The Board of Directors of Hoang Anh Gia Lai Joint Stock Company (HAGL, stock code: HAG) has recently approved a resolution to list its subsidiaries on the stock exchange.

According to the plan, HAGL aims to list Hung Thang Loi Gia Lai LLC in 2026 and Gia Suc Lo Pang JSC in 2027.

Hung Thang Loi Gia Lai LLC

Hung Thang Loi Gia Lai LLC, originally established as Hung Thang Loi Gia Lai JSC on October 12, 2016, specializes in agricultural services.

As per the latest business registration update on July 31, 2025, Ms. Vo Thi My Hanh, a Board Member and Deputy CEO of HAGL, serves as the Director and Legal Representative of Hung Thang Loi Gia Lai. She also holds a position on the Board of Directors of Hoang Anh Gia Lai International Agriculture JSC.

The company’s chartered capital stands at VND 1,285 billion, with Hoang Anh Gia Lai JSC holding 98.77%. The remaining shares are owned by Mr. Thuy Ngoc Dung (0.61%) and Ms. Le Thi Lieu (0.61%).

As of September 30, 2025, Hung Thang Loi Gia Lai owes HAGL over VND 822 billion, including VND 700 billion in principal, VND 39.4 billion in interest, VND 82.8 billion in borrowed funds and debt offsets, and VND 164.6 million in other liabilities.

HAGL plans to convert VND 300 billion of this debt into equity in Hung Thang Loi Gia Lai, increasing its chartered capital to VND 1,585 billion.

Illustrative image.

In mid-August 2025, Hung Thang Loi Gia Lai raised VND 1,000 billion through bond issuance. These bonds are guaranteed, allowing early redemption as per the issuance terms, with OCBS Securities acting as the registrar and depository.

In October 2024, the company redeemed a VND 350 billion bond issue with a 4-year term and a 10% annual interest rate, custodied by TPBank.

Gia Suc Lo Pang JSC

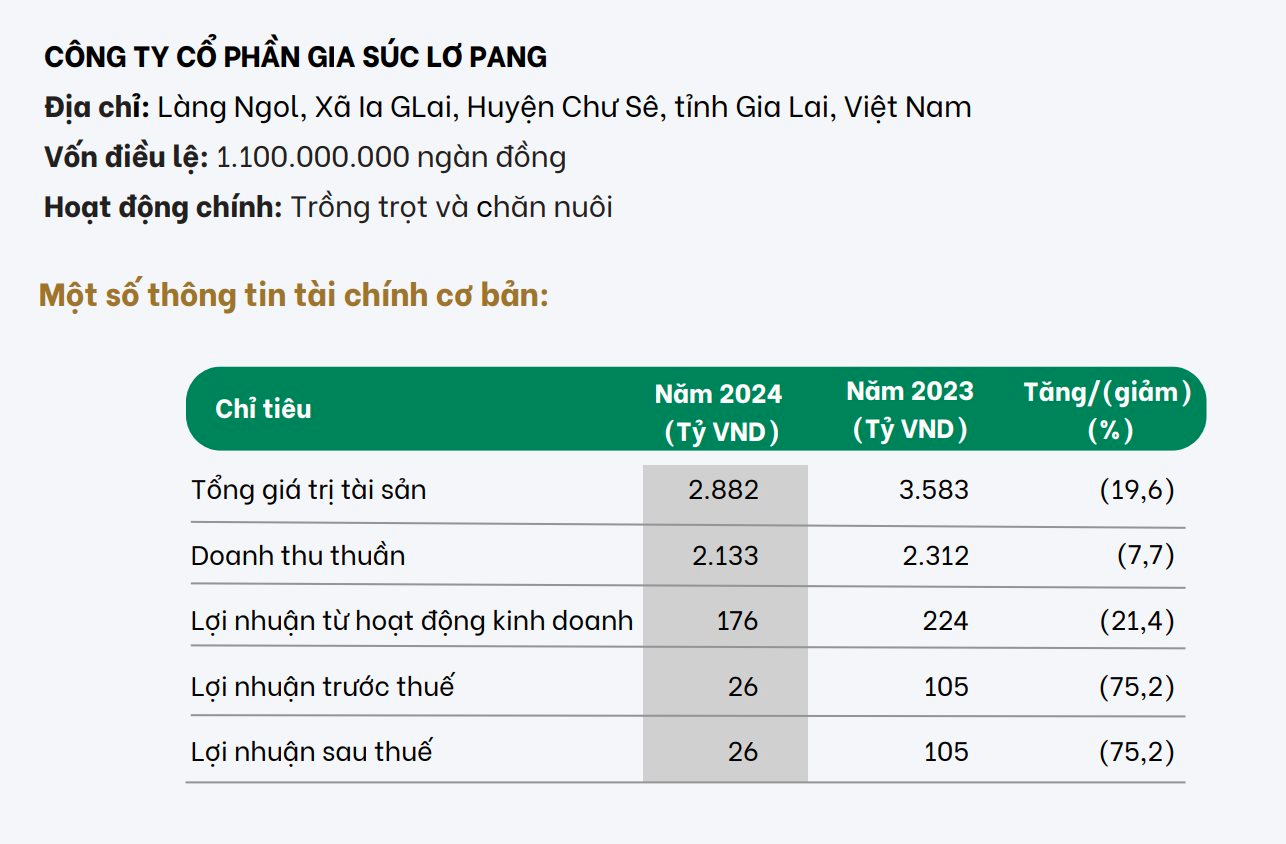

Gia Suc Lo Pang (GSLP) operates in agriculture, livestock, and crop cultivation, managing pig farms, extensive farmland, and supplying agricultural products to HAGL’s network.

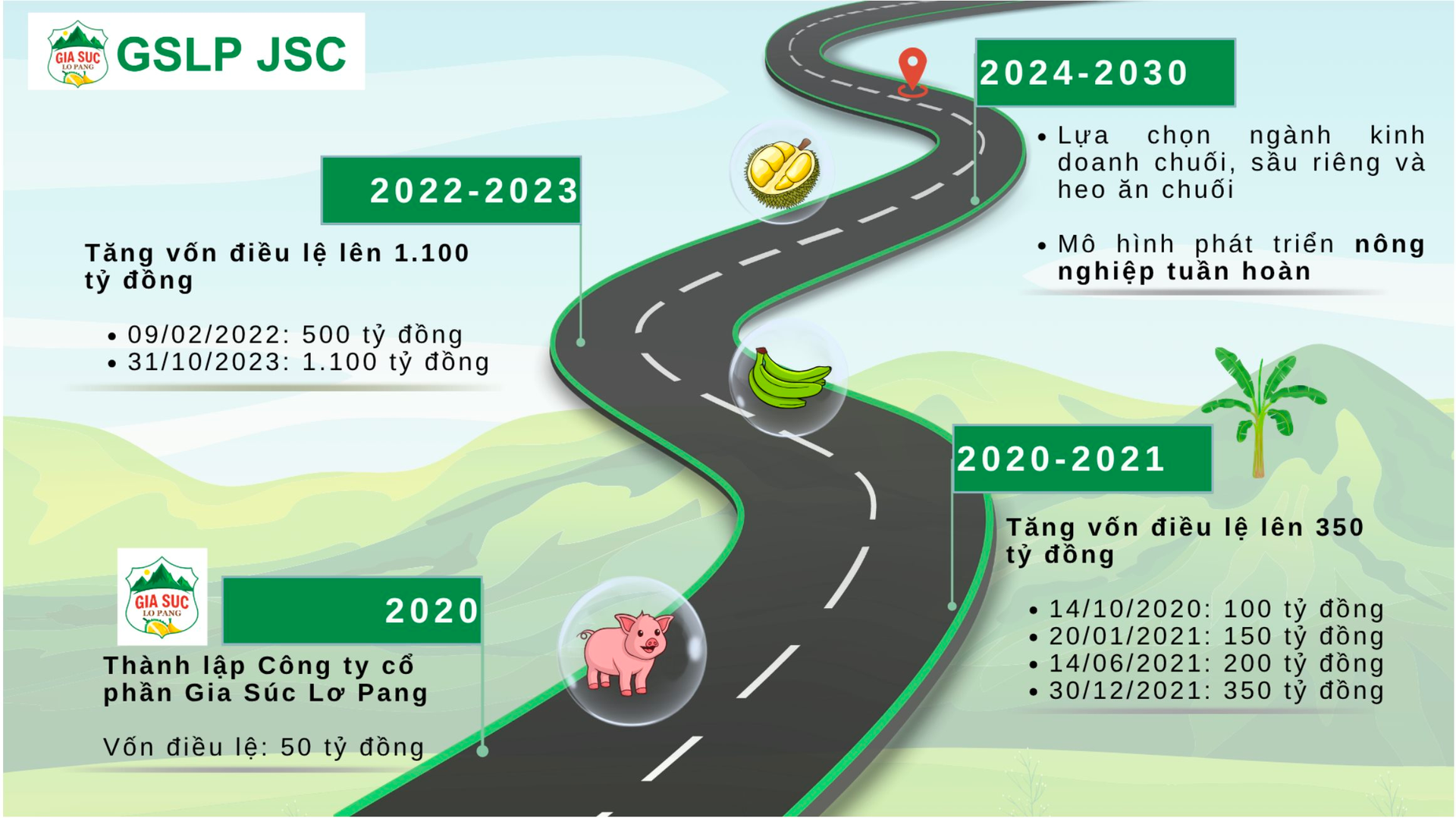

Established on June 19, 2020, with a chartered capital of VND 50 billion, GSLP’s headquarters are located at HAGL’s operations center in Pleiku City, Gia Lai Province.

By December 30, 2021, the company increased its capital to VND 350 billion to expand pig farming and cultivate bananas and durians. On February 9, 2022, the capital was further raised to VND 500 billion.

On March 31, 2022, HAGL acquired 50 million shares (99.75% ownership) in Lo Pang for VND 2,384 billion. At the time, Lo Pang owned 2,129 hectares of agricultural land in Gia Lai Province.

By December 31, 2023, the company’s capital increased to VND 1,100 billion.

Ms. Ho Thi Kim Chi, Deputy CEO of HAGL, currently serves as the Chairwoman of GSLP’s Board of Directors.

Source: HAGL’s 2024 Annual Report.

In 2024, GSLP reported VND 2,133 billion in revenue, VND 26 billion in net profit, and VND 2,882 billion in total assets. Compared to 2023, revenue decreased by 7.7%, net profit by 75.2%, and assets by 19.6%.

HAGL Group, founded by Chairman Doan Nguyen Duc, listed its HAG shares in December 2008 with an initial market cap of VND 8,522 billion. Currently, the company’s market cap is approximately VND 20,000 billion, largely due to capital increases through share issuances.

In July 2015, HAGL listed its subsidiary HNG (Hoang Anh Gia Lai International Agriculture JSC). However, HNG’s market cap has declined from VND 23,722 billion at listing to VND 6,540 billion.

Bầu Đức’s Burden Eases: HAGL Eliminates Over VND 2.5 Trillion in Debt, Officially Ending Years of Accumulated Losses

After years of restructuring, Bầu Đức’s Hoàng Anh Gia Lai has reached a turning point, successfully eliminating over 2.5 trillion VND in debt through a strategic conversion into shares for six key shareholders.