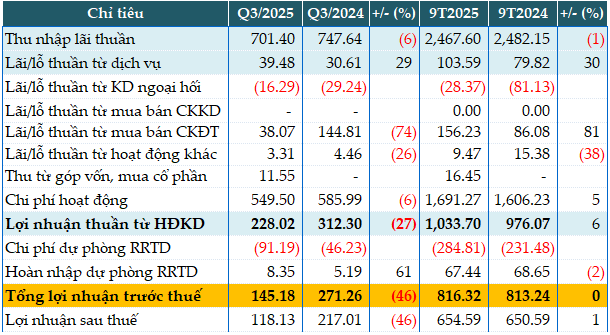

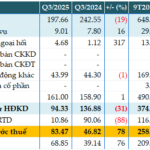

The third quarter of 2025 marked a downturn for Bac A Bank, with most revenue streams declining year-over-year. Net interest income fell by 6% to VND 701 billion.

Service fee income was the sole bright spot, surging 29% to VND 39 billion. Other non-interest income sources, however, saw significant drops: investment securities income plummeted by 74%, other operating income shrank by 26%, and foreign exchange trading resulted in losses.

Despite a 6% reduction in operating expenses to VND 549 billion, net operating profit plunged by 27% to VND 228 billion.

Furthermore, the bank’s credit risk provisions soared by 97% to VND 91 billion. Even with a VND 8 billion write-back, Bac A Bank’s pre-tax profit tumbled by 46% to VND 145 billion.

Consequently, the bank’s nine-month pre-tax profit remained flat at VND 816 billion, reaching only 63% of its annual target of VND 1,300 billion.

|

Q3 and 9M 2025 Financial Results of BAB. Unit: Billion VND

Source: VietstockFinance

|

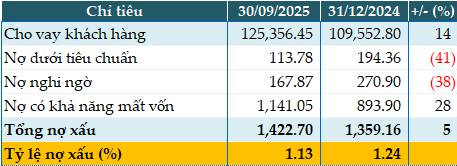

Total assets as of Q3-end rose 16% year-to-date to VND 191,964 billion. Deposits at the State Bank of Vietnam fell by 34% to VND 529 billion, while deposits at other credit institutions surged 51% to VND 18,824 billion. Customer loans grew by 14% to VND 125,356 billion.

Customer deposits increased by 6% to VND 130,418 billion. Deposits from other credit institutions jumped 54% to VND 18,092 billion.

Total non-performing loans as of September 30, 2025, reached VND 1,422 billion, a 5% increase from the beginning of the year. A shift towards potentially irrecoverable debt was observed, leading to a slight decrease in the NPL ratio from 1.24% to 1.13%.

|

Loan Quality of BAB as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 11:35 AM, October 31, 2025

FPT Retail Reports Q3 Net Profit of Nearly VND 220 Billion, Up 55% YoY

FPT Digital Retail Joint Stock Company (FPT Retail, HOSE: FRT) has released its consolidated Q3/2025 financial report, revealing a net revenue of VND 13.1 trillion and a net profit of VND 219 billion. These figures represent a remarkable 26% and 55% year-on-year growth, respectively, compared to the same period last year.

Viettel Global Reports Record-Breaking Q3 2025 Profits, Revenue Surges Over 20% for 8 Consecutive Quarters

Viettel Global (stock code: VGI) has released its consolidated financial report for Q3/2025, showcasing remarkable growth in both revenue and profit, marking another quarter of exceptional business performance.

Saigonbank Reports 78% Surge in Pre-Tax Profit for Q3 Despite Negative Credit Growth

According to the Q3/2025 Consolidated Financial Statements, Saigon Commercial Joint Stock Bank (Saigonbank, UPCoM: SGB) reported pre-tax profits exceeding 83 billion VND, a 78% surge compared to the same period last year. This remarkable growth is primarily attributed to an 88% reduction in credit risk provisioning expenses. Notably, customer lending at the end of Q3 decreased by 6% from the beginning of the year.