As of October 30, 2023, over 20 banks have released their Q3 2025 financial results. Notably, the customer deposit rankings have seen significant shifts.

Historically, while profit rankings often fluctuated, deposit rankings—especially among Vietnam’s top 10 banks—remained stable for years. However, this stability is eroding as the rise of private banks reshapes the capital mobilization landscape.

Since its 2015 merger, Sacombank has been Vietnam’s largest private bank by customer deposits (excluding SCB), maintaining this position for a decade. From 2017 to 2022, the top 3 private banks by deposits—Sacombank, ACB, and SHB—remained unchanged, with Sacombank leading by a wide margin. Techcombank and VPBank typically competed for the 4th and 5th spots.

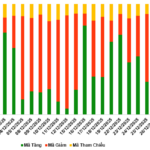

In recent years, Techcombank and VPBank’s ascent has disrupted the top 3 rankings, narrowing the gap with Sacombank. Now, Sacombank, Techcombank, VPBank, ACB, and SHB are in a tight race for dominance.

In 2025, each quarter has brought a new order to the top 5 bank rankings.

Techcombank’s Q3 2025 deposits surged by over VND 50 trillion, from VND 545 trillion to VND 595 trillion—its highest increase in over two years. This propelled Techcombank to second place among private banks, surpassing VPBank, ACB, and SHB since Q2 2025.

Conversely, VPBank’s deposits fell by nearly VND 15 trillion in Q3 2025, from VND 600 trillion to VND 585 trillion. This decline followed a robust VND 115 trillion increase in the first half of the year, one of the sector’s strongest performances. VPBank’s Q3 drop may stem from restructuring its funding sources, with a surge in bond and certificate of deposit issuance for individual customers.

ACB, once the second-largest private bank by deposits, now trails Techcombank and VPBank, with VND 571 trillion in deposits as of September 2025. SHB ranks fifth with nearly VND 565 trillion.

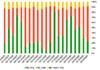

In the first nine months of 2025, deposit growth among top private banks was: VPBank (20.6%), SHB (13%), Techcombank (11.6%), and ACB (6.3%).

Deposit rankings may shift further in Q4 2025, as the gap between the top 5 banks is just over VND 10 trillion—easily achievable in a quarter.

Additionally, year-end months typically see heightened capital mobilization to meet rising credit demand. Banks like Techcombank, VPBank, SHB, and ACB also rank high in 2025 credit growth. In the first nine months, Techcombank’s credit grew by nearly 17%, SHB and ACB by 15%, and VPBank by over 28%.

Recently, some banks have raised deposit rates to enhance competitiveness. VPBank increased rates by 0.3% annually for terms of 1–11 months, while maintaining rates for terms of 12 months or more.

Sacombank raised its 1-month and 2-month deposit rates by 0.5% annually to 3.3% and 3.4%, respectively. The 3-month rate increased by 0.3% to 3.5%, and the 4-month rate rose by 0.5% to 3.7%. Sacombank also boosted its 5-month savings rate by 0.7% to 3.9%.

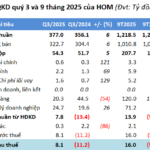

VIB Surpasses VND 7.04 Trillion in Pre-Tax Profit After 9 Months, Up 7% Year-on-Year, Completes 21% Dividend Payout for 2025

International Bank (VIB) has announced its business results for the first nine months of 2025, reporting pre-tax profits exceeding 7.04 trillion VND, a 7% increase compared to the same period in 2024. Credit growth and mobilization rose by 15% and 11%, respectively. Asset quality continues to improve, with safety management maintained at optimal levels.

Reaping Sweet Rewards from Cambodia: Rubber Industry Enterprises See a 60% Surge in Profits

A leading rubber industry enterprise has announced remarkable Q3 financial results, driven by the exceptional performance of its Cambodian subsidiary and enhanced selling prices.