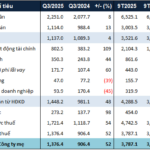

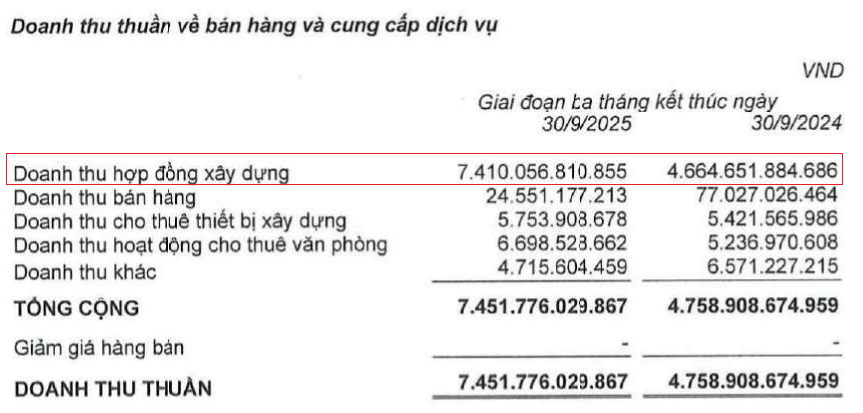

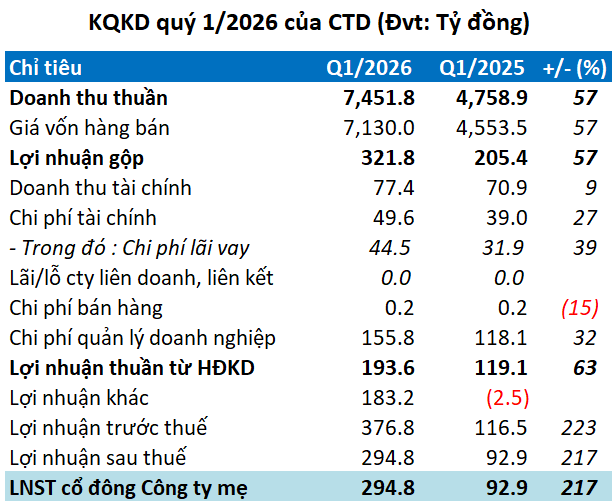

Kicking off the first quarter of the 2026 fiscal year (July 1 – September 30, 2025), Coteccons Construction Corporation (HOSE: CTD) reported a net revenue of nearly VND 7,452 billion, a 57% increase. This growth was driven by a 59% surge in its core construction contract business, reaching over VND 7,410 billion.

Source: CTD

|

Notably, the construction giant recorded an extraordinary other income of VND 183 billion, compared to a loss of VND 2 billion in the same period last year, attributed to the liquidation of a business cooperation contract.

After deducting expenses, Coteccons achieved a net profit of nearly VND 295 billion, 3.2 times higher than the same period last year, marking the highest level in 27 quarters (since Q1/2019).

| CTD’s Net Profit from Q1/2018 to Q1/2026 |

For the 2026 fiscal year (July 1, 2025 – June 30, 2026), CTD targets a consolidated revenue of VND 30,000 billion and a post-tax profit of VND 700 billion, up 21% and 54% respectively compared to the 2025 fiscal year. With this plan, the company has achieved 25% and 42% of its targets after the first quarter.

Source: VietstockFinance

|

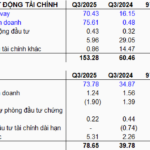

However, the consolidated cash flow statement shows a negative operating cash flow of VND 838 billion, compared to VND 388 billion in the same period last year. This is due to a sharp increase in inventory by over VND 900 billion compared to the beginning of the 2026 fiscal year and an additional VND 450 billion in accounts receivable.

As of September 30, 2025, CTD’s total assets amounted to nearly VND 31.2 trillion, with inventory accounting for VND 6,972 billion, or 22% of total assets. Accounts receivable from customers stood at nearly VND 15,153 billion, up 2% from the beginning of the year, including VND 1,269 billion in hard-to-recover short-term receivables.

Liabilities totaled over VND 21.9 trillion, up 6%; of which, short-term financial debt increased by 27% to over VND 3.8 trillion, accounting for 17% of total liabilities.

At the 2025 Annual General Meeting, Mr. Nguyễn Chí Thiện, Deputy CEO of CTD, stated that the company currently has a backlog of over VND 51 trillion. Coteccons is confident in achieving its revenue target for the 2026 fiscal year and has no plans for additional provisions. The company aims to maintain an average growth rate of 20-30% per year.

According to ACB Securities (ACBS), Coteccons will continue to expand into the infrastructure sector with notable projects such as the Long Thành airport parking lot and the Vietnam National University Ho Chi Minh City. As part of its Go Global strategy, CTD is implementing three projects in Taiwan (Taipei Twin Towers, Hsinchu project, and Taipei University) and a VinFast factory in India.

– 09:00 31/10/2025

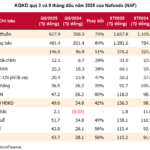

“Passion Fruit King” Sets Record Profit in 9 Months, Stock Reaches New Peak

Revenue surged 75%, with profits more than doubling in Q3, propelling Nafoods Group (HOSE: NAF), Vietnam’s leading passion fruit exporter, to its highest nine-month results in history. Meanwhile, the company’s stock continues its meteoric rise, nearing the peak of 35,000 VND per share.

Phong Phú Reports 30% Surge in Q3 Profits, Driven by Improved Performance of Affiliated Companies

In Q3/2025, Phong Phu Corporation (UPCoM: PPH) reported a net profit of over 93 billion VND, marking a 30% increase. This growth was driven by reduced production costs and significant earnings from affiliated companies. After nine months, the company has achieved nearly 90% of its annual profit target.