|

BAF’s Q3/2025 Business Targets

Source: VietstockFinance

|

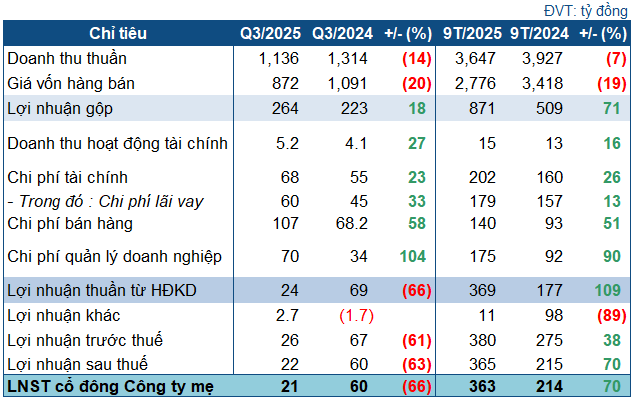

In Q3, the plant-based meat company reported net revenue exceeding VND 1.1 trillion, a 14% decline year-over-year. However, a 20% reduction in cost of goods sold led to an 18% increase in gross profit, reaching VND 264 billion. Gross margin improved to 23%, up from 16% in the same period last year.

Sales volume for the quarter surpassed 188,000 pigs, with pork dominating and growing nearly 16% year-over-year. Pork sales alone generated over VND 1.1 trillion, a 33% increase (as BAF phased out its agricultural trading segment this year, all revenue stems from pork sales).

Despite higher gross profit, BAF’s Q3 results declined due to rising expenses. Financial costs rose 23% to VND 68 billion (with nearly VND 60 billion in interest expenses); selling expenses surged 65% to over VND 107 billion; and administrative expenses doubled year-over-year to VND 70 billion. Net profit reached nearly VND 21 billion, down 66%.

The company attributed the decline to the low season for livestock farming in Q3, when school canteens close. Additionally, pig prices hovered at a low of VND 50,000-60,000/kg due to disease outbreaks and flooding, which increased the supply of pigs fleeing affected areas.

Natural disasters in Central Vietnam raised costs related to farming facilities, transportation, and feed supply. In Q3, BAF also launched two new farms, TMC and Hoa Phat 4, and began construction on major projects like Gia Han, increasing recruitment and training expenses. These factors elevated administrative costs faster than revenue and profit growth.

Strong Year-to-Date Growth

Robust first-half results kept BAF’s year-to-date performance strong. In the first nine months, pig sales volume and revenue grew 1.3 and 1.6 times year-over-year, respectively. Revenue reached nearly VND 3.65 trillion, down 7%, but pork sales (100% of revenue) increased 13% compared to full-year 2024.

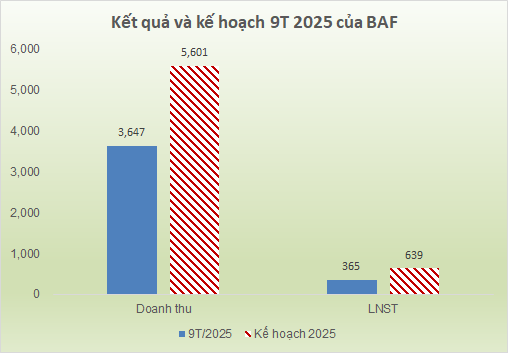

Net profit hit VND 363 billion, up 70%. The company achieved 65% of its revenue target and over 57% of its full-year after-tax profit goal.

Source: VietstockFinance

|

As of Q3-end, BAF’s total assets exceeded VND 9.6 trillion, up 29% year-to-date, with VND 3.8 trillion in current assets, up 23%. Cash and deposits totaled VND 503 billion, up 15%. Inventory reached VND 2.5 trillion, up 17%, including pigs ready for market when prices rebound. The company reported a herd of over 850,000 pigs, including nearly 80,000 sows.

Fixed assets totaled nearly VND 3 trillion, slightly up year-to-date, with the launch of TMC and Hoa Phat 4 farms. Work-in-progress long-term assets reached VND 1.314 trillion, up 47%, including farms and breeding stock.

Liabilities rose 18% to over VND 5.3 trillion. Total debt (short-term, long-term, and bonds) increased 36% to over VND 3.5 trillion. Financial ratios remained stable, with a current ratio of 1.1.

Continuous Expansion

In the first nine months, BAF launched nine high-tech farms, primarily in the Central Highlands and Thanh Hoa; began construction on a 300,000-ton/year feed mill in Binh Dinh to supply its farms and partners in Central and Central Highlands regions. It also started the Gia Han high-tech pig farm project, with a capacity of 15,000 sows and 450,000 pigs, totaling VND 2 trillion in investment.

Notably, BAF recently partnered with China’s Muyuan Foodstuff Group to develop Vietnam’s first high-rise pig farm in Tay Ninh. This six-story “pig condominium” will house 64,000 sows and produce 1.6 million pigs annually.

Rendering of BAF’s high-rise farm

|

On October 29, BAF met with Tay Ninh provincial leaders to discuss operations and propose high-tech farming development. The company requested support in adjusting zoning plans, land allocation, utilities, and infrastructure, and urged the Ministry of Agriculture and Environment to update high-rise farm design standards for legal compliance in Tay Ninh.

BAF also seeks collaboration with the province to establish disease-free farming zones and develop a sustainable, clean pork value chain.

– 13:12 30/10/2025

Dabaco (DBC): Q3 Earnings Surge 2.5x YoY, Achieving 2025 Targets Ahead of Schedule

Dabaco Vietnam Group (DBC) has announced its estimated profit for the first nine months of 2025, surpassing the full-year target. The company anticipates continued growth in the fourth quarter.

Deputy CEO of BAF: Assuring the Tightest Security Measures at Our Pig Farms

Amidst the raging African Swine Fever (ASF) outbreak, Mr. Ngo Cao Cuong, Deputy General Director of BAF Vietnam Agricultural Joint Stock Company (HOSE: BAF), assures that their farms are under stringent protection against the ASF virus.