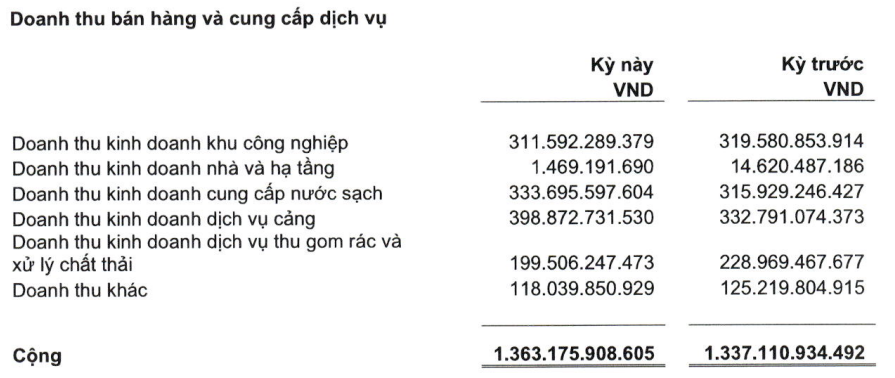

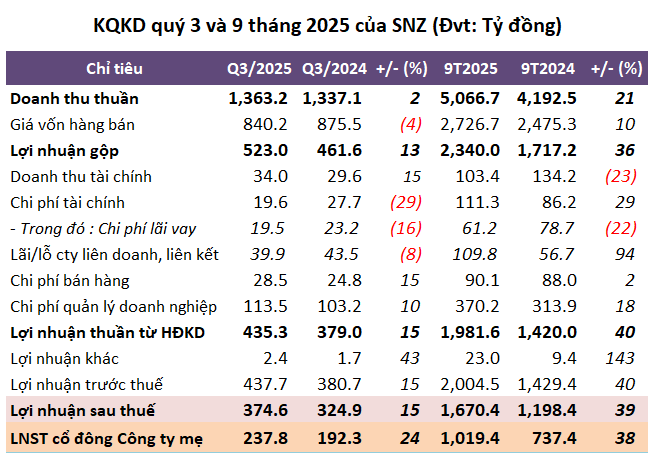

In Q3, Sonadezi (UPCoM: SNZ), a leading industrial zone developer, reported net revenue of over VND 1,363 billion and a net profit of nearly VND 238 billion, marking a 2% and 24% increase year-over-year, respectively.

| SNZ’s Business Results from Q1/2021 to Q3/2025 |

Sonadezi attributed the growth to a 13% rise in revenue from port services and clean water supply, reaching nearly VND 733 billion. Additionally, reduced production costs and a 15% increase in financial income, primarily from deposit interest, to VND 34 billion, were key drivers of the profit surge.

|

Revenue Structure of SNZ in Q3/2025

Source: SNZ

|

For the first nine months, revenue reached nearly VND 5,067 billion, with after-tax profit exceeding VND 1,670 billion, up 21% and 39%, respectively. These results represent 78% of the annual revenue target and surpass the after-tax profit goal by 19% after three quarters.

Source: VietstockFinance

|

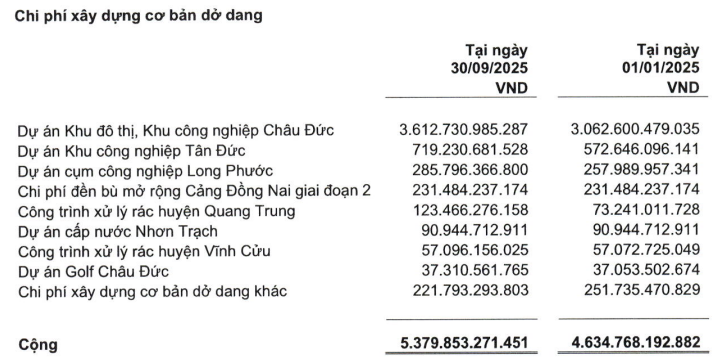

As of September 30, SNZ’s total assets stood at over VND 22,150 billion, a 5% increase from the beginning of the year. Cash and cash equivalents totaled more than VND 1,530 billion, down 4%. Inventory rose slightly to nearly VND 2,244 billion, primarily consisting of work-in-progress costs for the Chau Duc industrial zone and urban area (VND 1,568 billion) and the Huu Phuoc residential area (VND 245 billion). Construction in progress reached nearly VND 5,380 billion, up 16%.

Source: SNZ

|

Total liabilities amounted to over VND 10,623 billion, a 4% increase, with financial debt at nearly VND 3,690 billion, down 8% and accounting for 35% of total liabilities. Customer advances and unearned revenue exceeded VND 3,200 billion, slightly decreasing and representing 30% of total liabilities.

– 3:57 PM, October 30, 2025