Vietnam’s Real Estate Market Poised for Growth Amid Positive Macroeconomic Outlook

Van Phu’s leadership announced that the company concluded Q3/2025 with revenue of VND 395 billion, primarily from projects such as The Terra – Bac Giang and Vlasta – Sam Son. While this reflects a decline compared to the same period in 2024, these projects, initiated in previous years, benefit from reasonable cost of goods sold. This factor has enabled the company to sustain profit growth as the real estate market gradually recovers. Specifically, Van Phu’s pre-tax and after-tax profits for Q3/2025 reached VND 143 billion and VND 119 billion, respectively, marking a 16% and 8% increase year-over-year.

For the first nine months of 2025, the company recorded after-tax profits of VND 262.9 billion, achieving over 75% of its annual profit target.

Looking ahead to Q4/2025, Van Phu’s leadership expressed confidence in meeting annual profit goals, citing an impressive macroeconomic upturn with GDP growth at 8.23% in Q3. Vietnam’s continued appeal as a global destination and the real estate market’s positive recovery further bolster this optimism.

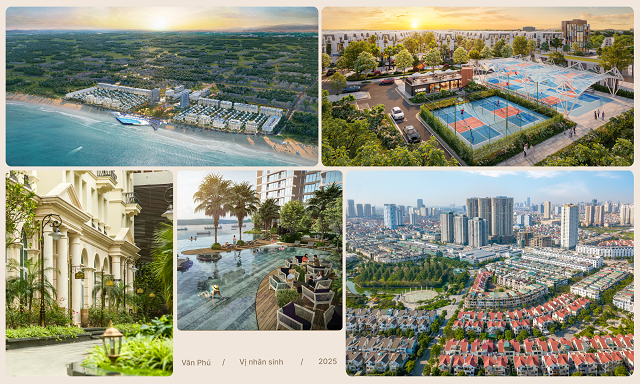

In 2025, Van Phu launched new sales for projects including Vlasta – Thuy Nguyen (Hai Phong) and TT39-40 (Hanoi), while continuing sales at The Terra – Bac Giang and Vlasta – Sam Son (Thanh Hoa).

After six months of sales, these projects have garnered positive market feedback. Vlasta – Thuy Nguyen has achieved sales nearing VND 1.8 trillion, and TT39-40 has sold out with sales of approximately VND 550 billion. These results are expected to significantly boost the company’s 2025 revenue and profits.

Projects such as Van Phu Urban Area – Ha Dong, Grandeur Palace – Giang Vo, Vlasta – Thuy Nguyen, and Vlasta – Sam Son are developed under the “human-centric” philosophy.

|

In addition to favorable macroeconomic conditions, infrastructure development is expected to play a crucial role in the real estate market’s recovery, particularly in late 2025. Key strategic projects, including Phase 2 of the North-South Expressway, Long Thanh Airport, and Ring Roads 3 and 4 in Ho Chi Minh City and Hanoi, are accelerating, creating a ripple effect in surrounding areas and satellite cities.

Q3/2025 marked a period of consolidation and recovery momentum. As market confidence returns and investment activities accelerate, real estate investment flows are expected to become more defined in Q4/2025.

“Investors are shifting focus to assets with real utility, complete legal frameworks, and sustainable exploitation potential,” stated a Van Phu representative, highlighting that the company’s development strategy aligns perfectly with market demands.

Strategic Expansion in Southern Markets

While maintaining growth in the North, Van Phu and other reputable developers are actively pursuing new projects in Ho Chi Minh City and neighboring provinces, supported by government efforts to resolve legal hurdles for stalled projects.

This is reflected in the inventory value, which stood at VND 5,407 billion as of September 30, 2025, an 83.5% increase from the beginning of the year. This growth is primarily driven by increased investment in projects such as Vlasta – Thuy Nguyen (Hai Phong), TT39-40 Van Phu New Urban Area (Hanoi), and a project in Phu Thuan Ward (former District 7, Ho Chi Minh City), among others. These projects are anticipated to generate stable revenue and cash flow for the company during 2025-2026.

Van Phu is also exploring investment in four key projects from 2025-2030 in Nha Be, Binh Chanh, former Vung Tau (Ho Chi Minh City), and Dai Phuoc (Dong Nai).

Rendering of the Dai Phuoc Tourism Urban Area (Dong Nai) under development by Van Phu.

|

According to Van Phu’s leadership, these projects are strategically located and have experienced significant transformation due to regional connectivity projects such as the Ben Luc – Long Thanh Expressway and Metro Line 4 (Thanh Xuan – Hiep Phuoc), linking southern Ho Chi Minh City with the city center and northern areas.

“These projects are expected to attract substantial interest from both end-users and investors, generating significant revenue for the company between 2026 and 2030,” stated Van Phu’s leadership.

The project in Phu Thuan Ward (former District 7, Ho Chi Minh City) is scheduled for launch in Q2/2026.

|

Seizing opportunities presented by Vietnam’s economic growth and real estate market dynamics, Van Phu’s debt reached VND 8,660 billion as of September 30, 2025, a 42% increase. To ensure financial stability, the company has reduced short-term debt by 11% while increasing long-term debt by 50%.

The company has also successfully recovered a significant portion of receivables from loans, interest, and business partnerships, providing additional resources for real estate project development.

A notable aspect of Van Phu’s Q3/2025 financial statement is the “short-term customer advances” category, which stood at VND 830 billion as of September 30, 2025, an 861% increase from the beginning of the year. This underscores customer trust and the appeal of Van Phu’s real estate products.

Regarding the 2023-2032 investment strategy, Van Phu’s representative noted that all projects are located in Vietnam’s leading provinces and cities, offering prime locations that cater to both residential and commercial needs, thereby receiving strong market acceptance.

Services

– 12:00 30/10/2025

Coastal Land Plots: Boost Property Value While Capitalizing on Year-Round Tourism

After a period of stagnation, the coastal land market is regaining momentum as investment capital returns to tangible assets—properties that not only preserve value but also offer profitable operational potential.

New Land Price Table in Hanoi Proposes Up to 26% Increase: Concerns Rise Over Potential Surge in Housing Costs

VNREA asserts that significant increases in land prices, as reflected in the Land Price Table, will drive up housing costs, thereby diminishing investment appeal, particularly for real estate projects in suburban areas.