Firstly, a thriving stock market, characterized by robust growth and increased participation from members, businesses, and investors, significantly enhances corporate capital raising through stock and bond issuances. This vital capital enables companies to invest, expand, and bolster their production and business operations. When effective, this process alleviates reliance on bank loans, particularly medium to long-term financing. Consequently, it fosters a conducive environment for banking sector development, aligning with its core function of providing short-term capital and financial services to the economy. This dynamic also amplifies the efficacy of monetary policies, especially those related to interest rates, exchange rates, and bank credit activities.

Secondly, the evolution of the stock market, with its heightened standards of transparency and quality, propels commercial banks towards more efficient, stable, and sustainable growth. As active market participants, joint-stock commercial banks (JSCBs) are compelled to meet rigorous performance and transparency benchmarks. This environment facilitates credit institutions in mobilizing capital from the market to fund expansion and innovation, particularly in digital banking and the digital economy. Such advancements are pivotal for leveraging resources effectively in this evolving landscape.

Upgrading the stock market positively impacts banking operations and enhances the effectiveness of monetary policies.

Thirdly, an upgraded stock market positively influences bank branding, service development, and market positioning. For JSCBs, listed stocks transcend mere commodities, embodying the bank’s operational efficiency and brand value. Prominent stocks like VCB, BIDV, and MBB attract both domestic and international investors, including foreign investment funds. This reinforced brand value drives bank growth, particularly in diversifying services to meet client and corporate demands, thereby contributing to the stock market’s advancement.

The expansion and growth of the market scale, intertwined with the operational scope of participants—especially JSCBs—underscore the importance of their performance quality. This not only determines stock market valuations but also solidifies their market standing, reputation, and brand. Ultimately, this fosters banking sector development, amplifying the impact of the central bank’s monetary, credit, and interest rate policies.

October 31, 2025: Warrant Market Dominated by Red as Sell-Off Takes Hold

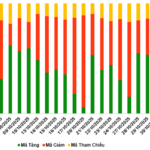

At the close of trading on October 30, 2025, the market saw 50 stocks rise, 165 decline, and 38 remain unchanged. Foreign investors resumed net selling, with a total net sell-off of VND 864.77 million.

Why Are Stock Investors Hesitant Despite Corporate Profit Reports?

Several stocks are signaling optimism following robust third-quarter earnings reports, yet the market continues to exhibit signs of stagnation as liquidity declines. At today’s close (October 29), the VN-Index edged up slightly, surpassing the 1,685-point mark.