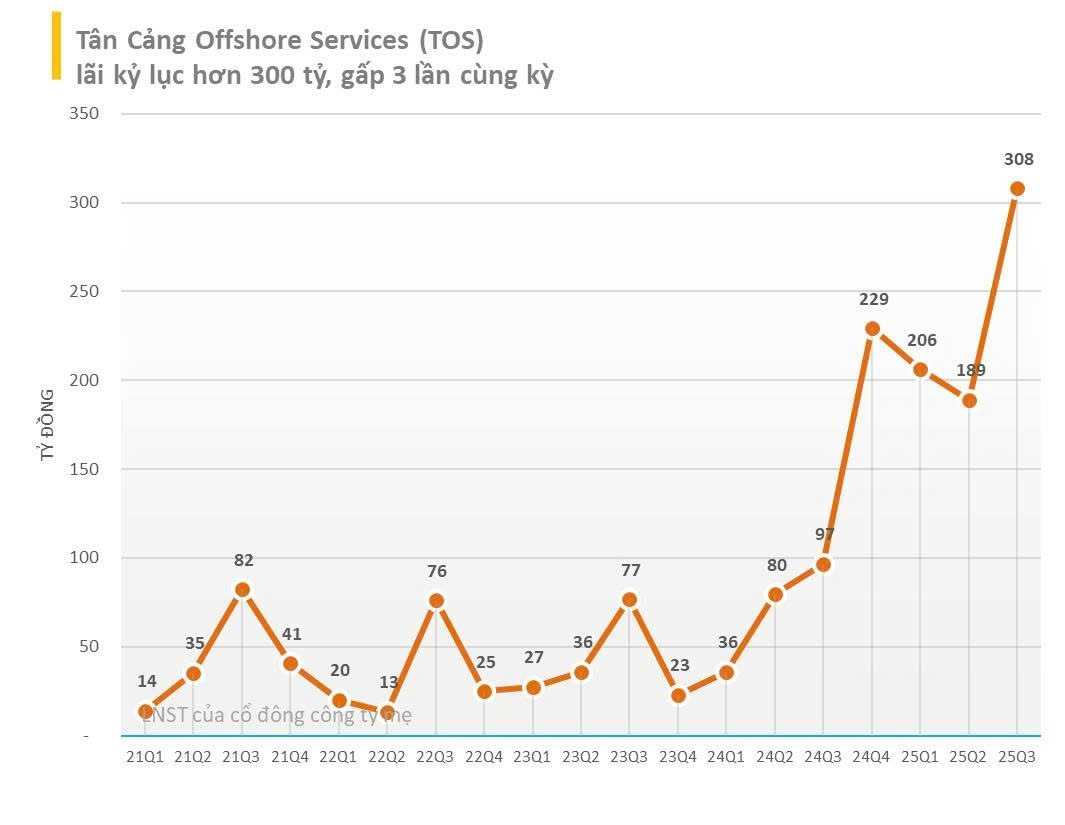

According to the recently released financial report, TOS recorded an after-tax profit of VND 325 billion in Q3/2025, a significant increase from VND 107.3 billion in the same period of 2024. This remarkable result stems from a 61.6% surge in net revenue, reaching VND 1,357.7 billion during the quarter.

Notably, the cost of goods sold increased by only 37%, lower than the revenue growth rate, leading to a substantial improvement in gross profit margin. Gross profit from sales and services reached VND 475.2 billion, a 142% increase compared to Q3/2024.

In the first nine months of 2025, TOS achieved a cumulative net revenue of VND 3,553 billion, up 72% year-on-year. Pre-tax profit soared to VND 936 billion, a 230% increase, while after-tax profit reached VND 762.5 billion, 3.2 times higher than the VND 235.9 billion recorded in the same period of 2024.

In TOS’s explanatory statement, the high profit growth in Q3 is attributed to multiple factors. The primary driver is the parent company’s successful deployment of most offshore service equipment both domestically and regionally.

Additionally, the company increased rental rates compared to the same period last year. Subsidiaries and associates also maintained strong profitability, with higher financial revenue.

As of September 30, 2025, TOS’s total assets reached VND 8,975 billion, a VND 3,314 billion (58.5%) increase from the beginning of the year, primarily due to rises in accounts receivable and inventory. Liabilities also increased by VND 2,443 billion to VND 6,579 billion, with short-term and long-term loans and finance lease liabilities rising by approximately VND 1,000 billion.

Tan Cang Offshore Service (TOS) is a member of the Saigon Port Corporation (SNP), a leading military enterprise in port operations and logistics. TOS’s financial statements highlight its close business relationships with related entities.

As of September 30, 2025, short-term receivables from the “Vietnam Navy” and “Saigon Port Corporation” were VND 664 billion and VND 174 billion, respectively. Conversely, TOS recorded VND 1,916 billion in “Short-term customer deposits” from the Vietnam Navy.

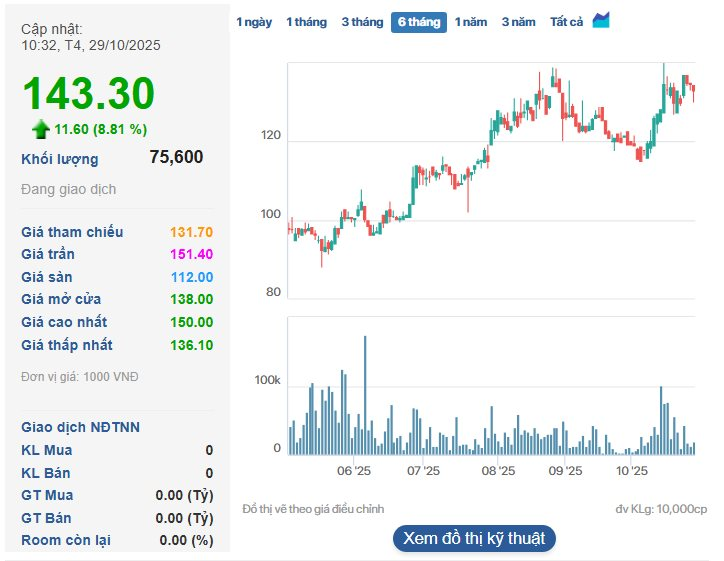

By the end of the nine-month period, TOS’s basic earnings per share (EPS) reached VND 14,179, a significant increase from VND 6,633 in the same period of 2024. The stock market has positively reflected TOS’s performance.

Over the past six months, TOS’s stock price has seen an impressive 60% increase, rising from VND 90,000 at the end of May 2025 to VND 143,300 in the morning session of October 29.

CMH Group’s Financial Report Reveals Close Ties with Tuan Huy Phu Tho

CMH Group’s financial report reveals that, beyond its investment partnerships and EPC contracting activities, the company also facilitated the payment of VND 230 billion in land use fees for the Cam Khe Central Park project on behalf of Tuan Huy Phu Tho.

Masan Group Q3 Net Profit Surges to Nearly VND 1.9 Trillion, 1.4x YoY Growth, Driven by Wincommerce and Masan MeatLife

In Q3, revenue surged to VND 21,164 billion, marking a 9.7% year-on-year increase. Post-tax profit reached VND 1,866 billion, a remarkable 1.4-fold growth compared to the same period last year.

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.