|

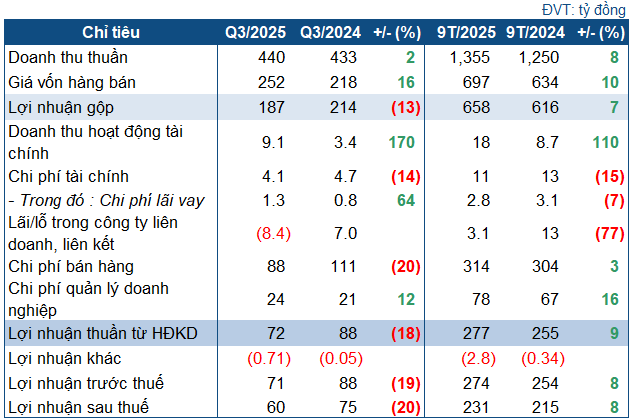

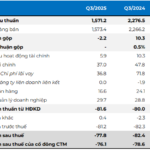

DBD’s Q3 2025 Business Targets

Source: VietstockFinance

|

In Q3, DBD’s net revenue reached VND 440 billion, a slight increase year-over-year. However, the cost of goods sold surged by 16% to over VND 252 billion, causing gross profit to decline by 13% to VND 187 billion.

Financial activities were a highlight, generating VND 9.1 billion in financial revenue, 2.7 times higher than the same period last year, while financial expenses decreased by 14% to VND 4.1 billion. Selling expenses unexpectedly dropped by 20% to VND 88 billion. Nevertheless, the company recorded a loss of VND 8.4 billion from its associate company (compared to a profit of nearly VND 7 billion in the same period last year). Administrative expenses rose by 12% to VND 24 billion.

After deducting all expenses, DBD’s post-tax profit was VND 60 billion, a 20% decrease year-over-year.

In its explanatory statement, DBD attributed the decline in Q3 profit primarily to the allocation of VND 15 billion to the Science and Technology Fund for R&D of new products. Additionally, expenses for sales and marketing activities were boosted during the period.

For the first nine months of the year, DBD still achieved an 8% growth in profit, reaching VND 231 billion; revenue totaled nearly VND 1.4 trillion, up by 8%. The company has fulfilled 68% of its annual revenue target and 82% of its pre-tax profit plan. DBD plans to continue strengthening marketing and R&D efforts to gain long-term advantages.

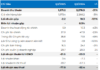

As of September 30, DBD’s total assets amounted to over VND 2.43 trillion, a 7% increase from the beginning of the year, with more than VND 1.4 trillion in current assets, slightly down. Cash and deposits reached VND 532 billion, up by 21%. Inventory decreased by 24% to VND 379 billion.

The most significant change was in long-term assets, where construction in progress rose by 89% to VND 442 billion. This item primarily includes investments in the “High-Tech Pharmaceutical Production Plant (Nhon Hoi),” totaling VND 407 billion.

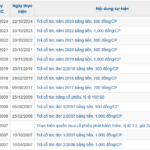

Regarding capital sources, total liabilities increased by 20% to VND 722 billion, with VND 531 billion in short-term debt (up by 15%). Short-term loans surged to VND 98 billion, 2.7 times higher than the beginning of the year; long-term debt nearly tripled to VND 80 billion.

– 09:30 31/10/2025

Viettel Post Reports Nearly VND 252 Billion Profit in 9 Months, Operating Cash Flow Turns Positive by Over VND 800 Billion

By the end of Q3, Viettel Post Corporation (Viettel Post, HOSE: VTP) held nearly VND 2.3 trillion in bank deposits, a 24% increase from the beginning of the year. The company’s operating cash flow turned positive, exceeding VND 800 billion, while cumulative net profit for the first nine months reached nearly VND 252 billion.

DIC Corp Seeks to Fully Divest Stake in Ceramic Tile Subsidiary

DIC Corp is offering to sell its entire stake of 8.82 million shares in DIC Anh Em at a price of no less than VND 4,696 per share, aiming to secure a minimum revenue of over VND 41.4 billion.