DIC Corporation (DIC Corp, Stock Code: DIG, HoSE) has announced a resolution by its Board of Directors to divest its entire stake in DIC Anh Em Ceramic Tiles Joint Stock Company (DIC Anh Em).

The company plans to sell its entire holding of 8.82 million shares in DIC Anh Em to interested investors. The transaction is expected to be completed in Q4/2025.

With a minimum selling price set at the investment cost of VND 4,696 per share, DIC Corp anticipates generating at least VND 41.4 billion from this divestment.

DIC Anh Em primarily operates in the production and sale of ceramic tiles, mining, and related activities. As of September 30, 2025, DIC Anh Em is a subsidiary of DIC Corp, with a 49% ownership stake.

Illustrative image

In other developments, DIC Corp recently approved the early redemption of two bond issuances.

The bonds, DIGH2326001 issued on December 29, 2023, and DIGH2326002 issued on March 25, 2024, both have a 36-month term.

The total issuance value of these bonds is VND 1,600 billion. DIC Corp plans to repurchase them in Q4/2025 and Q1/2026 using equity capital and/or other legal sources.

The company aims to restructure its debt, optimize capital costs, and enhance its market reputation through this bond repurchase.

According to the 2025 semi-annual review report, the DIGH2326001 bond, valued at VND 600 billion, was used for the Long Tan tourism urban area project in Nhon Trach, Dong Nai, as per its issuance purpose.

The DIGH2326002 bond, valued at VND 1,000 billion, saw approximately VND 155 billion allocated to the same project. The remaining VND 845 billion is held in a bond account at HDBank.

In terms of business performance, DIC Corp’s Q3/2025 consolidated financial report shows a net revenue of over VND 1,339.3 billion, a 28.3-fold increase year-on-year. After deductions, the company reported a net profit of over VND 193.2 billion, a 17.3-fold increase.

For the first nine months of 2025, DIC Corp achieved a net revenue of nearly VND 1,766.5 billion, up 103.3% compared to the same period in 2024. Pre-tax profit totaled over VND 273.4 billion, a 6.5-fold increase, with a net profit of nearly VND 200 billion, a 13.2-fold increase.

For 2025, the company targets a consolidated pre-tax profit of VND 718 billion, a 354.2% increase from 2024. As of Q3/2025, DIC Corp has achieved 38.1% of its annual pre-tax profit goal.

As of September 30, 2025, DIC Corp’s total assets increased slightly by 2.6% to over VND 19,013.4 billion, while total liabilities rose by nearly VND 288 billion to approximately VND 10,786 billion.

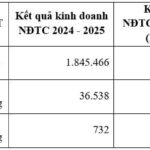

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability, Dividends, and Bonus Shares Up to 30%

HDBank (HOSE: HDB) has reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% year-on-year growth. The bank continues to lead the industry in profitability metrics, boasting an impressive ROE of 25.2% and ROA of 2.1%, underscoring its operational efficiency and robust financial foundation.