According to the announced plan, SHB is set to issue 750 million shares, equivalent to a 16.32% stake; this includes 200 million shares offered privately to professional domestic and international investors, 459.4 million shares to existing shareholders, and 90.6 million shares under the Employee Stock Ownership Plan (ESOP).

Upon completion, SHB’s chartered capital will increase by a maximum of VND 7.5 trillion, reaching VND 53.442 trillion, positioning the bank to enter the TOP 4 private commercial banks in Vietnam. The implementation is scheduled for Q4/2025 and 2026.

First-Ever Private Offering to Professional Investors

The bank plans to offer 200 million shares, representing 4.35% of outstanding shares, to professional investors. The offering price will be determined as the average closing price of SHB shares over the 10 consecutive trading sessions preceding the Board of Directors’ resolution on the offering.

Proceeds from this issuance will be allocated to supplement working capital, invest in fixed assets, and expand lending for business operations and project implementation.

SHB aims to partner with professional investors or organizations to enhance governance, technology, and market expansion.

Offering to Existing Shareholders

Concurrently, SHB will issue 459.4 million shares to existing shareholders at a ratio of 100:10 (100 shares held entitle the purchase of 10 additional shares). Funds raised will support business expansion, lending for production, project execution, and working capital.

ESOP Issuance for Employees

Alongside the offerings to professional investors and existing shareholders, SHB will also issue 90.6 million ESOP shares to employees. This initiative aims to strengthen the bond between the bank and its workforce, attract talent, and enhance productivity, contributing to the realization of long-term strategic goals.

The ESOP shares will have an 18-month transfer restriction. Proceeds will be directed toward credit activities to meet the capital demands of the economy.

The capital increase aligns with the bank’s strategy to bolster financial capacity and reinforce its role as a key capital channel for the economy, supporting Vietnam’s entry into a new era.

In the first nine months of the year, SHB reported pre-tax profits of VND 12,235 billion, a 36% increase year-on-year, achieving 85% of the annual target. This growth outpaces industry averages, reflecting effective credit strategies, cost control, and expanded product and service offerings.

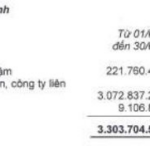

As of September 30, 2025, SHB’s total assets reached VND 852,695 billion, a 14.1% increase from the end of 2024, surpassing the 2025 target and on track to hit VND 1 trillion by 2026. Customer loans stood at VND 607,852 billion, up 17% year-to-date, showcasing stable capital absorption and strong market competitiveness.

The cost-to-income ratio (CIR) was 18.9%, among the lowest in the industry. SHB maintains its position as a top-performing bank through digital transformation, technology integration, and stringent asset quality management, targeting a bad debt ratio below 2%. Capital adequacy ratios exceed both State Bank regulations and international standards, with a CAR of over 12%, significantly above the 8% minimum required by Circular 41/2016/TT-NHNN.

On the stock market, SHB is one of the most liquid stocks, with a 110% year-to-date price increase to VND 16,900 per share. The bank consistently prioritizes shareholder value, distributing dividends regularly, including a 13% stock dividend and 5% cash dividend in 2024, totaling 18%, with plans to continue in 2025.

Successful capital raising will strengthen SHB’s capital buffer, maintaining a high CAR well above regulatory minimums, demonstrating robust financial health and risk resilience.

SHB is undergoing a comprehensive transformation to become a TOP 1 bank in efficiency, the most preferred digital bank, and a leading retail and corporate bank, focusing on strategic private and state-owned enterprises, supply chains, ecosystems, and green development. By 2035, SHB aims to be a modern retail bank, a green bank, and a leading digital bank in the region.

– 09:34 31/10/2025

Revised Title:

Optimizing Vietnam’s Railway Network Master Plan: 2021–2030 Framework with Vision to 2050

Deputy Prime Minister Trần Hồng Hà has signed Decision No. 2404/QĐ-TTg dated October 29, 2025, approving the adjusted master plan for the railway network for the period 2021–2030, with a vision toward 2050.

Revised Title:

Approval of Railway Planning Adjustment: Thu Thiem – Long Thanh Route Transformed into Urban Rail Line

In accordance with the decision to approve the adjusted Railway Network Plan for the 2021-2030 period, with a vision to 2050, the Thu Thiem – Long Thanh railway line will not be included in the planning and will be transformed into an urban railway. Ho Chi Minh City and Dong Nai are responsible for updating their provincial plans and related schemes accordingly.

Stock Market Upgrade Positively Impacts Banking Operations

From a capital mobilization perspective, Vietnam’s stock market upgrade and its alignment with international standards and practices will significantly boost financial market development. This progression will, in turn, positively impact banking operations.