Samsung’s headquarters in Mountain View, California, captured on October 28, 2018 – Image: Smith Collection/gado | Archive Photos | Getty Images

|

Compared to the same period last year, the South Korean tech giant’s quarterly revenue rose by 8.85%, while operating profit surged by 32.9%.

Samsung’s shares climbed nearly 4% in early Asian trading.

This marks a robust recovery following Q2, when the company’s chip business faced a severe downturn. Operating profit soared 160% compared to Q2, with revenue climbing 15.5%.

Samsung Electronics, South Korea’s largest company by market capitalization, leads in memory chips, semiconductor foundry services, and smartphones.

The chip division was the primary driver of the company’s earnings, with operating profit increasing more than tenfold from Q2, fueled by surging demand from AI servers.

Samsung anticipates continued growth in AI chip demand, aligning with rival SK Hynix, which reported earnings on October 29.

“We expect data center companies to consistently expand hardware investments due to the ongoing competition to secure AI infrastructure,” a Samsung executive stated during the earnings report.

“As a result, our AI-related server demand continues to grow, significantly outpacing industry supply,” he added.

Samsung’s chip business saw a 19% sales increase from Q2. The memory division achieved its highest-ever quarterly sales, driven by strong AI-related demand.

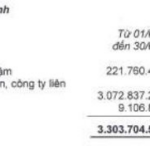

Chip revenue rose to 33.1 trillion Won, up 13% year-over-year, while operating profit jumped 81% to 7 trillion Won.

Known as the Device Solutions division, Samsung’s chip business encompasses memory chips, semiconductor design, and foundry operations.

The company noted that this division benefited from favorable pricing conditions, with quarterly revenue reaching a record high due to expanded sales of high-bandwidth memory chips—specialized for AI computing.

Samsung had lagged behind SK Hynix in the high-bandwidth memory chip market after being slow to secure major contracts with leading AI chipmaker Nvidia. However, a positive sign emerged in September 2025 when Samsung reportedly passed Nvidia’s quality tests for an advanced HBM chip.

A Counterpoint Research report in early October 2025 indicated that Samsung reclaimed the top spot in the memory chip market in Q3, overtaking SK Hynix after losing the lead for the first time in the previous quarter.

According to MS Hwang, Research Director at Counterpoint Research, Samsung’s Q3 performance was a natural outcome of the overall memory market boom, with prices for general-purpose memory also rising.

Looking ahead to 2026, Samsung stated that its memory business will focus on mass-producing the next-generation high-bandwidth memory chip technology, HBM4.

Smartphone Division

Samsung’s Mobile Experience and Network division, responsible for smartphones, tablets, wearables, and other devices, saw growth in both sales and profits.

The division reported a 3.6 trillion Won operating profit in Q3, up approximately 28% year-over-year.

The company attributed the growth to strong sales of its premium smartphones, particularly the launch of the Galaxy Z Fold7.

Samsung forecasts that the rapid growth of the AI industry will create new market opportunities for both its device and chip businesses in the current quarter.

– 11:50 30/10/2025

Samsung Expands Smart Home Robot Production in Ho Chi Minh City

Samsung Electronics Home Appliances Complex (SEHC), a 70-hectare, $1.4 billion investment, broke ground in Ho Chi Minh City in May 2015. Initially focused on premium TVs, including SUHD TV, Smart TV, and LED TV, this state-of-the-art facility marks a significant milestone in Samsung’s global manufacturing footprint.

Global Top 10 Conglomerate Powers Up Vietnam’s $100 Billion Economic Sector

Vietnam stands as the third-largest research and development (R&D) hub for this company globally, surpassed only by the United States and India.