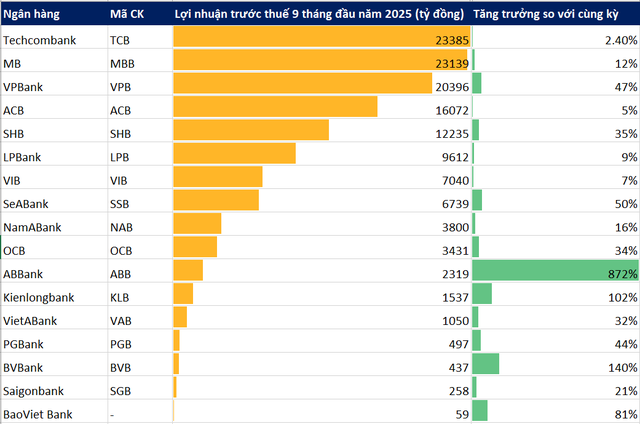

As of the morning of October 29, 2025, 19 banks have announced their profits for the first nine months of the year. Among them, three banks reported pre-tax profits exceeding VND 20,000 billion, and two banks surpassed VND 10,000 billion in just three quarters.

Leading the pack among the banks that have disclosed their figures, Techcombank achieved a pre-tax profit of VND 23,400 billion, a 2.4% increase year-on-year. In the third quarter of 2025 alone, the bank’s pre-tax profit reached VND 8,300 billion, up 14.4% compared to the same period last year, marking its highest quarterly pre-tax profit to date.

For the first nine months, MB’s consolidated pre-tax profit stood at VND 23,139 billion, an 11.6% rise year-on-year. In the third quarter, the bank’s pre-tax profit was VND 7,250 billion, down 0.8% year-on-year, primarily due to a 132% surge in provisioning costs to VND 3,801 billion, despite a 23.5% growth in net business income.

According to VPBank’s financial report, its consolidated pre-tax profit for the first nine months reached VND 20,396 billion, 47% higher than the same period last year. In the third quarter of 2025, the bank’s profit hit VND 9,166 billion, an impressive 77% increase and the highest in the last 15 quarters. VPBank’s nine-month profit has already surpassed its full-year 2024 results and achieved 81% of its 2025 target.

Source: Lan Anh

While the Big4 banks have yet to release their figures, Vietcombank, VietinBank, and BIDV are expected to report pre-tax profits exceeding VND 20,000 billion for the first nine months of 2025.

Earlier, Vietcombank posted a pre-tax profit of VND 21,894 billion in the first half of the year, a 5.1% increase compared to the same period in 2024. If it maintains this growth rate, the bank’s nine-month profit could surpass VND 32,000 billion.

VietinBank recorded a 46% year-on-year increase in pre-tax profit for the first half, reaching VND 18,920 billion. In the second quarter alone, the bank’s profit surged by 79%. Given this momentum, VietinBank’s nine-month profit is likely to significantly exceed the VND 19,513 billion achieved in the same period of 2024.

In the first half of the year, BIDV’s profit grew by 3.1% year-on-year to over VND 16,038 billion. With an average quarterly profit of approximately VND 7,500 billion over the last 10 quarters, BIDV’s nine-month profit could easily surpass the VND 22,000 billion mark achieved in 2024.

In the VND 10,000 billion profit group, ACB and SHB are the first two banks to cross this threshold for the nine-month period.

ACB’s pre-tax profit for the first nine months reached VND 16,072 billion, a 4.8% increase compared to 2024. In the third quarter of 2025, the bank’s pre-tax profit was VND 5,382 billion, up 11%.

SHB reported a nine-month profit of VND 12,307 billion, a robust 36% increase year-on-year, achieving 85% of its 2025 annual target.

Alongside ACB and SHB, the VND 10,000–20,000 billion profit group is expected to include HDBank and Sacombank.

By the end of the second quarter of 2025, HDBank became the ninth bank to achieve a semi-annual profit of VND 10,000 billion. This historic high was driven by optimized net interest margins (NIM), breakthrough fee income, and proactive risk management.

With higher-than-average credit growth in the agriculture and rural sectors, the recovery of the real estate market, and the acquisition of Dong A Bank, analysts estimate HDBank’s third-quarter pre-tax profit will exceed VND 5,000 billion. This would bring its nine-month cumulative profit to over VND 15,000 billion, potentially surpassing its annual target of VND 21,200 billion.

In the first six months of 2025, Sacombank earned a pre-tax profit of VND 7,331 billion, up 37.2% year-on-year, achieving over 50% of its annual target of VND 14,650 billion.

If it maintains its current growth rate, Sacombank’s nine-month profit is projected to exceed VND 10,000 billion. According to Vietcombank Securities (VCBS), the bank’s third-quarter profit is expected to reach VND 3,419 billion (up 24% year-on-year), with full-year pre-tax profit estimated at VND 15,806 billion. Sacombank’s growth is fueled by strong interest income from robust credit growth and improved non-interest income from fees and bad debt recoveries.

Beyond listed banks, Agribank is also expected to achieve a pre-tax profit of over VND 20,000 billion in the first nine months of 2025. Previously, the bank reported a profit of more than VND 13,200 billion in the first half of the year.

Saigonbank Reports 78% Surge in Pre-Tax Profit for Q3 Despite Negative Credit Growth

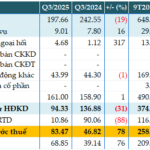

According to the Q3/2025 Consolidated Financial Statements, Saigon Commercial Joint Stock Bank (Saigonbank, UPCoM: SGB) reported pre-tax profits exceeding 83 billion VND, a 78% surge compared to the same period last year. This remarkable growth is primarily attributed to an 88% reduction in credit risk provisioning expenses. Notably, customer lending at the end of Q3 decreased by 6% from the beginning of the year.

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability, Dividends, and Bonus Shares Up to 30%

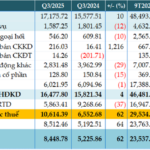

HDBank (HOSE: HDB) has reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% year-on-year growth. The bank continues to lead the industry in profitability metrics, boasting an impressive ROE of 25.2% and ROA of 2.1%, underscoring its operational efficiency and robust financial foundation.

Vietcombank Reports 5% Surge in Pre-Tax Profit for Q3, Bolstered by Robust Reserves

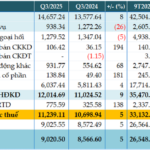

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 11,239 billion in Q3/2025, marking a 5% year-on-year increase despite a significant rise in risk provisioning costs, as revealed in its recently released consolidated financial statement.