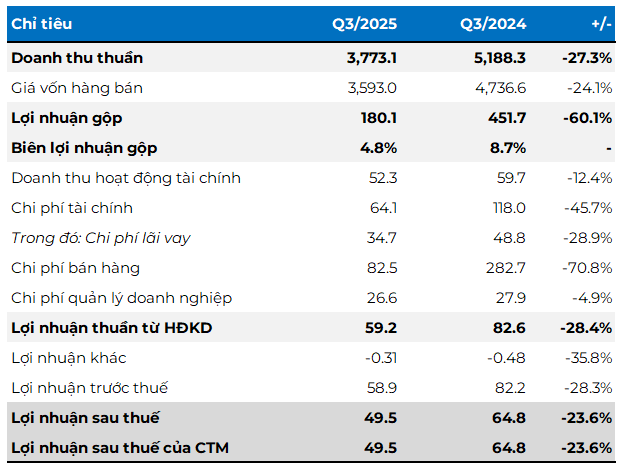

According to the Q3/2025 financial report, the company recorded net revenue of over VND 3,770 billion, a 27% decrease compared to the same period last year. Net profit reached VND 49.5 billion, down nearly 24%.

Concerningly, NKG’s gross profit margin continued to narrow to 4.8%, significantly lower than the 8.7% recorded in the same period last year.

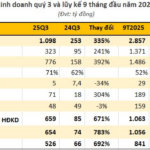

Q3/2025 Business Results of NKG

Unit: Billion VND

Source: VietstockFinance

|

In the first nine months, Nam Kim reported net revenue of VND 11,670 billion, a nearly 28% decline year-over-year. Net profit reached nearly VND 207 billion, a sharp drop of almost 53%. With these results, the company has only achieved 51% of its annual revenue target and 57% of its pre-tax profit goal.

The lackluster performance comes amid a weakening market and a wave of trade protectionism from several countries, particularly the U.S., putting significant pressure on export-dependent companies like Nam Kim Steel.

Data from the Vietnam Steel Association (VSA) shows that finished steel exports have stalled since April 2025, following U.S. President Donald Trump’s announcement of retaliatory tariffs. Galvanized steel sheets were the most affected, with export volumes in the first nine months reaching only 1.3 million tons, a 46% drop year-over-year.

Speaking to the press, Mr. Phạm Công Thảo, Deputy General Director of Vietnam Steel Corporation (VNSteel, UPCoM: TVN) and Vice Chairman of VSA, noted that while domestic demand for galvanized steel sheets remains strong, it is unlikely to offset the decline in exports. The primary reason is that current factory capacities far exceed domestic demand, requiring significant time for the market to absorb the produced goods.

“With export markets facing challenges, galvanized steel sheet production is likely to plateau, depending on the domestic market’s absorption capacity. This year, domestic market demand has been robust,” Mr. Thảo stated.

Despite these challenges, NKG is focusing its resources on the Phu My steel sheet plant, with long-term construction in progress reaching VND 3,900 billion by the end of September 2025, a sharp increase from VND 285 billion at the beginning of the year.

In terms of financial structure, the company has short-term financial loans of over VND 4,900 billion and long-term loans of VND 2,050 billion.

– 11:58 31/10/2025

Hoa Phat Agriculture, Chaired by Tran Dinh Long, Reports Over VND 1.4 Trillion in Profits Ahead of IPO

Hòa Phát Group’s agricultural division has demonstrated remarkable performance in the first nine months of 2025, achieving consistently high cumulative profits. This strong financial foundation sets the stage for the company’s planned initial public offering (IPO).