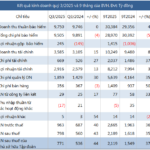

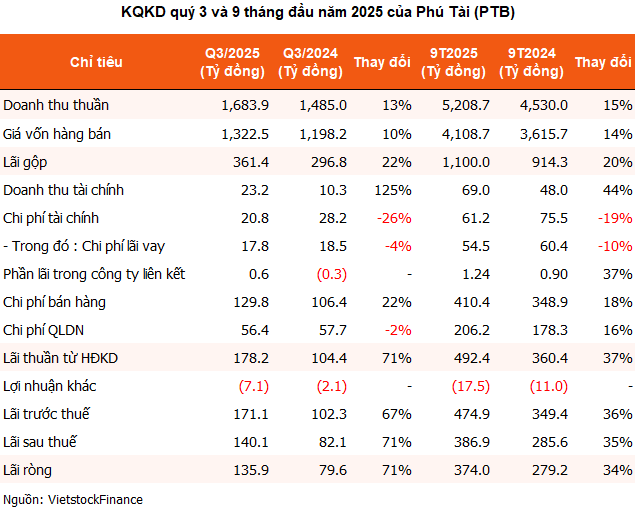

| Phú Tài’s Quarterly Business Results for 2022-2025 |

Phú Tài reported robust Q3 2025 results, with net profit surging 71% to nearly VND 136 billion—the highest since Q3 2022. This marks the fourth consecutive quarter of growth, with each quarter outperforming the previous one.

Quarterly revenue reached nearly VND 1,684 billion, up 13% year-on-year. Gross margin improved from 20% to 21.5%, while financial revenue soared 125% to over VND 23 billion. Financial expenses declined by 26%. Despite a 22% rise in selling expenses to nearly VND 130 billion, overall profitability remained strong.

|

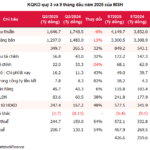

Wood and Stone Segments Drive Growth

In the first nine months of 2025, PTB recorded revenue of nearly VND 5,209 billion, a 15% increase year-on-year, with net profit reaching VND 374 billion—up 34% and the highest in three years. Although not yet back to 2021-2022 peaks, this nine-month profit surpasses full-year results for 2024 (VND 369 billion) and 2023 (VND 258 billion).

The company achieved 78% of its annual revenue target and nearly met its pre-tax profit goal (VND 475/477 billion).

Two core segments remained pivotal: wood (56% of total revenue, 94% exported) and stone (27%, 46% exported). Wood revenue grew 13%, while stone surged 31%, with gross margins of 20% and 30.5%, respectively. Toyota auto sales rose 18% to over VND 674 billion, and real estate revenue skyrocketed sevenfold to VND 218 billion.

Alongside strong performance, PTB expanded its workforce to 6,717 employees by September-end, adding 402 since year-start.

Improved Cash Flow, but Rising Bad Debt and Inventory

As of September 2025, PTB held over VND 588 billion in bank deposits (up 29%) and a trading securities portfolio valued at VND 46 billion (up 56%). However, fair value dropped to VND 43.5 billion, reflecting a 5% loss. New investments included FPT (VND 9.6 billion), HCM (VND 4.8 billion), and GEX (VND 4.2 billion), with FPT incurring the largest loss at 8%. VGC and KBC were removed from the portfolio.

Bad debt rose 4% to nearly VND 93 billion, with VND 18 billion deemed recoverable. The largest debt, VND 65 billion, is tied to Noble House Home (a U.S. client that filed for bankruptcy in late 2023), with VND 54.5 billion provisioned.

Inventory reached nearly VND 1,675 billion (up 15%), primarily due to VND 985 billion in work-in-progress costs (59%). Real estate inventory hit VND 614 billion (2.5 times year-start), concentrated in the Phú Tài Central Life project (former Quy Nhơn City), with a total investment of VND 615 billion.

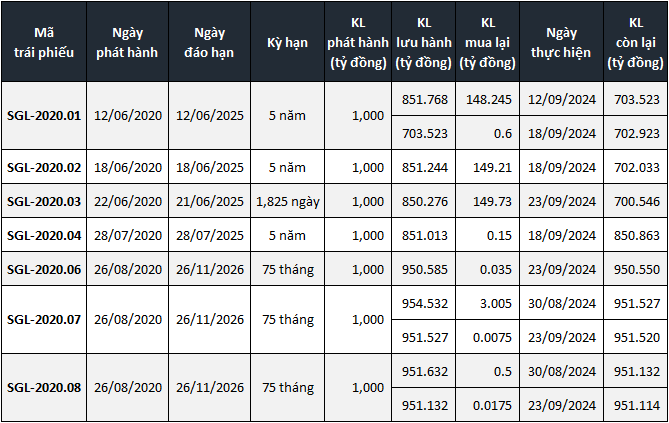

Total debt stood at VND 1,620 billion (up 4%), with 79% short-term. Major creditors include Vietcombank (VND 358 billion), MB (VND 280 billion), and Techcombank (VND 234 billion), plus a VND 230 billion unsecured loan from Phú Tài Vân Hà Investment JSC.

On HOSE, PTB closed October at VND 52,300/share, up 9% monthly but down 13% annually, with average liquidity of 172,000 shares/session.

| PTB Stock Price Over the Past Year |

– 16:58 31/10/2025

Bảo Việt Group Reports Over 2 Trillion VND in Profits After 9 Months

Bao Viet Group (HOSE: BVH) has achieved remarkable business results in the first nine months of 2025, marking three consecutive quarters of profit growth compared to the same period last year. In Q3 alone, the company recorded a net profit of VND 771 billion, a 44% increase, setting a new record for the highest quarterly profit in its history.

Red River Garment Smashes Quarterly Profit Record, Invests Nearly VND 1.6 Trillion in Bonds

Record-breaking Q3 profits for Hong Ha Garment Joint Stock Company (HOSE: MSH) as the company continues to maintain a substantial financial investment portfolio, with nearly one-third of its assets in bonds, while simultaneously ramping up production and overseas investments.

Western Region’s Fruit & Vegetable Enterprises Hit Record Profits, Expanding 1,500 Workforce Ahead of Market Upgrade

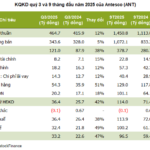

Ahead of its upcoming listing on HOSE, An Giang Fruit and Vegetable Processing Joint Stock Company (Antesco, UPCoM: ANT), a leading player in the Mekong Delta’s processed fruit and vegetable sector, reported a staggering 63% surge in nine-month profits, surpassing its entire 2024 earnings. This remarkable growth is complemented by a significant workforce expansion, now exceeding 1,500 employees.

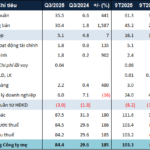

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.