Reasons for the “Southern Shift”

A report by the Vietnam Association of Realtors (VARS) reveals a significant capital migration from the northern to the southern real estate markets, particularly in Ho Chi Minh City and its surrounding provinces.

According to VARS, despite increased new supply, property prices in Hanoi have consistently reached new highs. Research data from the Vietnam Real Estate Market Research Institute (VARS IRE) shows that in the first nine months of 2025, Hanoi’s market recorded approximately 22,000 newly launched apartments, equivalent to 64% of the total supply in 2024 and the highest level in the same period from 2019 to 2025. Among these, condominiums remain dominant, accounting for 76% of the new supply.

Capital is shifting strongly into the southern real estate market.

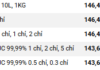

However, prices remain high, with new projects often exceeding 100 million VND per square meter. The current condominium price index compared to Q1/2019 has increased by over 96%, 1.7 times higher than the growth rate in Ho Chi Minh City during the same period.

High property prices have narrowed the price increase margin, reducing investment appeal. Additionally, the capital value exceeds the financial capacity of many investors, prompting capital to move out of Hanoi in search of opportunities in markets with more reasonable prices and higher growth potential.

Notably, VARS’s report highlights that besides concentrating in areas around Hanoi with well-developed infrastructure, capital is also shifting strongly to the southern region.

Mr. Nguyen Thai Binh, CEO of Dong Tay Land and Deputy Secretary-General of VARS, stated that preliminary statistics from some developers show that northern buyers accounted for about 20% of total transactions in the south in the first half of this year, double that of the same period last year. By the end of Q3/2025, this ratio reached 30%, nearly matching the peak period of 2016–2020.

The southern region attracts capital due to its stable price levels over the past three years, offering growth potential and attractive profit margins for investors. Some areas around former Ho Chi Minh City, including newly merged localities, have prices 30–40% lower than Hanoi, while infrastructure connectivity and urbanization rates are rapidly increasing.

For example, with 2–4 billion VND, in Hanoi, one can only buy a 1-bedroom or 1+1 apartment, whereas in Ho Chi Minh City, investors have more diverse options, from apartments to individual houses. Notably, prices for some new projects in the outskirts of Ho Chi Minh City are only two-thirds of those in Hanoi’s suburbs, offering more attractive medium and long-term price increase potential.

Following Familiar Developers

The shift of Hanoi investors’ capital to Ho Chi Minh City and its surroundings is not just about seeking lower prices but also diversifying investment portfolios, optimizing actual exploitation value, and improving capital efficiency. Compared to Hanoi, Ho Chi Minh City’s real estate market has a clearer segmentation, with luxury apartments, complete legal frameworks, prime locations, luxurious living spaces, and high-end amenities.

The southern shift of real estate investment capital is increasingly strong.

“These products suit investors with strong financial capabilities and long-term asset accumulation needs, offering dual profitability—both long-term price appreciation potential and effective rental exploitation with better returns than Hanoi,” a VARS representative said.

The “southern shift” trend is also driven by the return of major developers to the south after legal issues were resolved, along with strong marketing campaigns. Notably, many individual investors from Hanoi tend to follow familiar developers as they expand their projects southward, leveraging their understanding of the brand and implementation capabilities.

Another crucial factor enhancing investment appeal is the infrastructure development policy and regional planning momentum following the new administrative merger of Ho Chi Minh City. Many new projects are located near metro lines, ring roads, and key traffic axes, improving inter-regional connectivity and future asset value, particularly attracting Hanoi investors.

VARS IRE believes the southern shift of real estate investment capital is increasingly strong. The southern region, especially Ho Chi Minh City, is becoming a new destination due to reasonable prices, rapid infrastructure development, and improved legal frameworks.

However, investors should carefully select segments, assess financial capabilities, and prioritize long-term strategies (rather than quick profits) to ensure safety and effectiveness in a restructuring market.

Geleximco Consortium Wins Nearly $1 Billion Bid for Long-Stalled Quy Nhon Project After Decade of Inactivity

Nestled in the heart of Quy Nhơn, spanning across Quy Nhơn Bắc, Quy Nhơn Nam, and Quy Nhơn wards in Gia Lai Province, this expansive 279.7-hectare project redefines modern living. With its strategic location and ambitious scale, it promises to be a transformative development, blending innovation, sustainability, and community-centric design.

Văn Phú Surpasses 75% of 2025 Profit Target Ahead of Schedule

The recognition of revenue from The Terra – Bac Giang and Vlasta – Sam Son projects propelled Van Phu Real Estate Development JSC to a strong finish in Q3/2025, with after-tax profit reaching VND 119 billion, an 8% increase compared to the same period in 2024. For the first nine months of 2025, the company recorded an after-tax profit of VND 262.9 billion, achieving over 75% of its annual profit target.

Coastal Land Plots: Boost Property Value While Capitalizing on Year-Round Tourism

After a period of stagnation, the coastal land market is regaining momentum as investment capital returns to tangible assets—properties that not only preserve value but also offer profitable operational potential.