|

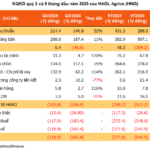

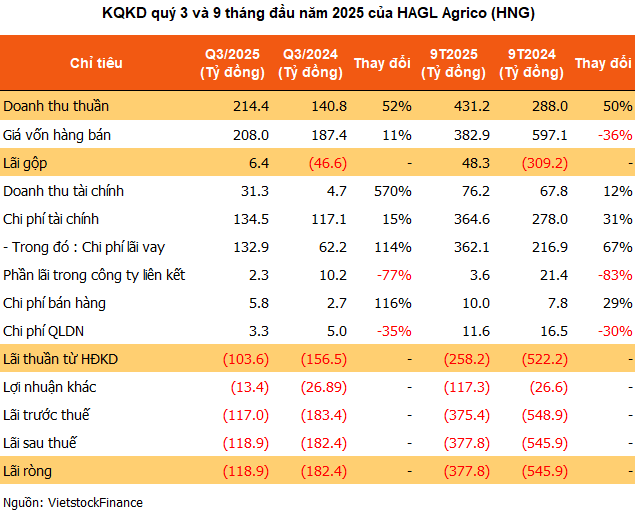

Hoang Anh Gia Lai Agriculture JSC (HAGL Agrico, UPCoM: HNG) reported its third consecutive quarter of gross profit, reaching VND 6.4 billion in Q3/2025, with a margin of nearly 3%. This positive development follows the heated discussions at the 2025 Annual General Meeting, where shareholders questioned the company’s practice of selling products below cost. Chairman Tran Ba Duong firmly stated, “It’s incorrect to say HAGL Agrico sells below cost,” arguing that the figures do not accurately reflect production efficiency.

Mr. Tran Ba Duong – Chairman of HAGL Agrico

|

Not only has the company escaped gross losses, but its revenue also surged this year, exceeding VND 214 billion in Q3, a 52% increase year-over-year and double that of the first quarter. Revenue structure shows rubber latex remains dominant, contributing over VND 149 billion (69%), while fruit sales reached more than VND 64 billion (30%).

For the first nine months, HNG’s revenue totaled over VND 431 billion, up 50% year-over-year, with both business segments contributing equally. Rising revenue and a 36% drop in cost of goods sold helped the company record a gross profit of VND 48 billion, reversing a gross loss of VND 309 billion in the same period last year, ending four consecutive years of nine-month losses.

Financial Costs Weigh on Profitability

Despite improved core operations, HNG remains unprofitable due to hefty financial expenses. In Q3, the company incurred VND 134.5 billion in financial costs, up 15% year-over-year, with nearly 99% attributed to interest payments. As a result, HNG posted a net loss of nearly VND 119 billion, down from over VND 182 billion in the same period last year, marking its 18th consecutive quarter of negative earnings.

| HAGL Agrico’s Near Five-Year Loss Streak |

In the first nine months, financial costs reached nearly VND 365 billion, up 31%. On average, HNG pays over VND 1.3 billion daily in interest. These massive expenses erased gross profits, resulting in a net loss of nearly VND 378 billion, pushing cumulative losses to VND 9,762 billion by September 2025, with equity capital down to VND 1,601 billion.

Debt Surpasses VND 10 Trillion, Thaco Agri as Major Creditor

By the end of Q3/2025, HNG’s total financial debt exceeded VND 10,238 billion (nearly USD 400 million), up VND 300 billion since the year’s start. Over VND 9,345 billion is owed to Truong Hai Agriculture JSC (Thaco Agri), HAGL Agrico’s largest shareholder and primary financier.

Previously, Mr. Tran Ba Duong noted: “When Thaco joined, we saw HAGL Agrico’s debt and land, but there were many underlying issues. HAGL Agrico was like a shell without a soul. We’re working to resolve lingering issues in 2025 for a smoother 2026.”

Inventory and Cattle Costs Surge

By September 2025, HNG’s bank deposits fell to under VND 5 billion, down 93% year-over-year. Conversely, inventory soared to over VND 2,415 billion, up 25%, with 87% tied to production costs. Notably, cattle-raising costs doubled to VND 308 billion, the largest increase, alongside construction contracts (VND 1,408 billion) and production expenses (VND 394 billion).

On UPCoM, HNG shares fell 1.6% to VND 6,200 on October 30 after earnings were announced, but remained up 5% for the week and 29% year-over-year. Average liquidity exceeded 4.3 million shares per session.

| HNG Share Price Over the Past Year |

– 16:55 30/10/2025

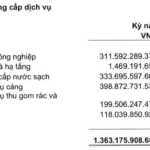

Sonadezi Surpasses Annual Plan with Over $1 Billion Profit in 9 Months

Following a record-breaking second quarter, Sonadezi’s net profit continued its upward trajectory in Q3 2025, driven by steady growth in port services, clean water, and improved gross margin. The company has already surpassed its full-year profit target after just three quarters.

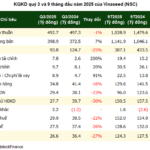

Vinaseed’s Gross Profit Hits Historic Low as Inventory Surges Past 1 Trillion VND

Amidst seasonal fluctuations and escalating financial costs, Vinaseed Group (HOSE: NSC) reported its weakest quarterly performance since 2020, with gross profit margins plummeting to a record low of 19%. Simultaneously, inventory levels surged past the 1,000 billion VND mark, exacerbating the company’s financial challenges.

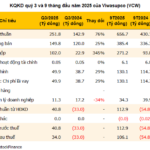

Viwasupco Posts Massive Profits, Seeks Delisting Amid Soaring Debt of Over VND 3,500 Billion

Viwasupco (UPCoM: VCW) reported a remarkable turnaround in Q3 2025, posting a net profit of VND 34 billion, a stark contrast to the VND 33 billion loss incurred in the same period last year. Amidst this robust business recovery, the company is seeking shareholder approval to delist and revoke its public company status.

THACO Secures $1.3B in Bank Loans Ahead of High-Speed Rail Investment Announcement, Asset Value Surges to $8.6B, Rivaling Novaland and Hoa Phat

THACO’s post-tax profit in 2024 soared to VND 3,025 billion, marking a remarkable 14% year-over-year growth.