-2013 to an expected 2.6% in the current fiscal year.

The trend in savings via gold and silver jewelry reflects this: from 1.1% of total savings in 2011-2012 to 0.7% in 2020-2021, 0.8% in 2022-2023, and back to 0.7% in 2023-2024.

If Indian gold demand has declined over the years, why did Tanishq hire Tendulkar to “remind” citizens why reducing gold imports benefits India’s economy? The answer lies in soaring gold prices, making households holding this precious metal significantly wealthier.

Multiple factors—U.S. trade war uncertainties, its potential impact on economic growth and inflation, geopolitical risks, and central bank purchases worldwide—have driven gold prices far higher than analysts anticipated.

Gold prices surpassed 100,000 Rupees/10 grams earlier this year in April and approached 1,300,000 Rupees. This represents a 50% increase from last year.

This surge has impacted Indians’ ability to buy gold, hurting jewelers and making old gold exchange for new jewelry an attractive business proposition, especially during the festive season.

The significant impact of high gold prices is evident in India’s trade data. Released last week, data showed gold imports in September soared to $9.62 billion from $4.65 billion a year earlier, yet still fell 9% in the first half of fiscal year 2025-2026.

“Part of the reason for rising gold imports is also the increased investment demand, given the stellar rise in gold prices. Silver imports have also risen ($1.3 billion in September vs. $452 million in August), and silver is emerging as a prominent investment choice,” noted Gaura Sen Gupta, Chief Economist at IDFC FIRST Bank.

Source: IndianExpress

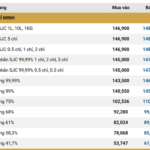

October 27: SJC Gold Bars and Plain Gold Rings Prices Plummet in a Sharp Decline

Today, domestic gold prices have seen a significant drop, falling by approximately 0.7 to 1.5 million VND per tael across the board.

Gold and Silver Poised for Another Dip Before Stabilizing

According to an independent metals trader, price movements indicate that gold, and particularly silver, require one more pullback before stabilizing.