| VGG’s Quarterly Business Results for 2019-2025 |

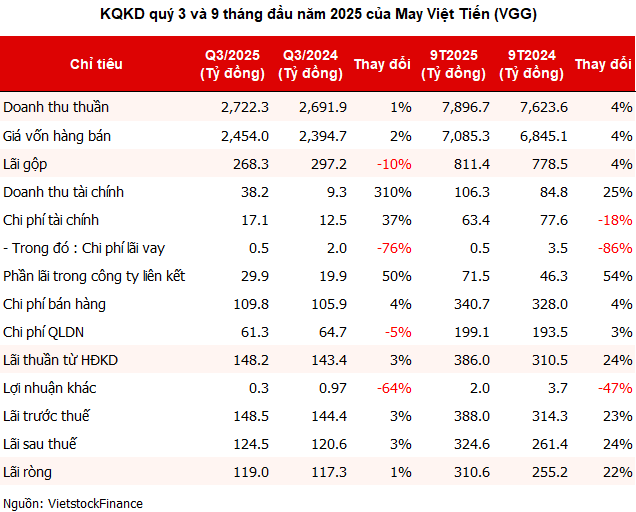

In Q3/2025, Viet Tien Garment recorded a net profit of 119 billion VND, a slight 1% increase compared to the same period last year, yet marking the highest quarterly profit since 2019. Revenue also edged up by 1% to over 2.722 trillion VND, though gross margin hit a one-year low below 10%, down from 11% in the same quarter, due to production costs rising faster than revenue.

The highlight of the business results lies in financial income, which surged by 310% to over 38 billion VND, alongside profits from associated companies doubling to nearly 30 billion VND. These factors played a pivotal role in offsetting the decline in the core business segment.

|

Nine-Month Revenue Peaks, Surpassing 18% of Annual Profit Target

In the first nine months, VGG’s net revenue reached nearly 7.897 trillion VND, a 4% increase year-on-year, setting a historical record. Net profit hit almost 311 billion VND, up by 22%, marking the highest in seven years for a nine-month period. This performance achieved 81% of the annual revenue target and exceeded the profit goal by 18%.

| VGG Records Highest Nine-Month Profit in Seven Years |

Within the profit structure, the financial segment remained dominant with revenue exceeding 106 billion VND, a 25% increase. Notably, nearly 94% of this stemmed from exchange rate gains. Additionally, profits from associated companies rose by 54% to 71.5 billion VND, helping balance selling and administrative expenses, which remained high at nearly 341 billion VND and over 199 billion VND, respectively, with slight increases year-on-year.

Strong Growth in Deposits and Financial Assets

By the end of September 2025, Viet Tien held over 1.243 trillion VND in bank deposits, a 53% increase from the beginning of the year. Investments in associated companies remained at the original cost of over 165 billion VND, but the parent company’s share of post-investment profits rose by 23% to 375.5 billion VND, bringing the total value to nearly 541 billion VND.

Inventory increased slightly by 2% to 1.551 trillion VND, with finished products accounting for approximately 42% at nearly 650 billion VND, and work-in-progress costs making up 37%, equivalent to 572 billion VND.

At the end of the period, Viet Tien’s total debt reached over 66 billion VND, more than five times the beginning of the year. However, short-term debt dominated, accounting for 90% at 59.5 billion VND.

On the UPCoM market, VGG shares traded at 43,600 VND per share on October 30, down over 8% in the last three months but still up slightly by 7% over the past year. Average liquidity reached over 8,000 shares per session.

| VGG Stock Price Trends Over the Past Year |

– 13:58 30/10/2025

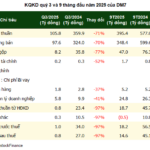

May 10 Reports Q3 Profits Surging 150%, Reaches Peak Profitability Since 2022

In Q3/2025, Garment Corporation No. 10 – JSC (UPCoM: M10) reported a net profit of VND 48.5 billion, a 52% increase year-over-year, matching its peak in Q4/2022. This impressive performance is attributed to significant cost-cutting measures and contributions from financial revenue.

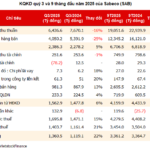

Sabeco Q3 Profit Surges 22%, Gross Margin Hits Decade-High

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”c1e6c0ea-afbb-4ef7-a109-fa67b2fcaf61″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Despite”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” revenue”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” decline”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Q”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”/”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”5″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Saigon”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Beer”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Alcohol”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Bever”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”age”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Sab”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”eco”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” SAB”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reported”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” its”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” highest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” net”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” profit”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” quarters”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reaching”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” nearly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” trillion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” This”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” achievement”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” was”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” driven”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” by”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” significantly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reduced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” production”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” costs”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” gross”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” margin”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” exceeding”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” and”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” consistent”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” interest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” income”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” from”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” deposits”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” averaging”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” over”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” billion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” daily”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

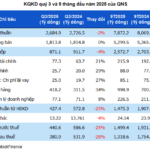

Fami Soy Milk Manufacturer Burns Hundreds of Billions on Promotions, Q3 Profits Drop 28%

In Q3/2025, Quang Ngai Sugar JSC (UPCoM: QNS), the parent company of Fami soy milk, reported a significant decline in profits, reaching a 10-quarter low. This downturn was primarily driven by a sharp increase in sales and promotional expenses. Despite this, the company maintains a substantial cash reserve of nearly VND 7,700 billion, accounting for over 55% of its total assets.