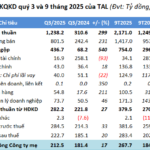

| Habeco’s Quarterly Business Results Over the Past 5 Years |

Habeco reported impressive Q3/2025 business results, reaching a peak since the beginning of 2021. Revenue exceeded 2.507 trillion VND, a 7% increase year-over-year, while net profit surged to 221 billion VND, up by 78%.

Notably, Habeco has returned to pre-COVID-19 levels, with revenue surpassing 2.500 trillion VND and profits exceeding 200 billion VND. Over the past five years, the company faced significant declines due to economic challenges, weak purchasing power, and stricter alcohol regulations for drivers.

Habeco’s gross profit margin remained strong at 29.5% in the last two quarters, matching pre-pandemic highs and significantly outperforming the 20-25% range of previous years.

|

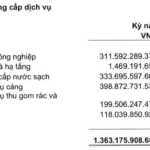

9-Month Results Far Exceed Annual Targets

In the first nine months of 2025, Habeco achieved nearly 6.322 trillion VND in revenue, a 6% year-over-year increase, fulfilling 53% of its annual plan. Net profit reached nearly 369 billion VND, up 45% and surpassing the full-year target by 87%.

This marks the highest 9-month profit in five years, even exceeding full-year profits of 2024 (371 billion VND) and 2023 (336 billion VND).

| Habeco’s Business Results from 2016 to 9M2025 |

Despite strong business performance, BHN shares on HOSE dipped slightly to 30,700 VND/share on October 31st. Over the past month, the stock has lost 6% in value, with a nearly 18% decline over the year. Average trading volume remains low, below 4,000 shares per session.

| BHN Share Price Trends Over the Past Year |

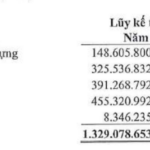

Bank Deposits Account for Nearly 2/3 of Total Assets

Financial activities significantly contributed to positive results, with 9-month revenue reaching nearly 152 billion VND, up 24% year-over-year. Interest income from deposits accounted for over 96%, averaging approximately 535 million VND daily.

By September 2025, Habeco’s total bank deposits exceeded 4.845 trillion VND, up by over 300 billion VND since the year’s start, representing nearly 64% of total assets.

Meanwhile, inventory decreased by 14% to over 615 billion VND, and short-term receivables more than doubled to 505 billion VND. Conversely, outstanding debt fell by 99% to just over 1 billion VND, following full repayment of major loans from Vietinbank (51.8 billion VND) and VIB (18.2 billion VND).

– 13:07 31/10/2025

Taseco Land: Industrial Park Segment Contributes to Revenue for the First Time, Achieving Half of Annual Plan in 9 Months

Expanding into the industrial park infrastructure sector in 2023, Taseco Land recorded its first revenue from this segment in Q3/2025, surpassing 636 billion VND and accounting for over 50% of total revenue.

Post-Restructuring, Each Phuc Long Store Averages Daily Revenue of 23.5 Million VND

As of Q3 2025, Phúc Long boasts an impressive network of 242 stores. The brand’s daily average revenue per store has surged by 8.8% year-over-year, reflecting its continued growth and market strength.

TDC Reports Over 150 Billion VND in 9-Month Profits, Seeks 1 Trillion VND Loan for TDC Plaza Project

Revised Introduction:

Revenue surged significantly for Binh Duong Trading and Development JSC (HOSE: TDC), posting a 9-month profit of over VND 150 billion—a 50% year-on-year increase and 62% of its annual target. Concurrently, the company plans to secure a VND 1,000 billion loan to advance its flagship TDC Plaza project.