Illustrative Image

Chinese electric vehicle (EV) sales are surging in the UK, with BYD emerging as the leading brand. According to Nikkei Asia, BYD recorded a staggering 880% year-on-year sales growth in September. However, BYD isn’t alone in this race to dominate the UK market.

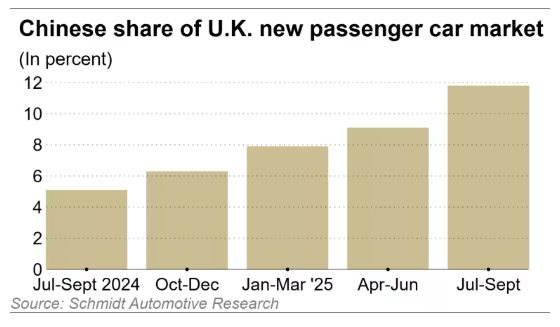

Data from Schmidt Automotive Research reveals that in Q3 2025, Chinese-made cars accounted for 11.8% of all new car registrations in the UK—double the figure from the same period last year and up 2.7% from the previous quarter.

Market share of Chinese EV brands in the UK continues to rise

Among Chinese brands, MG (a UK-origin brand owned by SAIC since 2007) still leads in sales. However, BYD and Chery Group are rapidly closing the gap with their diverse EV portfolios and competitive pricing. Together, these three brands account for over 90% of Chinese car sales in the UK. Meanwhile, Geely (owner of Volvo) is entering the market with its first model, targeting 10,000 annual sales.

The UK has become an attractive export market for Chinese automakers due to its zero import tariffs on cars, contrasting sharply with the US and EU. “We’re one of the few markets still open,” noted Sam Goodman, Senior Policy Director at the China Strategic Risks Institute (CSRI).

No Chinese automaker has established a UK factory yet, but reports suggest Chery and Geely are considering future production investments. BYD already operates an assembly plant in Hungary, seen as a stepping stone to Western Europe.

Despite being smaller than China and the US, the UK is the world’s third-largest EV market. In 2024, new EV registrations in the UK surpassed Germany, reflecting growing demand ahead of the government’s 2035 zero-emission vehicle target.

According to Autotrader, Chinese brands could capture up to 25% of the UK EV market by 2030. Their competitive edge lies primarily in pricing. A 2023 UBS report highlights that BYD’s production costs are approximately 25% lower than Western rivals, thanks to subsidies and economies of scale.

The BYD Dolphin Surf, launched in the UK in June, starts at £18,650 (around $24,800), making it one of the most affordable EVs available. Chinese brands have increased the number of EVs priced under £30,000 in the UK from 9 to 29 models in just one year.

In contrast, European EVs like Renault, Fiat, and Citroen remain around £20,000, while the Tesla Model 3 starts at £39,000.

A Carwow survey found that 38% of buyers are drawn to Chinese EVs for their value for money, up from 28% last year—a testament to the growing appeal of affordable electric vehicles.

Industry experts believe the influx of Chinese EVs benefits UK consumers by fostering competition. Mike Hawes, CEO of the Society of Motor Manufacturers and Traders (SMMT), stated:

“The arrival of Chinese brands is forcing established players to become more agile, accelerate innovation, and reduce costs.”

However, experts warn of potential risks to the UK’s domestic auto industry without adequate protections. Goodman from CSRI cautioned: “Without tariffs, local manufacturers struggle to compete with BYD on price. Job losses in the automotive sector and supply chain are inevitable.”

Source: Nikkei