Illustrative image

According to the State Securities Commission (SSC), the agency has issued Decision No. 359/QĐ – XPHC on administrative penalties in the securities and stock market sector against An Thịnh Joint Stock Company (Headquarters address: No. 11, Group 8A, Duc Xuan Ward, Thai Nguyen Province).

Specifically, An Thịnh was fined VND 92.5 million for failing to disclose information that must be disclosed under the law, as stipulated in Point a, Clause 4, Article 42 of Decree No. 156/2020/NĐ – CP dated December 31, 2020, by the Government, which regulates administrative penalties in the securities and stock market sector (Decree No. 156/2020/NĐ – CP).

The reason for the penalty is that the company failed to disclose information (DSI) on the DSI systems of the SSC and the Hanoi Stock Exchange (HNX) for the following reports and documents: Audited Semi-annual Financial Reports (SAFR) for 2023 and 2024; Audited Annual Financial Reports (AFR) for 2023 and 2024; Quarterly Financial Reports (QFR) for Q1, Q2, and SAFR for 2025; Annual Report for 2024; Semi-annual Corporate Governance Reports (SCGR) for 2024 and 2025; Annual Corporate Governance Report for 2024. The company also failed to disclose information within the required timeframe on the DSI systems of the SSC, HNX, and the company’s website for the following reports and documents: QFR for Q3 and Q4 of 2023; QFR for Q1, Q2, Q3, and Q4 of 2024; Annual Report for 2023; Annual Corporate Governance Report for 2023.

In another development, in early October 2025, HNX decided to maintain trading restrictions on ATB shares. This decision was based on the review of the Audited Semi-annual Financial Report for 2025.

The reason for maintaining the trading restrictions is that the trading registrar submitted the Audited Semi-annual Financial Report for 2025 more than 45 days after the deadline for information disclosure as required. Another reason for the restriction is that the auditing firm declined to provide an opinion on the 2021 financial report.

The shares are restricted in trading time; they can only be traded on Fridays starting from the date the shares are removed from the suspension list.

Within 15 days from the date the shares are restricted, An Thịnh must submit a written explanation to HNX detailing the causes and proposing a remedy plan.

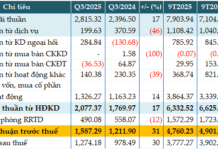

“DS3 Fined for Late Disclosure: Record-High Half-Year Profits, Yet Still in the Red Overall”

Despite facing penalties for delayed financial disclosures, the Joint Stock Company for River Management No. 3 (HNX: DS3) has recorded its highest-ever revenue and profits for the first half of the year. However, the weight of accumulated losses from 2022 continues to burden the company, resulting in a negative cumulative close to VND 12 billion, and keeping its stocks on the HNX warning list.

Unregistered Securities Trading Lands Cong Thanh Cement in Hot Water.

“The Cement Company, Xi Mang Cong Thanh, has been fined a total of VND 507.5 million by the State Securities Commission of Vietnam (UBCKNN) for failing to disclose information and violating securities trading laws. This penalty serves as a reminder to all listed companies of the importance of adhering to disclosure and transparency regulations.”

![[IR AWARDS] December 2024: A Month of Revealing Insights](https://xe.today/wp-content/uploads/2024/12/Screenshot_01-150x150.png)