According to the announcement by SZC, on October 30, the company received Decision No. 2226/QĐ-XPHC-DON dated October 28, 2025, from the Dong Nai Provincial Tax Department regarding administrative penalties. Consequently, the company is required to pay an additional corporate income tax (CIT) for 2024 amounting to VND 3.52 billion, late payment fees of VND 213.5 million, and an administrative fine of VND 704.8 million.

The Dong Nai Provincial Tax Department notified SZC to pay a total of over VND 4.4 billion, including tax arrears, late payment fees, and fines, within 10 days from the receipt of the decision.

Company leaders stated that the penalty resulted from the tax authority’s CIT reassessment based on the Ministry of Finance and General Department of Taxation’s guidelines during the review of the company’s 2024 tax declaration and obligations.

SZC actively cooperated with the tax authority throughout the inspection and review process, fulfilling its financial obligations as required. The company will comply with the penalty decision, complete the payment to the state budget, and self-declare and adjust taxes for related periods in accordance with regulations.

Regarding business performance, SZC’s financial reports over recent years show robust growth, with a significant portion of revenue derived from Chau Duc Industrial Park. In 2024, the company achieved VND 911 billion in revenue, exceeding the plan by 3.4%; VND 302 billion in after-tax profit, surpassing the plan by 32.4%; and VND 148 billion in tax contributions, exceeding the plan by 7.4%.

Chau Duc Industrial Park is a key project driving SZC’s revenue growth and state budget contributions.

|

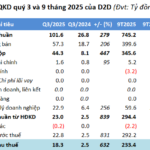

In the first nine months of 2025, SZC recorded revenue of over VND 745 billion and after-tax profit of over VND 242 billion, up 12% and 7% respectively compared to the same period in 2024. Against the 2025 plan, Sonadezi Chau Duc has achieved 77% of its revenue target and 80% of its profit target after nine months.

Company leaders indicated that the final quarter of 2025 looks promising, with land lease contracts from Chau Duc Industrial Park expected to generate around VND 300 billion in revenue. Additionally, the urban area, golf course, and other activities are projected to contribute an additional VND 50 billion. SZC anticipates meeting the targets set by the General Meeting of Shareholders and exceeding some key performance indicators for 2025.

At the close of trading on October 30, SZC shares were priced at VND 31,000 per share. Previously, on October 7, SZC paid a 2024 cash dividend at a rate of 10% of the par value.

Services

– 12:30 31/10/2025

Steel Company Fined and Ordered to Pay Tens of Billions in Back Taxes

Once the leading steel trader in Vietnam, the company has faced a steep decline in performance since 2022. Plummeting steel prices and challenges in debt recovery from clients in the construction and real estate sectors have significantly impacted its operations.

D2D Surpasses Annual Plan, Reporting Over 230 Billion VND in Profit After 9 Months

Industrial Urban Development Corporation No. 2 (HOSE: D2D) has reported a stellar Q3 performance, with both revenue and profit doubling year-over-year. This remarkable growth is attributed to the successful land transfer in Chau Duc Industrial Park, surpassing the annual plan after just nine months.

Why Was Kido Fined VND 240 Million in Administrative Penalties?

Kido has been fined a total of 240 million VND by the State Securities Commission of Vietnam (SSC) for failing to disclose information in a timely manner and for releasing misleading information.