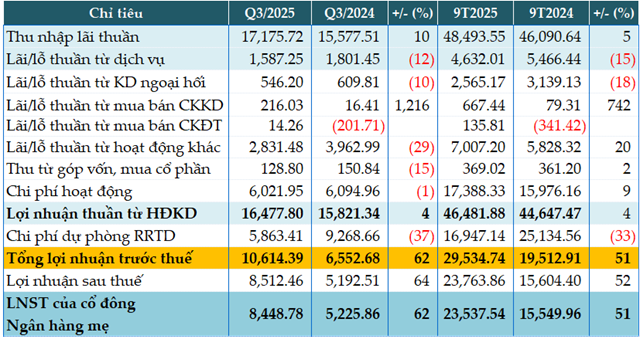

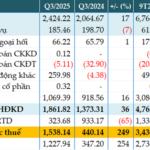

In Q3, VietinBank recorded a 10% increase in net interest income compared to the same period last year, reaching nearly VND 17,176 billion.

Trading activities in securities saw a remarkable surge, with a profit of VND 216 billion, a significant jump from the previous year’s VND 16 billion. Investment in securities also yielded a profit of over VND 14 billion, a stark contrast to the loss reported in the same quarter last year.

Conversely, non-interest income streams experienced declines. Service fees dropped by 12% to VND 1,587 billion, foreign exchange trading profits decreased by 10% to VND 546 billion, and other operating income fell by 29% to VND 2,831 billion.

Operational costs were reduced by 1% to VND 6,021 billion, resulting in a 4% rise in net profit from operations to VND 16,478 billion.

During the quarter, VietinBank significantly cut its credit risk provisions by 37%, allocating only VND 5,863 billion. This led to a pre-tax profit of over VND 10,614 billion, a 62% increase year-over-year.

For the first nine months, VietinBank reported a pre-tax profit of nearly VND 29,534 billion, a 51% growth compared to the same period last year.

|

Q3 and 9-month business results of CTG as of 2025. Unit: Billion VND

Source: VietstockFinance

|

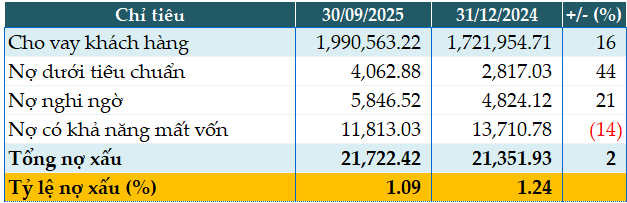

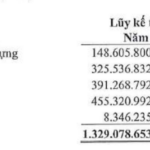

Total assets as of Q3 end rose by 16% from the beginning of the year to over VND 2,760 trillion. Customer loans increased by 16% to VND 1,990 trillion, while customer deposits grew by 11% to nearly VND 1,780 trillion.

Non-performing loans as of September 30, 2025, saw a slight 2% increase from the start of the year, totaling VND 21,722 billion. However, loans at risk of loss improved, reducing the NPL ratio from 1.24% at the beginning of the year to 1.09%.

|

Loan quality of CTG as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 21:06 October 30, 2025

Sacombank Reports Pre-Tax Profit of Nearly VND 11 Trillion in 9 Months, Up 36%

Sacombank (HOSE: STB) reported a pre-tax profit of nearly VND 3.657 trillion in Q3/2025, marking a 33% year-on-year increase. This impressive growth is attributed to robust core revenue expansion and reduced risk provisioning costs. Consequently, the bank’s nine-month profit surged to VND 10.988 trillion, reflecting a 36% rise compared to the same period last year.

Q3/2025 Financial Reports Due by October 28: Major Corporations Announce Earnings, OCB Reports Pre-Tax Profit Surge of Nearly 250%

Masan Hightech Materials (MSR) reported a pre-tax profit of VND 14 billion in Q3, a remarkable turnaround from a VND 292 billion loss in the same period last year. Meanwhile, PAN Group (PAN) saw a 16% decline in Q3 pre-tax profit to VND 305 billion. However, for the first nine months, PAN’s profit rose 3% to VND 848 billion.

TDC Reports Over 150 Billion VND in 9-Month Profits, Seeks 1 Trillion VND Loan for TDC Plaza Project

Revised Introduction:

Revenue surged significantly for Binh Duong Trading and Development JSC (HOSE: TDC), posting a 9-month profit of over VND 150 billion—a 50% year-on-year increase and 62% of its annual target. Concurrently, the company plans to secure a VND 1,000 billion loan to advance its flagship TDC Plaza project.

Q3/2025 Financial Reports Due by October 28: Major Corporations Announce Earnings, OCB Reports Pre-Tax Profit Surge of Nearly 250%

Masan Hightech Materials (MSR) reported a pre-tax profit of VND 14 billion in Q3, a stark contrast to the VND 292 billion loss in the same period last year. Meanwhile, PAN Group (PAN) saw a 16% decline in Q3 pre-tax profit to VND 305 billion. However, for the first nine months, PAN’s profit rose 3% to VND 848 billion.