A booth of Thien Long Group – Illustrative image

|

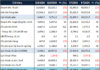

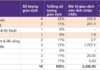

Thien Long Group (HOSE: TLG) has released its consolidated financial report for Q3/2025, revealing a net profit of VND 76 billion, a 17% decline compared to the same period last year.

This decrease is primarily attributed to the stationery manufacturer’s marketing and trade show expenses, which soared to VND 284 billion, 3.5 times higher than the previous year. The company stated that this increase was a strategic move to ensure the stability of its distribution network amidst intensifying market competition.

In Q3, Thien Long’s domestic and international revenues grew by 35% and 21%, reaching VND 894 billion and VND 291 billion, respectively. Gross profit margin improved to 49.6%, up from 42.9% in the same quarter last year, as the company restructured its product portfolio to prioritize higher-margin items, enhanced production efficiency, and controlled input costs.

Domestically, the company’s Q3 performance demonstrated the resilience and adaptability of its sales system in a volatile market. The quarter’s revenue growth was largely driven by delayed orders from Q2, a period when traditional retail channels faced challenges due to new tax regulations and anti-counterfeiting campaigns.

Additionally, trade support programs and the back-to-school season positively impacted Q3 sales. However, severe flooding in Northern and North-Central Vietnam disrupted logistics and distribution activities.

For the first nine months of the year, Thien Long achieved an 11% revenue growth, but its post-tax profit declined by 11%. The company has fulfilled 84% of its annual profit target set by shareholders.

– 17:28 31/10/2025