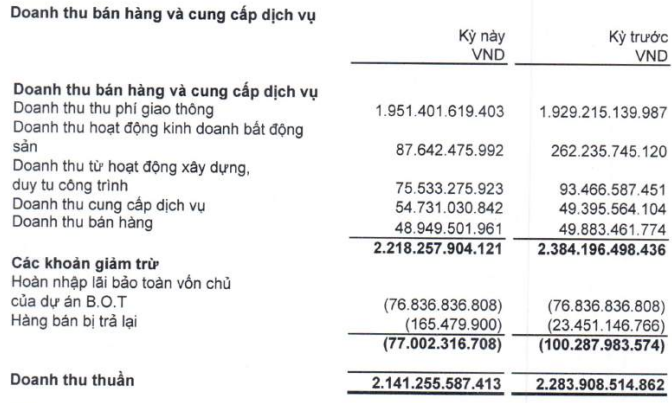

Specifically, CII recorded a net revenue of over 2.1 trillion VND in the first nine months of the year, a 6% decrease compared to the same period last year.

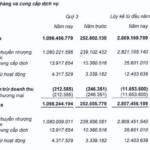

Among its revenue streams, toll collection—the primary revenue driver—remained relatively stable, accounting for approximately 88% of the company’s total revenue. Other activities, such as real estate, construction, and infrastructure maintenance, saw revenue declines of 67% and 21%, respectively.

|

Breakdown of CII‘s net revenue in the first nine months of 2025

Source: Q3/2025 Consolidated Financial Report

|

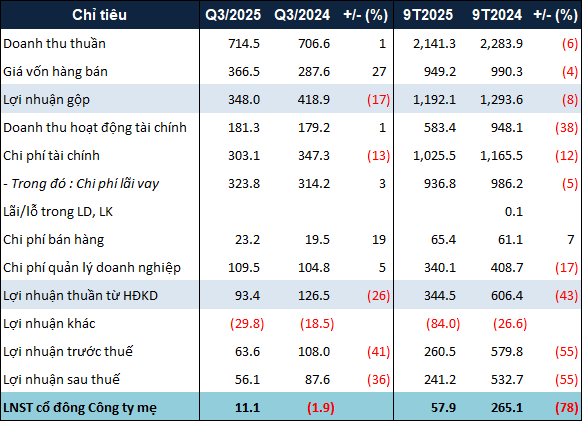

In addition to the decline in net revenue, financial revenue also decreased by 38%, totaling over 583 billion VND. This reduction is attributed to the absence of a significant gain from the fair value adjustment of the investment in Năm Bảy Bảy Investment Corporation (HOSE: NBB), which amounted to over 430 billion VND in the same period last year.

Furthermore, the company incurred an other loss of 84 billion VND (compared to nearly 27 billion VND in the same period last year) due to increased contract violation penalties and over 13 billion VND in expenses related to suspended projects.

Despite significant reductions in financial and management expenses, CII‘s net profit in Q3 plummeted by 78% year-over-year, reaching nearly 58 billion VND.

|

Business results of CII in the first nine months of 2025. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, CII‘s total assets as of September 30, 2025, stood at over 37.9 trillion VND, a 3% increase from the beginning of the year. The company’s short-term cash holdings surged by 67%, exceeding 3.6 trillion VND.

Construction in progress costs for CII‘s NBB Garden II project rose by nearly 13%, reaching almost 1.3 trillion VND. The company announced that the project received investment approval from the Ho Chi Minh City People’s Committee in June 2025. As of the Q3 consolidated report, the project has completed compensation efforts and is in the process of finalizing legal procedures for construction commencement.

In contrast to total assets, total liabilities decreased by 5%, amounting to nearly 26.1 trillion VND. Outstanding loans remained stable at nearly 20.1 trillion VND. However, the value of convertible bonds decreased by 44%, totaling nearly 1.6 trillion VND. Notably, deposits received, margin deposits, and escrow deposits increased 2.4 times since the beginning of the year, reaching over 83 billion VND.

– 11:37 31/10/2025

Record-Breaking Unrecorded Sales of VHM Reach 223.9 Trillion VND by End of September

According to the Q3/2025 Consolidated Financial Statements, Vinhomes JSC (HOSE: VHM) recorded VND 51.1 trillion in net revenue and nearly VND 14.4 trillion in net profit for the first nine months of the year.

KDH’s Inventory Nears 23.1 Trillion VND, Q3 Profit Hits Nearly 236 Billion VND

As of Q3/2023, Khang Dien House Investment and Trading JSC (HOSE: KDH) boasts an inventory value nearing VND 23.1 trillion, marking a significant increase of nearly VND 830 billion since the beginning of the year. The company’s net profit for the period soared to approximately VND 236 billion, more than tripling the figure from the same period last year.