With approximately 72.2 million shares outstanding, BVS is estimated to pay a total dividend of nearly VND 58 billion. The parent company of BVS, Bao Viet Group (HOSE: BVH), stands to benefit the most, holding 59.92% of the capital, equivalent to nearly VND 35 billion.

This dividend rate aligns with the plan approved at the 2025 Annual General Meeting of Shareholders, part of the 2024 profit distribution strategy. Alongside the dividend, the plan includes allocating nearly VND 62 billion to the development investment fund, over VND 10 billion to the welfare and reward fund, and more than VND 2 billion (1% of net profit) to the management board rewards, with the remaining VND 74 billion retained.

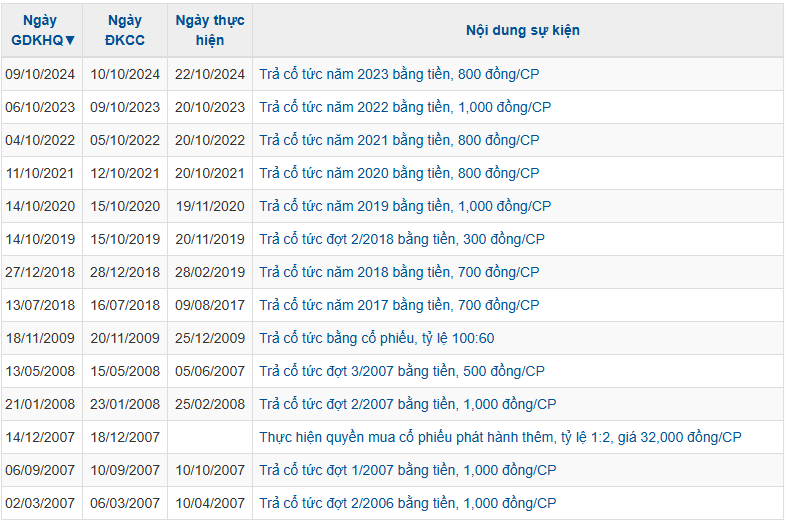

Over the past five years, BVS has consistently paid cash dividends at a rate of 8% or 10%. For 2025, BVS plans to continue with an 8% dividend rate.

|

BVS has consistently paid cash dividends over the years

Source: VietstockFinance

|

At the 2025 Annual General Meeting of Shareholders, BVS shareholders approved the 2025 business plan, targeting a total revenue of VND 1,068 billion, an 8% increase compared to 2024. However, net profit is expected to decrease slightly by 3% to VND 195 billion, including realized profit of VND 180 billion, down 13%.

The company notes that the 2024 realized profit included a VND 44 billion provision reversal. Excluding this, the actual profit was VND 171 billion, meaning the 2025 plan still represents a 25% growth.

In the first nine months of the year, BVS achieved a net profit of over VND 193 billion, nearly meeting the annual target. Over the years, the company has consistently grown its nine-month net profit.

In Q3 alone, the company reported a profit of over VND 81 billion, up 128%, with realized profit exceeding VND 64 billion, a 115% increase. The company attributes this to favorable market conditions, with average daily trading value surpassing VND 44 trillion, up nearly 137% year-over-year.

| BVS‘s nine-month net profit has consistently grown in recent years |

In the market, BVS shares are trading near support levels after a decline from the peak of around VND 44,000 per share. Trading volume has significantly decreased, averaging 297,000 shares per day over the past month, down from nearly 647,000 shares per day in the last three months and 713,000 shares per day year-to-date.

| BVS shares have seen continuous price and volume declines |

– 5:29 PM, October 31, 2025