Thien Long Group Joint Stock Company (Stock Code: TLG, HoSE) has announced a resolution by its Board of Directors to implement a share issuance plan for the 2024 dividend payment.

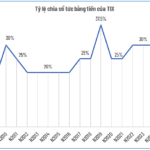

Accordingly, Thien Long Group plans to issue up to nearly 8.8 million shares as dividends to shareholders, equivalent to 10% of the total outstanding shares. The rights ratio is 10:1, meaning shareholders holding 10 shares will receive 1 additional newly issued share.

The total issuance value, based on the par value, is approximately VND 87.8 billion, sourced from undistributed after-tax profits as of December 31, 2024, according to the audited consolidated financial statements of Thien Long Group.

Illustrative image

The implementation is scheduled after the State Securities Commission (SSC) confirms receipt of the complete issuance report, expected in Q4/2025.

If successful, the outstanding shares of Thien Long Group will increase from nearly 87.8 million to over 96.5 million, with the charter capital rising from VND 877.5 billion to nearly VND 965.3 billion.

Previously, on September 12, 2025, Thien Long Group completed the allocation of 1.3 million ESOP shares to 23 employees. These shares are restricted from transfer for one year.

With an issuance price of VND 10,000 per share, the company expects to raise VND 13 billion, which will be used to supplement working capital for business operations.

According to the published list, Mr. Co Gia Tho, Chairman of the Board of Directors, acquired the most shares at 340,000, followed by Ms. Tran Phuong Nga, CEO, with 200,000 shares, and Ms. Co Cam Nguyet, Board Member, with 180,000 shares.

Regarding business performance, the audited consolidated financial report for the first half of 2025 shows that Thien Long Group achieved a net revenue of over VND 2,040 billion, an increase of VND 24.5 billion compared to the same period in 2024; after-tax profit reached over VND 300 billion, a decrease of 8.9%.

For 2025, the company targets a net revenue of VND 4,200 billion and an after-tax profit of VND 450 billion.

Thus, by the end of the first two quarters, Thien Long Group has completed 48.6% of its revenue plan and 66.7% of its after-tax profit plan.

As of June 30, 2025, the total assets of Thien Long Group increased by 12.1% compared to the beginning of the year, reaching over VND 3,765 billion. Inventory stands at nearly VND 941 billion, accounting for 25% of total assets.

On the liabilities side, total payables are at nearly VND 1,299.7 billion, up 28.4% from the beginning of the year. Short-term and long-term loans total nearly VND 525 billion, representing 40.4% of total assets.

What’s Happening to Hoang Anh Gia Lai’s Stock Under Bầu Đức’s Leadership?

Liquidity surged with nearly 25 million shares traded, doubling the average volume and marking the highest level in the past two months.

OCB Reports Q3/2025 Profit of VND 1.538 Trillion, a Threefold Increase Year-on-Year

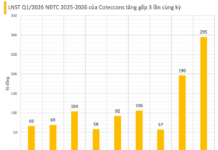

Oriental Commercial Joint Stock Bank (Stock Code: OCB) has released its Q3/2025 financial report, revealing a pre-tax profit of VND 1,538 billion, a threefold increase compared to the same period last year. This remarkable growth is attributed to the continued expansion of its core business operations.

LPBS Convenes Fourth Extraordinary Shareholders’ Meeting to Elect Board of Directors Members

On November 17, 2025, LPBS will finalize the list of shareholders eligible to attend the 4th Extraordinary General Meeting of Shareholders in 2025, dedicated to electing new members to the Board of Directors.