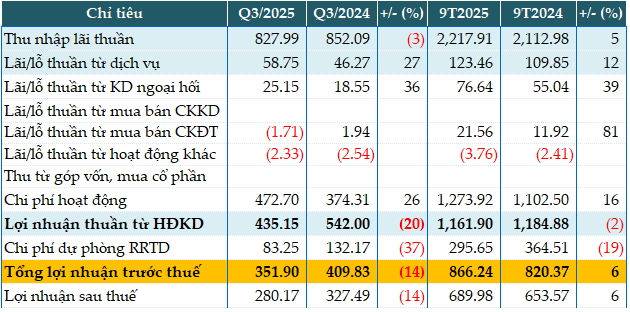

In Q3, Vietbank’s net interest income dipped by 3%, reaching approximately VND 828 billion.

Non-interest income streams showed mixed performance. Service fees surged by 27% to VND 59 billion, while foreign exchange gains climbed 36% to VND 25 billion.

Conversely, securities trading shifted from profit to a loss of VND 1.7 billion, and other operations also reported losses.

Additionally, a 26% rise in operating expenses to VND 473 billion contributed to a 20% decline in net operating profit, which stood at over VND 435 billion.

Despite a 37% reduction in credit risk provisions to just over VND 83 billion in Q3, pre-tax profit still fell by 14% to nearly VND 352 billion.

For the first nine months of the year, Vietbank’s pre-tax profit exceeded VND 866 billion, a modest 6% increase year-on-year, primarily due to lower risk provisions. Compared to the 2025 target of VND 1,750 billion in pre-tax profit, Vietbank has achieved 49% of its goal.

|

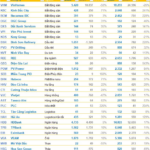

VBB’s Q3 and 9-month 2025 business results. Unit: Billion VND

Source: VietstockFinance

|

As of the end of Q3, Vietbank’s total assets grew by 16% from the beginning of the year to VND 188,133 billion. Customer loans increased by 12% to VND 105,195 billion; deposits at the State Bank decreased by 40% to VND 4,244 billion; deposits at other credit institutions rose by 33% to VND 45,286 billion; and loans to other credit institutions plummeted by 80% to VND 500 billion.

On the funding side, government and State Bank debt reached VND 2,550 billion by the end of Q3, up from VND 222 billion at the start of the year; deposits from other credit institutions increased by 49% to VND 49,396 billion; and customer deposits grew by 6% to VND 100,829 billion.

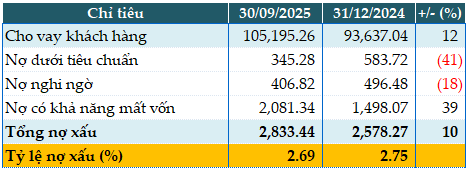

Total non-performing loans as of September 30, 2025, increased by 10% to VND 2,844 billion. There was a shift from substandard and doubtful debts to potential loss debts. As a result, the NPL ratio decreased from 2.75% at the beginning of the year to 2.69%.

|

VBB’s loan quality as of September 30, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 13:28 31/10/2025

BIDV’s Total Assets Surpass 3 Quadrillion VND, Q3 Pre-Tax Profit Surges 17%

BIDV’s consolidated Q3/2025 financial report reveals a pre-tax profit of nearly VND 7,594 billion, marking a 17% year-on-year increase. As of the end of Q3, the bank’s total assets surpassed VND 3,000 trillion.

Q3/2025 Financial Reports Deadline: Vinhomes, HDBank, TPBank, Vietjet, BSR, and More Companies Announce Surprising Results by October 30th

Khang Điền (KDH) reported a staggering 783% surge in Q3/2025 net profit, reaching 654 billion VND. Similarly, Becamex IJC and Intresco saw remarkable growth, with net profits soaring by 203% and 308%, respectively.