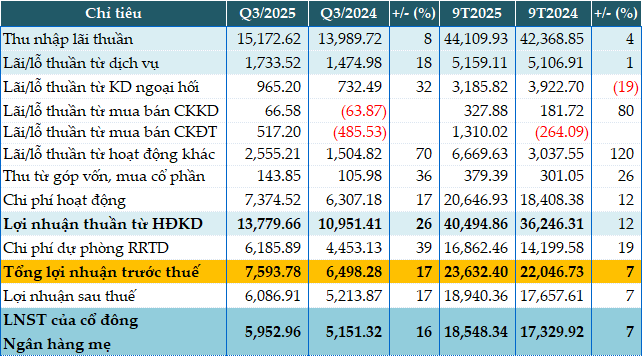

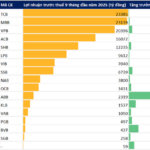

In Q3, most of BIDV’s business activities saw growth compared to the same period last year. Net interest income rose by 8%, reaching nearly VND 15,173 billion.

Non-interest income streams also experienced strong growth: service fees increased by 18% (VND 1,734 billion), foreign exchange trading profits surged by 32% (VND 965 billion), and other operating income jumped by 70% (VND 2,555 billion). Trading securities generated a profit of VND 67 billion, and investment securities yielded VND 517 billion, compared to losses in the same period last year.

Operating expenses increased by 17% to VND 7,374 billion, resulting in a 26% rise in net profit from business operations to VND 13,779 billion.

However, BIDV allocated VND 6,189 billion (+39%) for credit risk provisions during the quarter, leading to a 17% increase in pre-tax profit to VND 7,594 billion.

For the first nine months of the year, the bank’s pre-tax profit exceeded VND 23,632 billion, a 7% increase year-on-year.

|

BID’s Q3 and 9-month business results for 2025. Unit: Billion VND

Source: VietstockFinance

|

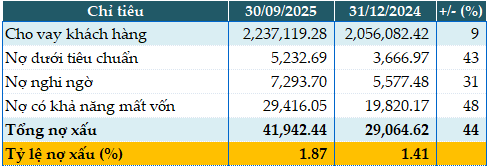

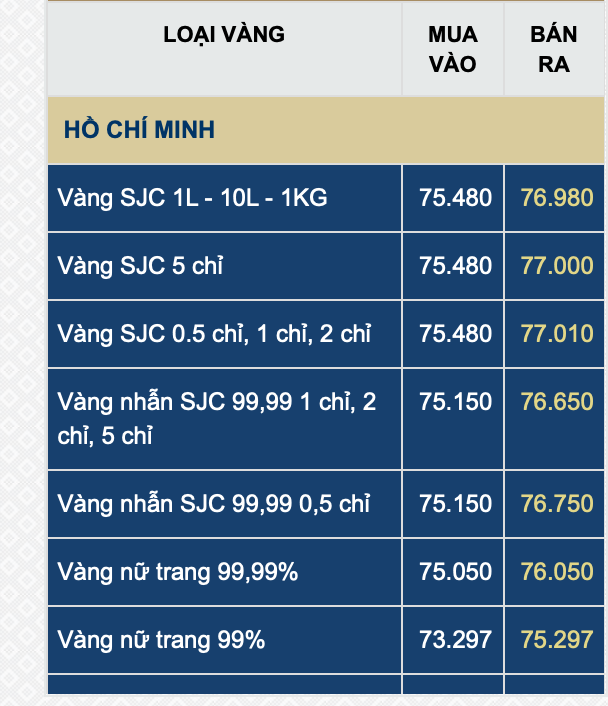

As of the end of Q3, BIDV’s total assets reached over VND 3,070 trillion, an 11% increase from the beginning of the year. Customer loans grew by 9%, and customer deposits rose by 7%, reaching nearly VND 2,240 trillion and VND 2,079 trillion, respectively.

As of September 30, 2025, BIDV’s total non-performing loans amounted to VND 41,942 billion, a 44% increase from the beginning of the year. The non-performing loan ratio rose from 1.41% at the start of the year to 1.87%.

|

BID’s loan quality as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 10:28 October 31, 2025

Q3/2025 Financial Reports Deadline: Vinhomes, HDBank, TPBank, Vietjet, BSR, and More Companies Announce Surprising Results by October 30th

Khang Điền (KDH) reported a staggering 783% surge in Q3/2025 net profit, reaching 654 billion VND. Similarly, Becamex IJC and Intresco saw remarkable growth, with net profits soaring by 203% and 308%, respectively.