Hanoi Transformer and Electrical Materials Joint Stock Company (stock code: BTH) announced that November 7, 2025, is the final date for shareholders to be listed for the second dividend payment of 2024 in cash. The payout ratio is 250%, meaning shareholders holding one share will receive 25,000 VND. The payment will be made on November 26, 2025.

With 25 million outstanding shares, BTH is expected to disburse 625 billion VND for this dividend. Hoàng Thành Group, the largest shareholder, is projected to receive 406 billion VND.

This dividend rate is considered among the most generous in the industry this year. The total dividend payout is nearly three times BTH’s charter capital of 250 billion VND.

Previously, on October 21, 2025, the company completed the payment of the 2023 dividend at a rate of 7% and the first interim dividend of 2024 at a rate of 10% in cash. Thus, the total dividend payout for 2024 is 260% in cash, as approved by the Annual General Meeting.

The company’s high dividend payout stems from its remarkable 2024 performance. According to audited financial reports, 2024 revenue reached 1.8 trillion VND, a 1,700-fold increase from 2023, while after-tax profit hit a record high of over 708 billion VND—7,000 times higher than the previous year. As a result, earnings per share (EPS) reached 28,306 VND.

Rendering of Hoàng Thành Pearl project.

This growth is attributed to the company’s revenue recognition from the handover of the Hoàng Thành Pearl Apartment Complex (Từ Liêm District, Hanoi) starting in Q3/2024. The project, with a total investment of 1.1077 trillion VND, comprises three 30-story towers housing 334 apartments.

However, BTH’s 2025 performance has significantly declined. In the first nine months, revenue reached only 22.5 billion VND, down 98.4% year-on-year, while after-tax profit was 31.7 billion VND, down 93.6%.

For 2025, the company has set a conservative target of 194 billion VND in revenue and 100.8 billion VND in after-tax profit. After three quarters, it has achieved 11.6% of its revenue target and 31.45% of its profit target.

Hoàng Thành Pearl project.

Hanoi Transformer and Electrical Materials Joint Stock Company originated from the Transformer Manufacturing Plant under the Vietnam Electrical Equipment Corporation, established in 1963 at 10 Trần Nguyên Hãn, Hanoi. It was Vietnam’s first major plant tasked with designing and manufacturing power transformers to support the national economy.

In September 2005, the company was formed through the merger of Hanoi Electrical Equipment JSC and Hanoi Transformer Manufacturing JSC, as per Decision No. 105/2005 of the Electrical Equipment Corporation (Gelex – stock code: GEX).

By August 2007, Gelex held 45% of the company’s shares. In November 2014, Gelex divested its entire 49.49% stake, which was acquired by Hoàng Thành Infrastructure Investment and Development Company (Hoàng Thành Group).

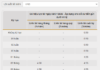

The 2024 audited financial report reveals that as of year-end, Hoàng Thành Group owned 65% of the company’s equity. Mr. Nguyễn Hoa Cương held 5.05%, Mr. Hoàng Ngọc Kiên held 19.39%, and Mr. Hoàng Ngọc Quân held 5.16%.

Viglacera Sets Date to Distribute Nearly VND 1 Trillion in 2024 Dividends

On December 5, 2025, Viglacera will distribute a substantial dividend of 986.37 billion VND to its shareholders, reflecting the company’s strong performance in 2024.

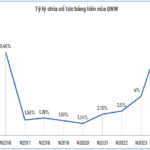

QNW Announces 10% Cash Dividend Payout with Rights Issue

Quang Ngai Water Supply, Drainage and Construction JSC (UPCoM: QNW) has announced a dividend payout for 2024. Shareholders will receive a 10% cash dividend, equivalent to VND 1,000 per share. The ex-dividend date is set for October 30th, with payment expected to commence on November 20th.