|

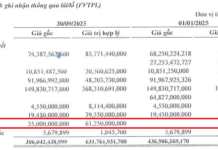

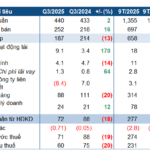

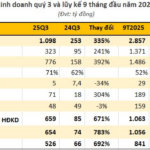

REE’s Q3/2025 Business Targets

Source: VietstockFinance

|

Specifically, REE achieved nearly VND 2.6 trillion in revenue in Q3, a 26% increase year-on-year. After deducting the cost of goods sold, gross profit reached VND 932 billion, up 36%.

Financial revenue surged by 63% to VND 102 billion, while financial expenses remained relatively stable at VND 184 billion. Contributions from associates and joint ventures rose by 17%, totaling VND 243 billion.

After deducting expenses, REE reported a net profit of VND 674 billion, a 41% increase.

According to REE, the primary driver of this profit growth was the electricity segment, with significant contributions from Central region enterprises benefiting from favorable hydrology, such as VSH and SBH. The electromechanical segment also saw improvement, thanks to a vibrant infrastructure investment market, contributing an additional VND 31 billion.

The real estate segment recorded growth, primarily due to profits from partial divestment in the associate company SGR (Saigonres). In the water segment, the associate company Song Da Water Supply made a notable contribution to the increase, driven by higher consumption volumes and price adjustments.

For the first nine months of 2025, REE‘s net revenue exceeded VND 7.1 trillion, an 18% increase year-on-year; net profit reached VND 1.9 trillion, up 45%. These results represent 70% of the revenue target and 79% of the profit target approved by the 2025 Annual General Meeting.

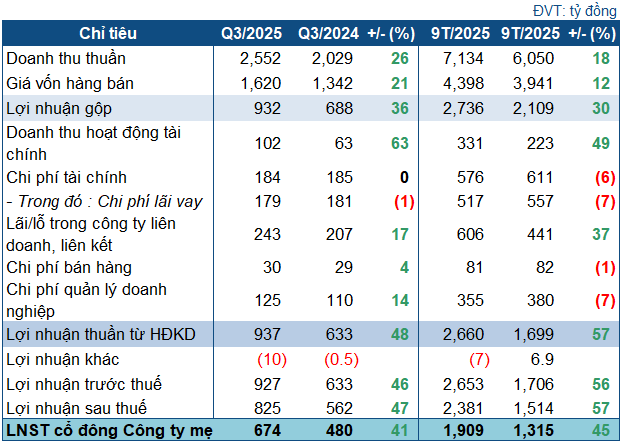

By the end of Q3, REE‘s total assets surpassed VND 38 trillion, a 5.2% increase from the beginning of the year, with over VND 12.3 trillion in current assets, up 9.5%. Cash and cash equivalents amounted to more than VND 5.8 trillion, slightly decreasing.

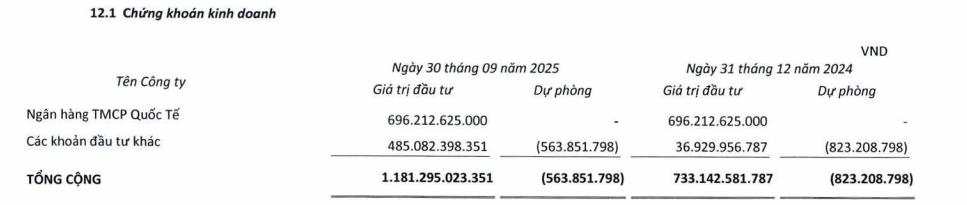

REE‘s securities investments rose significantly to nearly VND 1.2 trillion, 61% higher than at the start of the year. This increase was primarily driven by other investment items reaching VND 485 billion (only VND 37 billion at the beginning of the year). Notably, this figure was VND 237 billion at the end of Q2, indicating that REE invested an additional VND 248 billion in the market during Q3. This investment is still at a loss of VND 564 million, down from VND 823 million at the beginning of the year.

Source: REE

|

Construction in progress expenses increased by 26% to over VND 1.8 trillion, primarily focused on wind power projects (VND 886 billion) and hydropower projects (VND 606 billion).

On the capital side, total liabilities remained stable at VND 14 trillion. Total loans (short-term and long-term) slightly decreased to over VND 10 trillion, accounting for 27% of total capital.

– 10:58 31/10/2025

DXS Q3 Profits Double Year-Over-Year, Secures Nearly 6 Trillion VND in Marketing and Project Distribution Deposits

Revised Introduction:

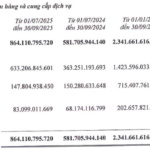

CTCP Dịch vụ Bất động sản Đất Xanh (HOSE: DXS) reported a remarkable surge in consolidated net profit for Q3, doubling year-over-year. Notably, short-term receivables reached approximately VND 10.5 trillion, with nearly VND 6 trillion attributed to deposits and advance payments for marketing and project distribution contracts.

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.

DIC Corp Seeks to Fully Divest Stake in Ceramic Tile Subsidiary

DIC Corp is offering to sell its entire stake of 8.82 million shares in DIC Anh Em at a price of no less than VND 4,696 per share, aiming to secure a minimum revenue of over VND 41.4 billion.