Recently Released Q3/2025 Financial Reports as of October 30th:

Vinhomes (VHM) reported a 50% drop in Q3 pre-tax profit to VND 5,420 billion, with a 9-month cumulative profit of VND 18,293 billion, down 26%.

BSR turned a profit with a pre-tax earnings of VND 1,051 billion, compared to a loss of VND 1,329 billion in the same period last year.

HDBank’s Q3 pre-tax profit reached VND 4,735 billion, a 5% increase.

TPBank’s Q3 pre-tax profit hit VND 1,902 billion, up 10%.

Eximbank’s Q3 pre-tax profit declined by 38% to VND 560 billion.

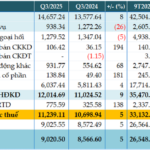

Sacombank announced its Q3/2025 financial report with a pre-tax profit of VND 3,657 billion, up 33% year-on-year. For the first 9 months, the bank’s pre-tax profit reached VND 10,988 billion, a 36% increase.

Nam A Bank reported a 9-month pre-tax profit of over VND 3,800 billion, up by nearly VND 520 billion (16%) year-on-year, achieving 77% of its annual target.

FPT Retail (FRT) disclosed a Q3 pre-tax profit of VND 325 billion, a 65% increase. Its 9-month cumulative profit reached VND 804 billion, up 125%.

Khang Dien (KDH) saw a 783% surge in Q3 pre-tax profit to VND 654 billion, with a 9-month total of VND 1,055 billion, up 93%.

Sai Gon Port (SGP) recorded a 745% increase in Q3 pre-tax profit.

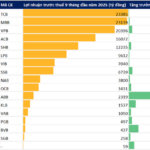

2025 Q3 Bank Performance Update: More Lenders Surpass VND 10 Trillion Pre-Tax Profit by October 29

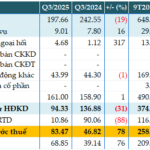

In Q3/2025, a bank reported a staggering pre-tax profit, soaring 12 times higher than the same period last year.

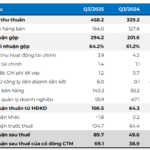

Saigonbank Reports 78% Surge in Pre-Tax Profit for Q3 Despite Negative Credit Growth

According to the Q3/2025 Consolidated Financial Statements, Saigon Commercial Joint Stock Bank (Saigonbank, UPCoM: SGB) reported pre-tax profits exceeding 83 billion VND, a 78% surge compared to the same period last year. This remarkable growth is primarily attributed to an 88% reduction in credit risk provisioning expenses. Notably, customer lending at the end of Q3 decreased by 6% from the beginning of the year.