Cautious sentiment persists as the stock market continues to experience significant volatility. The VN-Index closed the session on October 30th with a 16-point decline (0.96%), settling at 1,669.57 points. Trading liquidity remained low, with transaction values on HOSE exceeding 23.8 trillion VND.

Foreign trading activity was a notable downside, with net selling reaching 1.21 trillion VND across the market.

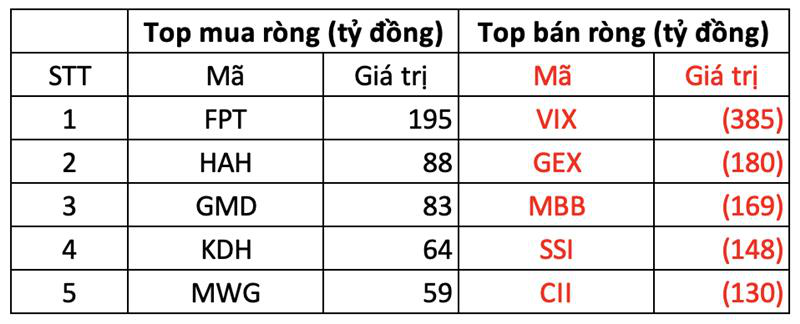

On HOSE, foreign investors net sold 1.152 trillion VND

On the buying side, FPT was the most heavily purchased stock by foreign investors on HOSE, with a value of over 195 billion VND. HAH followed closely, with 88 billion VND in purchases. Additionally, GMD and KDH were bought for 83 billion VND and 64 billion VND, respectively.

Conversely, VIX was the most heavily sold stock by foreign investors, with 385 billion VND. GEX and MBB followed, with sell-offs of 180 billion VND and 169 billion VND, respectively.

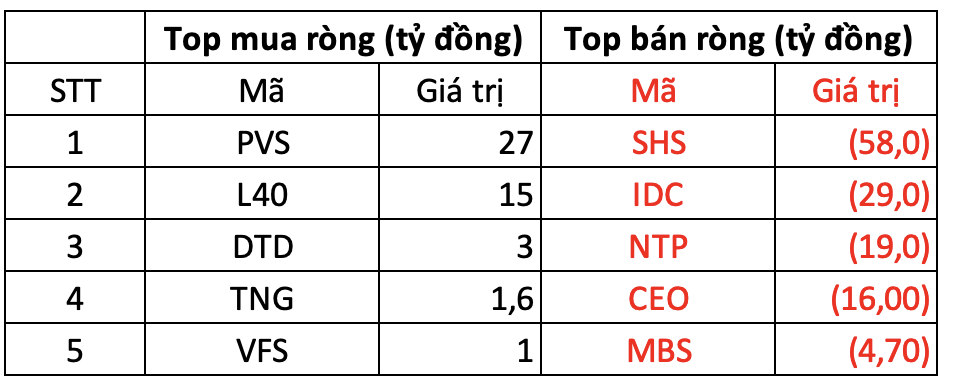

On HNX, foreign investors net sold 82 billion VND

On the buying side, PVS was the most heavily purchased stock with a value of 27 billion VND. L40 was the next most bought stock on HNX, with 15 billion VND. Foreign investors also allocated a few billion VND to DTD, TNG, and VFS.

On the selling side, SHS faced the most significant selling pressure from foreign investors, with nearly 58 billion VND. IDC followed with 29 billion VND, while NTP, CEO, and MBS saw sell-offs of a few billion VND each.

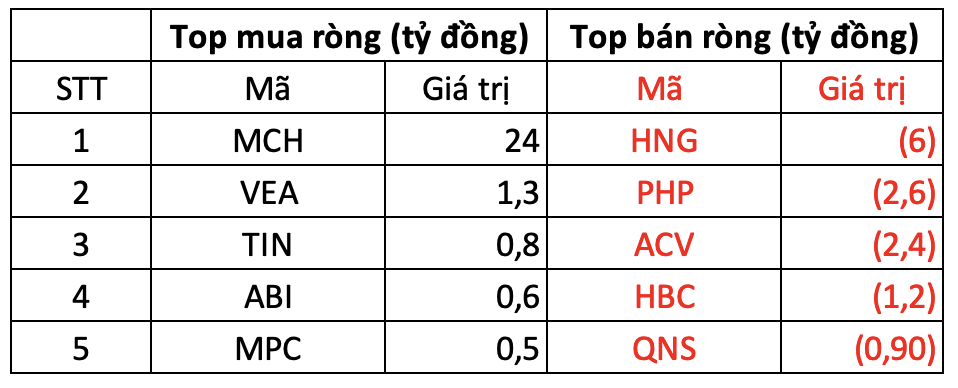

On UPCOM, foreign investors net bought 24 billion VND

On the buying side, MCH was purchased by foreign investors for 24 billion VND. VEA and TIN also saw net buying of a few billion VND each.

Conversely, HNG was net sold by foreign investors for 6 billion VND. Additionally, PHP, ACV, and others also saw net selling.

Mai Chi

Vietstock Daily 31/10/2025: Market Volatility Persists?

The VN-Index has retraced and continues to oscillate around the 50-day SMA. Trading volume declined for the fourth consecutive session, remaining below the 20-day average. Additionally, the Stochastic Oscillator has reversed, signaling a sell indication, suggesting that short-term volatility is likely to persist.

Pyn Elite Fund: Market Pullbacks Are Transient, Bullish Trend Remains Intact

According to Pyn Elite Fund, the upward trajectory of the stock market is underpinned by robust economic growth and substantial corporate profit expansion.